Food, Fuel and Fallen Angels

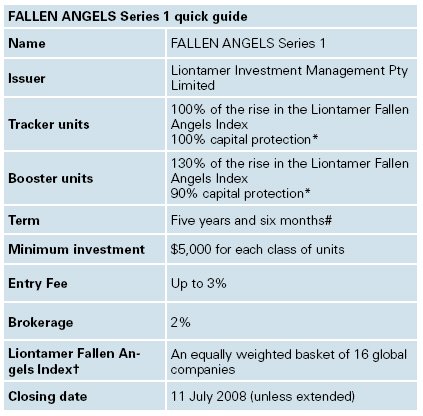

Liontamer has launched a pair of capital protected funds that provide investors with exposure to two new, and very topical, investment themes. FALLEN ANGELS Series 1 hunts for bargains amongst the global sharemarket fallout, while COMBI Series 5, the 'food and fuel' fund, continues Liontamer's successful series of commodity-linked investments.

Wednesday, May 21st 2008, 1:46PM

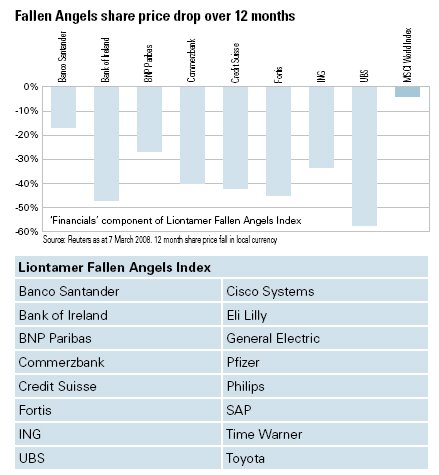

FALLEN ANGELS Series 1Someone once said that 'volatility is just opportunity in fancy dress' i.e. it is sometimes difficult to recognise an advantageous situation when you are surrounded by distractions – and there have certainly been a lot of those about lately. Current market conditions are a case in point. There is a lot of 'noise' out there distracting investors from seeing the true nature of the global market. Investors have been understandably nervous; after-all the international sell-down is a direct result of fundamental concerns over the state of the global economy. The recent sell-off in international equities has seen the MSCI World Index lose over 19% since its 2007 high1. While that's concerning, it's no market crash, and history tells us that when sell-offs do occur they can provide a great buying opportunity for those willing to take a long-term view.

This most recent sell-down appears to have been largely indiscriminate. Around the globe quality companies with strong fundamentals have had their share prices knocked down along with those that perhaps deserved to lose value. Liontamer believes that the current environment can now be likened to a worldwide stock-take sale, where bargain basement prices are to be found – provided you look hard enough. The negative sentiment has spilled over to affect a wide range of sectors, resulting in solid companies with well known brands becoming undervalued. Savvy buyers can use this opportunity to purchase these 'fallen angels' at a discount to their true market value.

Hunting bargains

FALLEN ANGELS Series 1 contains a basket of companies,

which in Liontamer's view, have been oversold relative to their

underlying value, as a result of the recent market corrections.

The methodology used to identify the 16 stocks that make up

the basket involved first looking at the top stocks across the

world's major indices. The companies Liontamer were looking

for had to meet certain criteria, in particular each stock had to

have underperformed the MSCI World Index over both a six

and 12 month period2. Additionally, and very importantly, the

company had to have a current 'buy' recommendation from our

parent company, KBC Asset Management.^

It quickly became apparent that companies in the banking and

financials sector represented good value at current levels. Financial

stocks have been heavily discounted despite many continuing to

show underlying financial strength; therefore a 50% index weighting

was given to this sector. However, clearly not all banking stocks are

'fallen angels'. The final criterion was the specific exclusion of any

US-based banks. Despite the likes of Citigroup and JP Morgan

significantly underperforming the MSCI World Index over the

relevant period, Liontamer and KBC Asset Management felt the

on-going environmental risk in the US credit market effectively

ruled these companies out of the Fallen Angels Index.

Get Smart-start

FALLEN ANGELS also introduces a brand new feature

designed to address any market timing concerns investors may have. With the new 'Smart-start' feature investors can benefit

even if the Index drops in value during the first few months

of the investment term. Smart-start finds the lowest level at

three points in time during those first few months (initial start

date, and around three months and six months) and re-sets the

initial opening value of the Index to that lowest level. So, even

if markets keep falling during the early stages of the investment

period, the Smart-start feature means investors in FALLEN

ANGELS Series 1 can still benefit.

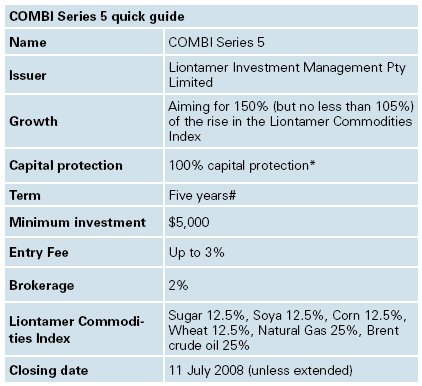

COMBI Series 5 – the fuel and food fund

A visit to the supermarket is enough to remind us that the price

of many grocery items has increased dramatically over the last

few years. Like all products, food prices are affected by the

pressures of supply and demand. Currently there are two main

factors affecting global demand for staple foods like sugar,

wheat, soya and corn. First, people in developing nations are becoming wealthier as their economies thrive, resulting in a huge

influx of middle-class consumers demanding access to quality

foodstuffs, including grains and meat products. In 1985 the

average annual meat consumption in China was 20kg; in 2007

it was 50kg per person. Given that it takes approximately 8kg

of feed grain to produce 1kg of beef3, that's a lot of additional

pressure on grain prices.

Secondly, the high price of oil is also contributing to rising

food prices. The burgeoning bio-fuel industry has a huge

appetite for corn, sugar and wheat; three of the main options

from which to create ethanol. Soya beans are also used as a key

ingredient for the production of bio-diesel. In 2006, bio-fuels

used almost 50% of Brazil's total sugar production. This year,

up to 30% of the grain harvest in the U.S. is expected to go

straight to ethanol distilleries3. Despite a record growing season

last year, suppliers are having trouble meeting the extra demand.

COMBI Series 5 is a capital protected investment* that

provides investors with a boosted exposure to a special

commodities-linked index. The index contains a mix of

important agricultural goods and essential energy resources

– key elements that feed the world's expanding population and

fuel global industry.

1.Reuters

2. As at 7 March 2008

3. The Economist

Full details are contained in the Investment Statement and registered Prospectus,

provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325).

Copies can be obtained from Liontamer by calling 0800 210 450 or emailing

adviser_relations@liontamer.com.

*Capital protection at maturity means you will receive back 100% or 90% (as

applicable) of the combined amount invested and early bird interest (earned

during the offer period) less any entry fee charged (up to 3%). There is a more

detailed description of capital protection in the Investment Statement and the

limited circumstances when capital protection may not be available. †Index

levels are averaged monthly in the final year, which will protect you from any

sharp falls in the index. In a rising market averaging lessens returns. #Liontamer

has the discretion to reduce or increase the maturity date by six months,

depending on market movements during the offer period. ^KBC Bank NV (as

the Fund Asset Provider), is legally liable to pay to Liontamer, as trustee of the

funds, certain amounts but it does not, and nor does any other entity (including

KBC Asset Management NV), guarantee repayment of the investment amount or

accept any liability to investors.

| « The Best of Both Worlds | ING Life enhances its already great product line! » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |