Kauri Notes - High targeted returns

Savings and Loans has launched a capital protected investment backed by Merrill Lynch.

Tuesday, July 10th 2007, 11:08AM

Summary of the key features of Kauri Notes invested in Merrill Lynch Prosper Notes Series II

Background

Savings & Loans Superannuation and Investments Limited is

a funds management organisation with a focus on providing

Securities that are:

- Capital guaranteed

- Provide regular income

- Offer the opportunity to earn higher returns

- Have a clear secondary market mechanism for sell back.

Kauri Notes, the proceeds of which are invested in NZD Merrill Lynch Prosper Notes Series II, will be attractive to those clients wanting to diversify their finance company debenture holdings and other fixed interest securities into rated investments with higher returns but which also provide regular income.

Kauri Notes – High targeted returns

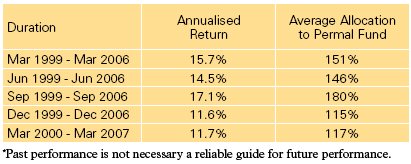

Five hypothetical Prosper Notes back tests illustrate annualised

returns between 11.61% – 17.13%*.

Regular quarterly coupon payments

Kauri Notes are an interest bearing debt security designed to provide

investors with a regular coupon rate of 9.50% per annum return paid

quarterly, over the 7 year 3 month term of the Kauri Notes.

Interest guarantee in respect of the first eight coupon

payments from the Prosper Notes – Series II

As well as the capital guarantee, the payment of the first eight

quarterly interest payments of the Kauri Notes are supported by

a Prosper Notes coupon interest guarantee from Merrill Lynch

& Co., Inc which is rated AA-. Subsequent coupon payments are

subject to the performance of the Permal Financials & Futures

portfolio of funds into which Merrill Lynch invests the proceeds

of Prosper Notes. To pay each subsequent quarterly coupon the

net asset value of Prosper Notes must be above $1.02375 for each

$1 invested. If not the coupon is deferred 90 days until the next

coupon date and the asset value is sufficient to make the payment.

This means the actual rate of return achieved by Kauri Note

investors could be higher or lower than 9.5% pa.

Higher Returns through Uncapped Redemption Premium

potential

The opportunity for higher returns is provided by payment

of a redemption premium at maturity. In the event that the

performance of the Prosper Notes generates annualised interest

returns for Savings & Loans Securities in excess of 9.50% per

annum then it will pay to the Kauri Noteholders 100% of this

excess as a redemption premium at the maturity.

Merrill Lynch will generate these returns by implementing a

constant proportional portfolio insurance mechanism ("CPPI")

which is designed to maximise the exposure to the Permal FX,

Financials & Futures portfolio of funds at the same time as

ensuring that the principal and first eight coupon payments

are always protected. This mechanism enables investors to gain

the benefit of up to a maximum exposure of 200% of their

investment to the Permal portfolio of Funds (subject to the funds

performance) through Merrill Lynch lending the additional

amount at 0.5% over interbank interest rates. Where the Permal

portfolio achieves good returns additional amounts are invested in

the fund. If performance declines the investment is de-leveraged

and amounts are notionally invested in risk free bank deposits.

Secondary market Sell Back facility

Kauri Notes can be sold back to Savings & Loans early by

Noteholders each month, subject to certain circumstances.

The

size of the Permal fund, the very liquid instruments in which

the Fund managers invest and Merrill Lynch International's

secondary market trading experience all assist in making this sell

back feature possible.

Sell back prices will be linked to the net asset value of the

Prosper Notes.

If a net asset value premium (or discount) above (or below)

issue price has been generated, the sell back price will include

this net asset value adjustment.

A diversified investment in the Permal FX, Financials &

Futures Limited portfolio (the Permal Fund)

The net proceeds raised from the issue of the Prosper Notes

– Series II will be invested in the flagship Permal portfolio of funds.

The US$ 7.9 billion Permal Fund portfolio is diversified

across more than 50 different managers. Investments are

made in the global marketplace with exposure to the financial,

metal, energy, agricultural, currency and other markets. The

Permal Fund also achieves diversification through the range of

investment styles and trading strategies in numerous U.S. and

international currency, futures, options, forward and other liquid

markets.

This Permal fund does not invest in either illiquid sub-prime

or high-yield debt securities. It is specifically designed not to be

correlated to debt and equity returns in order to maximise its

diversification value to an investor.

The Permal portfolio of Funds, which has been operating

successfully since 1992, has been selected for its long history of

delivering real returns to investors in all market conditions, for

its resilience to past market shocks over a 15 year period and for

the liquidity of the instruments in which its managers invest.

Permal's role is to continually monitor risk and to optimise

the whole portfolio of managers based on their current

performance by adding and removing managers.

The Permal fund has a Standard & Poor's AA rating.

Track Record of the Investment Manager

Permal the Investment Manager of the Permal portfolio of

funds is a subsidiary of Legg Mason's Wealth Management

Division a company listed on the New York Stock exchange.

It has over 33 years of experience and as of January 2007 has

approximately US$30 billion of funds under management. Legg

Mason is a global funds management firm with over US$969

billion of funds under management around the world as at 31

March 2007.

Merrill Lynch & Co., Inc the Guarantor rated AA

Merrill

Lynch is one of the world's leading wealth management,

capital markets and advisory companies, with offices in

37 countries and territories and total client funds under

management of approximately US$1.6 trillion.

Merrill Lynch is ranked number 22 in the Fortune 500 (being

the list of the 500 largest public corporations in the United

States by gross revenues aggregated by Fortune magazine).

Merrill Lynch & Co., Inc, the guarantor has a AA-, AA-/A-1+,

Aa3 credit rating (Fitch Ratings, S&P's, Moody's respectively).

Investors Interests protected through appointment of

Trustee

The Perpetual Trust is acting in a trustee role on behalf of Kauri

Notes investors. The Trustee holds a security deed over the Merrill

Lynch Prosper Notes in favour of the Kauri Noteholders.

The initial value on the date of allotment of the Kauri Notes

will be $1.00 per Kauri Note.

Brokerage

Savings & Loans will pay to advisors 1.5% brokerage on all client

subscriptions.

Further Information

To receive further information, an investment statement and

prospectus can be obtained from www.kaurinotes.co.nz or call

0800 728464 (0800 Savings).

| « Twice the gain - Limit the pain | WATER - Blue Gold » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |