Market Review: A little bit of history repeating

Tyndall Investment Management New Zealand Ltd managing director Anthony Quirk comments on what was an extraordinary month

Monday, April 3rd 2006, 1:54PM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management New Zealand Limited (Tyndall). To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

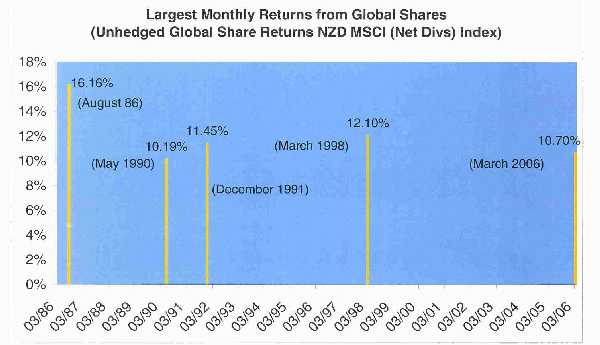

So we are in the midst of a bull market with both the New Zealand and overseas markets having produced annual compound returns of around 20% over the past three years; 24% and 19% (unhedged), respectively. Bull markets do not carry on forever (for example the NZ sharemarket was down 35% in the 1990 calendar year despite a 13% rise in May) but they are fun while they last!

So what caused this huge spike in equity market returns in March?

Well, it can’t be the current state of the New Zealand economy, which has a good chance of being in a "technical" recession. The December quarter GDP number was a slight negative and the March quarter may be even worse. Two consecutive negative quarters is termed a recession so we have the rather strange juxtaposition of a bull market in New Zealand shares at the same time as the reported numbers of economic activity are poor.

I say "technical", as it doesn't much feel like a recession at the moment does it? I think if you asked 10 people in the street whether we were in a recession at present you'd be lucky to get one or more to say "yes". Low unemployment and historically high house prices mean most people (while less confident than previously) are not sensing an economy in that much trouble.

Clearly a key catalyst for last month's high return for both New Zealand and overseas sharemarkets for a domestically based investor was the massive fall in the kiwi dollar. In March it was down 8% against the US dollar and the Euro, 6% against the Yen and 4% against the Aussie dollar. This obviously boosts the unhedged returns from offshore markets, many of which are at five year highs in any case.

A second catalyst is the merger and acquisition (M&A) activity both here and overseas. In one of my monthly commentaries last year I mentioned that this could be a factor in driving markets higher and M&A activity has certainly accelerated recently in most sharemarkets. Often this is a late cycle development and a sign that markets are coming to the end of a strong run.

This is because it can be a sign that companies are finding organic growth harder to achieve and have to resort to using their high priced shares as a basis to buy some growth through acquisitions. Thus it can be a precursor to lower earnings growth and therefore lower (or at least stagnant) sharemarkets.

Of course markets are forward looking and the bond market appears to be factoring in an interest rate cut in this country as early as June this year, on the back of the negative GDP number. The prospect of lower rates and of a relatively "soft" landing are certainly positive factors, as is the "Working for Families" package being introduced. However, the importance of the latter factor to the overall economy looks to be overstated in some parts of the media, as its overall impact will be to increase total household incomes by only 0.5% for the 2006 year.

The bond market over the past few years has consistently been overly optimistic on how soon rates would be cut by the RBNZ. The market is pricing in the prospect of rate cuts by June and I think may get it wrong again this year. This is because the fall in the kiwi dollar is doing the job of easing monetary conditions for the RBNZ. As I said last month, we were at the cross roads of a hard or soft landing, with the direction of the kiwi dollar holding the key. The kiwi’s fall means a soft landing is more probable.

This is shown in the MCI measure (which incorporates both interest rates and the currency). This was at a 10-year high late last year, meaning we ran a real risk of having a hard landing this year. The kiwi dollar is now 18% down from its high against the US dollar and 15% against the TWI (trade weighted index). This has meant the MCI is now at more normal levels from its high just three months ago.

The RBNZ will also be very happy at the monetary policy mix at the moment with exporters being helped out by the currency at a time when key commodity prices are falling and relatively high interest rates are constraining a previously (overly?) buoyant housing sector.

So after being lambasted by many commentators the RBNZ may be shown to have got its monetary policy settings just about right. In fact from here their major risk may be of a collapse in the kiwi dollar forcing them to raise rates further – although we are probably some way from that. Another issue they will have in mind is the housing market.

Source: First NZ

There has been quite a lot of commentary both here and in the United States that the residential housing markets have, at the very least, topped out and may be due for a significant correction. For example, in the US unsold housing inventory levels are at record highs as demand continues to fall. This, in turn, is being caused by the debt service payment ratios rising to their highest levels in over 15 years as interest rates in the US continue to increase.

In New Zealand a slow down in the housing sector seems to be starting, with sales turnover at its lowest level since 2001. This is being caused by lower incoming migrants, lower rental yields on the multitude of investment properties out there and households' debt servicing continuing to rise. This latter factor will be even more of an issue with some low fixed rate mortgages rolling over to materially higher rates later this year.

So another risk for the RBNZ is that the residential housing market falls significantly, which would require an acceleration of the need to cut rates. They do not have the easiest job in the world right now but one has to say that it is "so far so good".

I feel I have to finish with a health warning! One concern I have is that as cash rates and residential property prices start coming down some retail investors may turn to the New Zealand sharemarket, particularly after its excellent run. Some retail investors have a habit of coming in too late to a market that has been running hot and we may be set for a repeat here. I think that recent (and probably future) events show the value of setting in place a long term investment portfolio rather than trying to time the entry and exit into and out of markets.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « Extend tax review to housing: Arcus | Fact sheet 3: New tax rules for New Zealand managed funds » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |