Market Review: (Almost) boring

Tyndall Investment Management managing director Anthony Quirk comments on what was (almost) a boring month.

Wednesday, May 3rd 2006, 8:58PM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

In contrast bond markets continued to struggle given a strong global growth outlook. Global bond returns (Lehman Global Aggregate Index) were slightly negative for the month, with the US 10-year Government Bond yield breaching 5.0%, its highest level in four years. New Zealand bond returns were slightly better, being essentially flat.

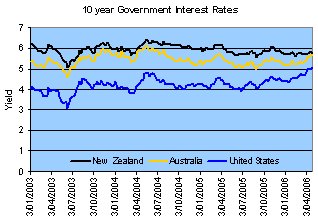

The following charts show the recent sell-off in the US and Australia has been much more pronounced than in this country. This reflects the different stages of the respective growth cycles with New Zealand technically in, or close to, recession, while Central Banks in the US and Australia are having to deal with sustained economic growth.

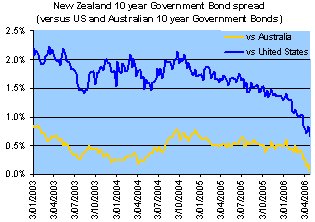

The overseas bond sell-offs have meant the traditional margin of New Zealand Government Stock rates over their US and Australian equivalents have decreased to very low levels. For example, the New Zealand 10 year Government Bond yield is now at just above parity to the Australian 10 year, the lowest gap since 1999. Against the US 10 year bond, the NZ margin is around 0.7%, the lowest since 2000 (5.8% in NZ versus 5.1% in the US).

While our bond desk had expected these margins to contract, we were surprised at the speed and magnitude of the change. Overseas yields have moved higher than expected while the New Zealand market is now probably more realistically pricing in when the RBNZ will ease rates. As I mentioned last month we thought the market was overly optimistic in anticipating an easing in interest rates.

If you believe in mean reversion then at some stage the margins will move out again, either through a sell-off in New Zealand bonds and/or a lowering of global bond yields. Frankly, neither appears likely in the short-term but is possible in the longer-term as New Zealand emerges from recession in 2007. There is also an argument that New Zealand's country risk is decreasing as our low inflation environment is now almost two decades long. This would mean our margin over overseas bonds may average lower levels going forward than in the past.

The two major drivers of sharemarkets tend to be interest rates and earnings. With the rising bond yields globally (mentioned earlier) this places more pressure on earnings to sustain current company valuations.

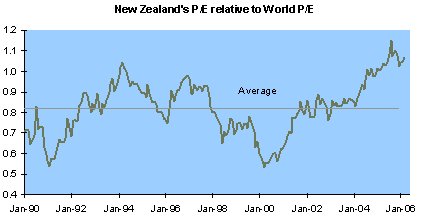

This is particularly true in New Zealand where future earnings growth prospects are relatively low and P/E ratings are relatively high. The latter is shown in the following chart, which shows that the P/E for the New Zealand sharemarket is at historically high levels relative to the rest of the world. Combine this with a mixed corporate earnings outlook and it wouldn't surprise me if the domestic sharemarket had a "breather" for a while. However, I have been thinking this for some time and the March surge was a reminder on how hard it is to try to time market turning points.

Part of the reason for buoyant overseas markets, despite higher oil prices and interest rates is that earnings have stayed strong. The March quarter reporting season was no exception to this with corporate profits up 20%, year on year. This was due to strong sales growth, restrained wage costs and corporates maintaining some pricing power. From their 2001 lows, US corporate profits have surged 117%, according to the ISI Group.

In a commentary earlier this year I mentioned that two areas that could cause current positive market sentiment to reverse were rising interest rates and an oil shock. The former has been covered above but a hint of the latter occurred through April. With perceived and real supply shocks impacting on the oil price, it will probably need an easing in demand before the oil price rally falters. This does not seem to be occurring – yet!

On the currency front the Kiwi dollar strengthened 4% for the month against a generally weaker US dollar, while the Kiwi was down over 2% against the Aussie and essentially flat against the other major currencies. It may be the major part of the Kiwi dollar correction is over with our high interest rates continuing to underpin the Kiwi at around these levels. However, any hint of the RBNZ beginning to ease and then a move below US$0.60 and A$0.80 would not surprise.

So in summary, April saw a continuation of buoyant sharemarkets and more subdued bond markets. To date the sharemarkets have been taking both higher interest rates and high oil prices in their stride but can this continue? I feel we may be at risk of a correction at some stage over the next year. However, the longer-term growth outlook is looking sound with co-ordinated global growth, plus the China influence, being very positive drivers.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « Managed Funds find favour as conditions change | Market Review: The sell-off » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |