Market review: December 2007 commentary

This month's comment from Tyndall is penned by by London-based economist Andrew Hunt.

Thursday, December 6th 2007, 1:54PM

During the early 1990s, we observed the battle that was then raging in Japan between market forces, which were trying to deflate Japan's extended property and stock market bubbles, and the combined might of the authorities and financial institutions who were trying to support the system.Although it may be difficult to remember now, at the end of the 1980s Japan's land prices had been the highest in the world by far and the equity market was more than twice its current index level. In an effort to maintain these absurd prices, the Japanese banks began to 'warehouse' their bad loans and any properties that they received in lieu of debt repayments, rather than selling them on for whatever price they could gain. This was in an effort to artificially support the markets.

Meanwhile, the pension funds (particularly those close to the government) were frequently seen as buyers in the equity market, even as it fell, as they attempted to support equity prices. Moreover, by 1992, the Bank of Japan had entered the fray with a series of rate cuts. Unfortunately, the 'bottom line' was that equity and land prices were so far out of kilter with the economy's earnings potential – for either wages or profits – that these various 'price-keeping-operations' exerted little long term impact, save perhaps to make the ultimate situation worse.

Despite the various attempts to support the markets through this warehousing of bad assets, and purchases of other assets, there were nevertheless sufficient numbers of forced sellers to imply that the markets maintained a downward bias with the result that the losses being experienced by the banks on their warehoused assets, and the equities purchased by the funds continued to mount, until eventually they threatened the very profitability and capital positions of these various 'lifeboats'.

Moreover, as these losses mounted, the markets began to expect that the banks and other institutions would eventually be obliged to offload their assets, with the result that not only did pricing in the markets remain weak, it became impossible for potential issuers of new shares or bonds to find willing buyers. The latter, of course, became a serious and long-lasting impediment to the real economy's ability to function and grow effectively.

In effect, no one would buy in case the 1000lb gorilla (in the form of forced selling by the banks and others) finally turned up and so forced the markets into a crisis and this had the effect of starving the real economy of the financing that it needed (since no one could issue new shares or bonds) to escape the recession.

Consequently, although the price-keeping-operation may have provided some support to the financial and property markets in Japan during the early 1990s, their long run impact was to create a dysfunctional financial system that proved a lasting impediment to the real economy. In fact, one might argue that there are still some problems that could be associated with these events in existence today, some ten years later.

Unfortunately, recent developments in the US have reminded us all too clearly of these events. It has become apparent that much of the 'recovery' in financial asset prices in the US and elsewhere since August has been the result of a similar degree of warehousing of bad assets amongst the major US banks.

Through a combination of assistance from the central bank, and strong inflows from fearful savers who have been exiting the more exotic parts of the savings product spectrum, the major US banks have all experienced large inflows of savers' money over recent weeks. However, it seems that the banks have used these funds to finance what has amounted to a price-keeping operation of their own in the structured finance markets (i.e. the infamous CDOs and SIVs) and this action created the illusion of stability within the financial system.

Moreover, as the banks created this impression of normalcy, and implicitly added money to the financial system through their purchases of these instruments, they have encouraged other investors to begin taking risks again.

Thus, we saw the share markets resume their bull run, commodity prices rise and those favourite risk trades, the Australian and New Zealand currencies (along with other favourites such as the Icelandic, Turkish and Polish currencies), begin to appreciate once again as capital flows returned in search of the high yields on offer.

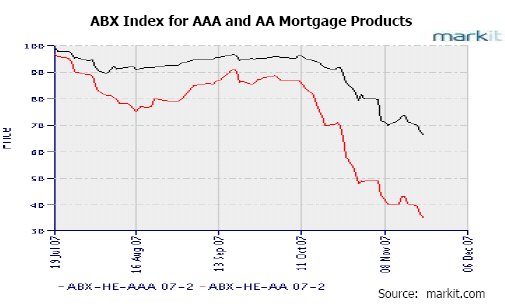

Unfortunately, like Japan a generation ago, the price-keeping-operation has not managed to obscure the unsustainable nature of some of the prices of the assets involved. Adding together mortgages of dubious quality from different parts of the economy, and then pretending that since they were assumed to be unrelated to each other, they deserved a higher investor rating (which itself implied higher prices / lower yields for these 'packets' of securities than the individual components could gain) was always a dubious form of financial alchemy and in recent weeks we have seen that the assumptions and hypothesis that underpinned this sleight of hand are flawed.

Default rates are rising amongst the underlying loans and structured finance products are falling in price.

Moreover, the investment and commercial banks that seem to have been trying to stem this tide of selling are now finding that, not only are the reported losses starting to sap their capital bases and effective firepower, but that the auditors are taking a closer look at their books and the valuations that they have applied to the assets that they are holding. Thus, it seems that the US's version of the 'price-keeping-operation' is beginning to unwind.

As this situation unfolds, real world investors are beginning to fear the (re-) emergence of the 1000lb gorilla. Specifically, if the big banks are now reversing their strategies and selling down their considerable holdings of assets, then although bargains will ultimately be created, real investors will obviously want to steer clear of the credit markets until prices are seen to bottom.

This, of course, implies that the mortgage and other lenders, such as Northern Rock and others in the UK who have traditionally relied on these markets as a source of funds, are unable to gain access to the financing that they need for their businesses.

For the households in the 'Anglo Saxon' world (i.e. the US, UK, and Australasia) and many others (including those in Southern and Eastern Europe), this drying up in credit supply will have significant consequences. Consumers in each of these regions are cash flow negative on a running basis; that is to say that they need to borrow money just to maintain yesterday's level of spending into tomorrow.

But, if their lenders cannot obtain financing, then these consumers will not be able to borrow and as a result they will have to start bringing their level of expenditure down in line with their level of incomes. Such a decline in spending may look – and feel – perilously close to being in a recession.

Therefore, we suspect that the latest bout of jitters in the credit markets has the potential to derail economic growth across the globe and, while we have no doubt that this event will ultimately cause the central banks to reduce interest rates, in the near term share markets may have to cope with disappointing growth and earnings figures from companies.

For Australasia, this nascent global slowdown may have the added impact of reducing investor demand for the region's currencies, which may now retrace their recent gains. Moreover, as the global economy slows, it may have the effect of reducing some of the demand for (particularly hard) commodities, which has recently also helped to buoy the growth within the Southern hemisphere economies.

Tyndall's Comment on the Month's Numbers

A very poor month for sharemarkets globally, the worst being the NASDAQ (down 6.9%), closely followed by

Japan (down 6.3%). The best sharemarket was Germany, but that was still down 1.9%. Global bonds continued

their recent strength, with the LBGAI index (hedged) returning 1.5% for the month. The NZD was mixed, although

rose nearly 4.5% against the AUD.

| « Seven key themes to influence funds management | ASSET - Festive Talkfest » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |