Market Review: May 2008 London commentary

With financial markets easing, this month Andrew Hunt comments on whether the credit crunch is over, and questions whether inflation is now the worry? The global economy delivers our Central Banks a complex state of affairs.

Tuesday, May 6th 2008, 1:53PM

Over recent weeks, global equity markets have apparently regained some of their composure and the year long decline in financial sector shares has shown signs of easing. In its recent pronouncements, the Federal Reserve has provided some implicit support to financial markets by suggesting that following its numerous rate cuts and provision of emergency collateral to the banking community, the worst may be over with regard to the immediate threat to the integrity of the financial system. In the UK, the Bank of England has perhaps gone even further in its Financial Stability Review and stated that it believes that the credit markets may now offer value to investors at these levels.Positively, following our travels over the last month, which included a few days researching in New York, we would suggest that the chances of a major bankruptcy at a major financial institution are clearly receding and that the Bear Stearns / JP Morgan debacle may have marked a turning point in this regard. However, this is not because the financial institutions have placed their respective houses in order. According to our contacts, the major commercial and investment banks are perhaps no more than a quarter of the way through dealing with the legacy problems of the long 2003-7 credit boom; there are still substantial administrative and valuation problems within the banks' huge proprietary trading assets and certainly there are many more losses to realise and these will continue to eat up the banks' capital reserves for the foreseeable future. Hence, we expect there to be a continued procession of rights issues and other capital raising strategies from these institutions for at least the next 12 months or so.

However, what has changed with regard to these banks is that the regulators and the central banks do appear to have found a way to allow the troubled banks more time to deal with these problems. Potential losses on assets are not being immediately realised (despite protests from some investors, the banks are making heavy use of so called tier three 'mark to make-believe valuations' to postpone taking losses on existing assets) and this is leaving the banks with the appearance of sufficient capital. At the same time, the Federal Reserve, Bank of England and others are conducting asset swaps with the most troubled of the banks so that these weaker institutions will have at least some 'safe assets' that they can offer as security to their own creditors , who are primarily conventional banks in Asia. Through these varied measures, and the lower level of official interest rates, the infrastructure of the financial system should be protected and maintained in a notionally working order.

What the authorities categorically have not succeeded in doing however is re-opening the credit channels for real world borrowers. Thanks to their large on-going financial deficit, US households and companies must together borrow around $80 billion every month simply to finance the now wide gap between their level of expenditure and their (lower) level of income. But, with the banks and other lenders so pre-occupied with dealing with the legacy problems of the previous boom, it seems that the US private sector is still finding it very difficult to raise the credit that it needs to fund its cash flow deficit. Consequently, we believe that both US households and companies now face a very binding cash flow constraint on their ability to spend. It is this constraint that has led to an almost unprecedented decline in nominal retail spending in the consumer sector and employment intentions surveys in the corporate sector. These events, we would argue, make a US recession is not just a probability for the future but a current reality.

Against such a background of US economic weakness (and indeed UK and European weakness – credit cycles have weakened in all these areas over recent months, as has the New Zealand cycle), we suspect that it will be very difficult for the Western economies to generate domestic inflation in the near term. However, this does not mean that the countries will not experience higher reported inflation rates in the near term. Already, higher food and fuel prices are providing an unwelcome impetus to official inflation rates around the globe but, for the Western Economies (including Australia and New Zealand), there is also a new inflationary threat emerging from China.

For a decade or more, we in the West have relied on importing goods from China that were both cheaper than domestic substitutes and generally falling in price as a way of both improving our living standards and keeping our widely watched consumer price inflation rates in check. Had China not been exporting huge quantities of cheaper consumer goods over recent years, we suspect that inflation rates in the West would have been one or even two percent higher on average since 2001. Unfortunately, China's water, pollution and agriculture crisis has now become so severe that food price inflation has ratcheted up to significant levels and this has in turn implied that Chinese wages have begun to rise sharply as workers in the country have sought to maintain their own purchasing power.

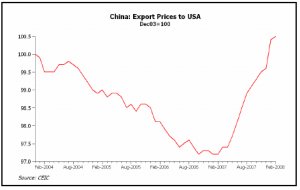

As one might imagine, Chinese manufacturing sector profit margins were already wafer thin and the recent outbreak of wage inflation has obliged companies to pass on much of their increased labour costs (and higher energy costs) to their customers. Hence, Chinese inflation rates are rising, including those for Chinese exports. After a more than a decade of export price deflation, China is now exporting inflation to its customers – including those in the US and elsewhere. Hence, we have seen an unwelcome increase in core inflation rates in the West as TVs, toys and even clothing prices have begun to rise.

The advent of Chinese export price inflation has obviously come at a most inopportune moment for the Federal Reserve, ECB, Bank of England and the Reserve Bank of New Zealand. These institutions increasingly want to move to counter the credit crunch and global slowdown but the persistence of reported inflation is acting as an impediment and, in some cases, the central banks simply cannot cut interest rates as a result of the inflation situation.

But, maintaining tighter than necessary monetary regimes will do little directly to tackle food price inflation in China, since the latter has been caused by years of Chinese under investment in its agricultural sector. In order to solve its food shortages, China will need to invest more in this long neglected sector and liberalise its food import regimes. The latter will clearly provide a long run boost to the Australasian economies, once the process begins.

Given this complex state of affairs, we expect that central banks in the West and particularly in Australasia, will wait to see developments in their domestic labour markets before deciding just what to do with their own official interest rates. If the domestic labour market is perceived to still be tightening, and therefore vulnerable to a pickup in wage inflation in response to the higher food, fuel and Chinese goods prices, then they may consider raising interest rates further. Indeed, we still expect that Governor Stevens at the RBA may be obliged to follow this course. However, in the US, UK and New Zealand, in each of which there are signs that domestic labour conditions are easing, we would expect the central banks to either continue their existing easing strategies (i.e. the US) or to begin easing in late 2008 (NZ), safe in the knowledge that even if the currencies do come under downward pressure as interest rates decline (as seems likely), the domestic labour markets will be sufficiently weak to prevent higher import costs leading to a sustained pick up in either domestic wage or general price inflation.

In short, we expect the western economies to weaken further over the course of the second half of 2008 and the central banks to either begin easing (New Zealand and Europe) or continue to ease (US and UK) despite the potentially elevated level of the reported consumer price inflation rates. Australia may, however, have to wait until 2009 before it can join these banks and start to experience lower official interest rates.

Andrew Hunt, London, International Economist

| « ASSET - NZ's boutique renaissance | Market Review: May 2008 commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |