Market review: Classic show-down between earnings and interest rates

Tyndall Investment Management managing director Anthony Quirk comments on the state of the markets

Monday, July 3rd 2006, 11:46AM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

Thus the market anticipated last week’s US rate hike (the 17th straight rise) and if rates had not been raised, after such a co-ordinated set of speeches expressing concern on inflation, it would have left the Federal Reserve with zero credibility. Moreover there seems to be co-ordinated Central Bank tightening underway, from countries as diverse as the US and China through to Korea, Sri Lanka, Peru and Turkey. New Zealand seems to be one of the few exceptions to this, given we are at a different stage of our economic cycle.

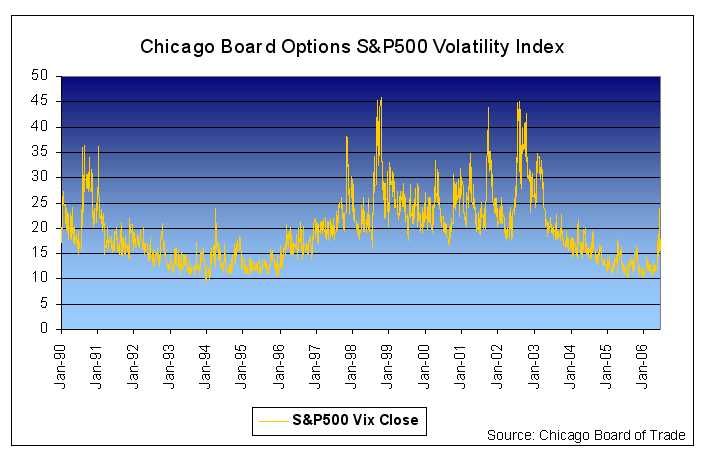

After a period of relatively low volatility for the past three years sharemarkets have gyrated recently. For example, in June the three major US sharemarket indices hit new lows for 2006 and then posted their biggest one-day gains in years! The increased market volatility and heightened investor concerns are shown in the chart below. This shows the Chicago Board Options S&P 500 Volatility Index (VIX) rising from early May after being at historically low levels over the past few years, before settling to more normal levels by the end of June.

The increased volatility, combined with inflation concerns and general uncertainty, means investors required a higher return from equities to compensate. That is, the discount rate used to value companies rose. If the earnings outlook stays constant then sharemarket values fall, and that is what we experienced in May and June.

So two related key issues from here are:

-

is increasing inflation a long-term issue?

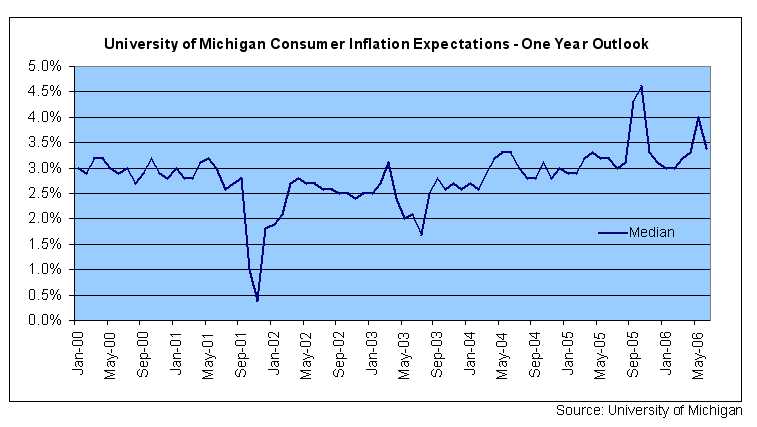

Somewhat surprisingly while the Federal Reserve seems concerned about possible price and wage rises, the US public’s inflation expectations (as shown below in the monthly University of Michigan survey) are falling. Combine this with a slowing US economy (particularly in the residential housing sector) plus low unit labour cost increases and it is hard to believe inflation is about to get out of control. Instead inflation concerns should subside once the US economy cools.

Perhaps this is the reason why the bond market seems much more sanguine about the inflation outlook than sharemarkets? The US yield curve has flattened suggesting the bond market is pricing in an economic slow down – which should help to ease inflation worries. - can earnings growth rates drive sharemarkets from here?

It is interesting to note that through the recent sharemarket sell-off earnings expectations for US and European companies have actually been rising. For example, according to First Call, analysts now expect 12% US corporate earnings growth for the 2006 second quarter, up from 11% six weeks ago. Thomson Financial has a similar second quarter growth expectation of 12%, which would be the 11th consecutive quarter of earnings growth above 10%! This has only happened once before since 1950. Moreover, expectations for the third and fourth quarters are now comfortably in the mid-teens, which would extend this great earnings run even further.

The combination of this and the recent sell-off means a forecast price to earnings ratio (P/E) for the S&P 500 of about 14, down 50% from levels five years ago. This P/E decline is the greatest since the mid-1970s! It also means that P/Es are at record lows compared to bond yields in several developed markets. And this is all in the context of strong global growth. As our global equity manager, Capital International, points out: “in 2006 only 1.6% of the nations tracked by the International Monetary Fund are expected not to see economic expansion, compared with 24% in 1980”.

So my conclusion is similar to last month’s commentary. Namely that, subject to no external shocks (including the Federal Reserve over tightening), I do not believe this is the start of a bear sharemarket but merely a healthy correction that was needed given the extraordinary returns from shares over the past few years.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « The Asian miracle – on track, but risks are higher | ASSET Magazine: July 2006 » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |