Market Review: Our Current Account Woes

In this month's commentary Tyndall Investment Management managing director Anthony Quirk comments on New Zealand’s dreadful current account deficit and trade imbalances around the globe.

Wednesday, October 4th 2006, 3:44PM

by Anthony Quirk

|

This market summary is provided by Tyndall Investment Management. To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here |

The US currently has a significant trade deficit but has traditionally received positive interest income. However, the US is now paying out more to foreign lenders than it is receiving for the first time in at least 90 years. It currently owes US$2.5 billion, a small amount in the context of the huge US economy but a trend that could quickly accelerate to New Zealand-type proportions if the US continues to rack up large trade deficits. This comes at a time when a weaker US dollar is actually helping their trade position, but clearly not enough!

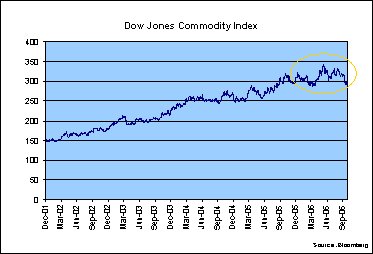

Of course one country’s deficit is another country’s surplus and part of the western world’s deficit issue is oil related with the oil producing nations well in surplus. Even Russia has a 12% trade surplus currently. But this is not the full story with oil importers such as China and Japan still enjoying trade surpluses. These surpluses have to find a home and are partly being re-invested into increasing productive capacity, although in the case of China one could argue that over-investment may be going on there at present. This is a key reason why the Chinese Government is trying to slow its economy.

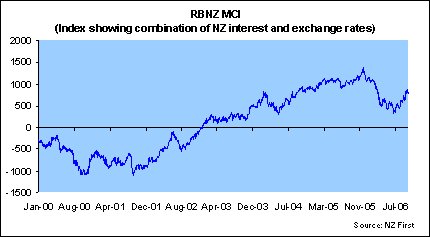

The surpluses are also going into investments around the globe and this is one of the factors behind global bonds doing so well recently (as well as the Kiwi dollar) as investors seek high yielding but safe investment areas. Thus we could continue to see a situation where western countries such as the US and New Zealand receive investor inflows from Asian countries which are generating surpluses. However, a deficit of New Zealand-like proportions cannot continue indefinitely.

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

Anthony Quirk is the managing director of Guardian Trust Funds Management.

| « How the fair dividend rate would work | Market Review » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |