The Best of Both Worlds

Tuesday, March 18th 2008, 9:31AM

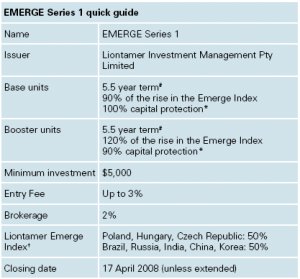

Liontamer has just launched a pair of capital protected funds that provide investors with exposure to two diverse aspects of international markets. EMERGE Series 1 accesses an exciting selection of emerging economies, while GLOBAL Series 5 is the latest iteration of Liontamer's successful series of international equity funds. Both funds offer investors the choice between full or partial capital protection at maturity and the option of accelerated returns via a booster feature.

Liontamer has just launched a pair of capital protected funds that provide investors with exposure to two diverse aspects of international markets. EMERGE Series 1 accesses an exciting selection of emerging economies, while GLOBAL Series 5 is the latest iteration of Liontamer's successful series of international equity funds. Both funds offer investors the choice between full or partial capital protection at maturity and the option of accelerated returns via a booster feature.EMERGE Series 1

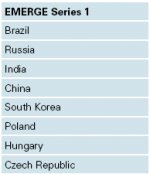

Liontamer's latest offer, EMERGE Series 1, combines the powerhouse markets of Brazil, Russia, India and China (known as BRIC), together with the growing force of South Korea and the successful emerging European economies of Poland, Hungary and the Czech Republic – and packages them all up with the added benefit of either full or partial capital protection at maturity*.

Energising Europe

Central Europe is an exciting new element to Liontamer's emerging markets basket. It's an area that Liontamer, through its European parent company KBC Asset Management, knows well. In recent years, KBC has been active in Central and Eastern Europe establishing a large network of retail banks. KBC now has a significant local presence in this part of Europe and reports that the prospects for the region are very good indeed. In particular, Poland, Hungary and the Czech Republic are attracting a lot of similar foreign investment as they establish themselves as a part of mainstream Europe and work their way towards full membership of the Economic and Monetary Union (EMU).

Since these three countries joined the European Union in 2004 (as a precursor to joining the EMU) lower wage and production costs have lured a number of foreign companies to set up shop locally. For example, iconic chocolate maker, Cadbury, is currently transitioning production from Keynsham in the UK to Poland; joining Gillette, Fiat and Dell Computers, who all now manufacture in that country. Lego has a large factory in the Czech Republic and Suzuki is the largest car manufacturer in Hungary. Central Europe is now poised to take the next step. Eventual conversion to the Euro will open even more doors as will marketing themselves as service providers with intelligent graduates from good education systems.

These economies also have a major geographical advantage. Positioned between developed Western Europe and the resource-rich nations of Russia, Belarus and the Ukraine, they act as a trade conduit, adding manufacturing value and sending cheap goods and services westward. This, combined with their skilled and productive workforces, explains why Poland, Hungary and the Czech Republic are getting the reputation of being the 'Tiger' economies of Europe.

Food, fuel, factories and funds

So, while Central Europe is something new for a Liontamer fund, the BRICK economies are more familiar, having formed the basis of the popular BRICK Series 1 fund last year. The BRIC economies first came to the fore in the 2003 Goldman Sachs' paper "Dreaming with BRICs: a path to 2050". This paper outlines a case where the BRIC economies have the potential to be economic powerhouses that will fuel global growth throughout this century, eventually shunting the UK, Germany and France out of the G6. Looking at the demographics, it's easy to see how they arrived at that premise. Together, the BRICs contain more than 40% of the world's population and account for over a quarter of its land mass. BRIC growth rates, despite a global slowdown, remain impressive with China continuing to record double-digit growth (11.4% pa) and India not far behind (8.5% pa)1.

India and China's massive populations and the process of industrialisation demand more and more resources from all over the world, contributing in large part to the increased price of basic commodities such as oil, metals and food. On the flip-side, the commodity rich nations of Russia (with oil and gas) and Brazil (agriculture, steel and cement) are on the other side of the Asian transaction, as suppliers of commodities and beneficiaries of the continual price increases. Liontamer has again added South Korea to the BRIC group. This Asian up-and-comer has transformed itself into a knowledge economy, embracing sound economic policies, adopting a high-growth development agenda, and gaining efficiencies in its labour force.

Liontamer has picked that the resulting BRICK basket will complement the countries forming the Central Europe component of the index and provide a strong set of diverse emerging markets in the fund. While these markets are certainly at the higher end of the risk spectrum, the two capital protection options continue to provide investors with that all important 'sleep at night' factor.

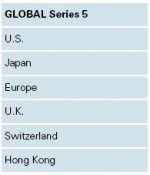

GLOBAL Series 5

Liontamer's other new fund, GLOBAL Series 5, is specifically designed for investors who have a positive long-term view of global sharemarkets and who are looking to maintain or grow their exposure but still want the reassurance of knowing that their capital is either fully or partially protected from losses*. The fund tracks a basket of international sharemarkets via the Liontamer Global Index, which includes the US, Japan, Europe, UK, Switzerland and Hong Kong.

Super-boosted returns

Like all of Liontamer's 23 previous funds, GLOBAL Series 5 shields investors' capital from falls in the market, in this case by offering two different levels of protection; booster units provide full (100%) capital protection, while super-booster units provide partial (90%) protection. In addition, booster units give investors a 130% exposure to the Global Index, meaning returns are accelerated by 1.3 times. For investors willing to sacrifice just a little of that capital protection, the super-booster units provide an even more impressive 170% exposure to the market, or 1.7 times the gains - as well as the 90% capital protection.

Super-booster units limit any losses to just 10%, while providing the potential to significantly accelerate returns. As an example, if the markets increase by 50% over the five year term, investors receive a gain of 85% to add back to their capital. On a $1 investment, 90 cents of capital is repaid and 85 cents of gains, giving a total of $1.75.

Liontamer believes that two capital protection options, both utilising a booster feature, makes GLOBAL Series 5 a compelling investment product in the current market environment.

1. CIA World Fact Book, 2007 (est).

Full details are contained in the Investment Statement and registered Prospectus, provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325). Copies can be obtained from Liontamer by calling 0800 210 450 or emailing adviser_relations@liontamer.com. Neither KBC Bank NV, KBC Group NV nor KBC Asset Management NV guarantees repayment of the investment amount nor do any of them accept any liability to investors. However, as the Fund Asset Provider, KBC Bank NV is legally liable to pay to Liontamer as trustee of the funds certain amounts. Neither KBC Group NV nor any other member of the KBC Group guarantees the obligations of KBC Bank NV. *Capital protection at maturity means you will receive back 100% or 90% (as applicable) of the combined amount invested and early bird interest (earned during the offer period) less any entry fee charged (up to 3%). There is a more detailed description of capital protection in the Investment Statement and the limited circumstances when capital protection may not be available. †Index levels are averaged monthly in the final year, which will protect you from any sharp falls in the index. In a rising market averaging lessens returns. #Liontamer has the discretion to reduce or increase the maturity date by six months, depending on market movements during the offer period.

| « Riding the Global Credit Crunch and Commodities Boom | Food, Fuel and Fallen Angels » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |