Market Review: June 2008 commentary

For Dairy Farmers, It's A Land Of Milk And Money

Monday, June 9th 2008, 12:55PM

Last week's increase of Fonterra's payout to dairy farmers to $7.90/kg of milk solids is astonishing. Even more, next year's payout is also forecast to be somewhere around the $7.00 level, however the drought conditions in various parts of New Zealand in the first quarter of this year will reduce production volumes and income levels. This is fantastic news for the dairy farmers who supply milk to Fonterra, but not so good for the rest of us.Look at the prices of the goods in the refrigerated section of the supermarket. If you had been out of NZ for the past couple of years, you would not believe the increases of prices for many food items, especially dairy. The bread and butter of New Zealand's exports is milk and, um, butter and, at the moment, they are a hot commodity on the world's marketplace. Hot commodities mean hot prices and this has seen increases of 80% in milk prices and 62% in butter. Unfortunately (in this instance), we live in a very open economy, so despite the fact that we produce so much of this commodity (as a country), we have to pay so much for it as well (as consumers).

The global shortages in food that have led to this inflation have happened surprisingly quickly. Almost all food prices have increased at far higher levels than what general CPI shows. Look at the increases in the price of rice, tomatoes, coffee. What are the causes of this? Is it a sudden desire by emerging Asian citizens (particularly the burgeoning middle-class in China) to change their eating patterns? Or is it because, in the urbanisation rush of modern emerging countries, agricultural growing areas are being lost to new factories, offices and housing complexes? Or is it even because, in the quest to look for alternative fuel supplies, much of the US corn stock is being used to produce ethanol (possibly through the aid of Government subsidies) rather than as a food source? Probably all three have played some part. The last reason above (changing use of corn) may have helped the NZ dairy farmer, as our cows are grass-fed rather than corn-fed.

It would be much easier to live with food inflation if it were the only significant form of inflation. However, there are two others that are making life far tougher. As everyone on the planet is aware, the price of oil is at extremely high levels. With crude prices nearly USD150 a barrel and NZ petrol stations charging $2.00+ a litre for 91, discretionary income gets further curtailed whenever the car's fuel gauge needle hovers towards 'E'. However, this inflation also has significant ramifications for almost every other good and many services – fuel increases mean delivery costs go up and production costs rise whenever that production requires the use of fuel. (The largest per capita users of fuel are actually the oil-producing Gulf States). Taxi fares go higher and airfares keep going up (remember those airline fuel surcharges – they are now an ingrained and permanent part of flight costs, which is understandable given the exorbitant cost of jet fuel).

The trouble with fuel inflation is that it is probably not really being caused by OPEC limiting volumes. It is primarily being driven higher by speculators – those risky investors who seek huge capital gain opportunities by participating in the futures markets. Their trading actions are driving the prices ever higher. Of course, if they can drive prices higher, they could also drive them down, but that doesn't seem to be in their current plans.

The third major form of inflation is one that, for the past fifteen years, has been deflationary. Andrew Hunt has covered it in his commentary, but the export of price inflation from China has caused significant further deterioration in New Zealander's disposable incomes. Those cheap toys we have been buying for our kids will become much more expensive.

Fortunately, though, all has not yet been as bad as it could have been. The Chinese inflation and fuel inflation are things that we import. The higher the New Zealand dollar (NZD) is, the cheaper the imports. So our high NZD is keeping the cost of imported goods and, hard to believe, fuel prices down. In other words, were the NZD to fall, things would become even more expensive.

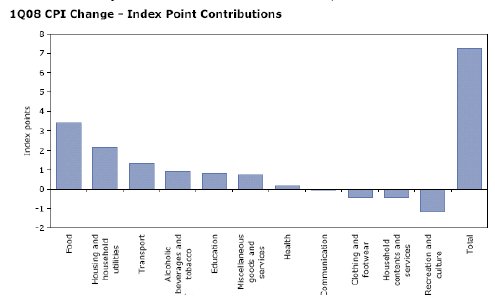

Which brings us to the point as to what to do about this. It really lies in the hands of the Reserve Bank of New Zealand (RBNZ). The RBNZ has maintained a relatively hawkish monetary policy over the years, keeping our interest rates higher than the rest of the developed world's as they attempted to keep the CPI level below the 3% maximum level. (They failed in the December 2007 and March 2008 quarters, with annual inflation rates at 3.2% and 3.4%, respectively).

Having said that, the RBNZ has not altered its Official Cash Rate since 26 July 2007. This is despite the inflationary impacts mentioned above increasing significantly over the past ten months (which would normally result in an increase in the OCR). On the converse, all of the recent economic data coming out points to a dramatic slowing of the NZ economy. This usually requires a cut in interest rates in an attempt to foster renewed growth. This loosening of monetary policy is the model that the US used under Greenspan and now Bernanke. Keep interest rates low to encourage growth, rather than focus on warding off inflation through keeping rates higher.

And this is the dilemma that the RBNZ faces. Should it keep interest rates at their current high levels (or even put them higher), or help out the economy by cutting? If the latter, which it will likely have to do if it doesn't want New Zealand to fall into a recession, just when should it do so?

Only recently it seemed that the RBNZ would be able to hold off cutting interest rates until late 2008 or even early 2009. While food and fuel costs and mortgage rates continue to rise, the average New Zealander could get by just fine, provided they still had a job. So, as long as the employment data did not look too concerning, the RBNZ had justification in delaying any cut in interest rates.

However, that employment data is beginning to look more suspect as the year progresses. The March quarter employment data showed a huge drop in the number employed (29,000), but the participation rate also decreased, so the actual unemployment rate figure is still relatively low.

The nightly news during May, though, frequently had items of plant closures and layoffs and, if this trend continues, the RBNZ's decision might be easier to make sooner. We suspect that the RBNZ will wait until the next Household Labour Force Survey is released to see if the pattern of unemployment is continuing to deteriorate. If so, then it will likely cut rates immediately.

The next Household Labour Force Survey, for the June 2008 quarter, is not due out until August 7, thereby bypassing the June 5 and July 24 dates for the next two OCR announcements. The OCR announcement after the Labour Force Survey release is not until September 11.

And, on that fateful date, we believe the RBNZ should take the first cut in a program of monetary loosening. The reality is that any inaction by keeping interest rates high is not really having any effect on curbing inflation (other than keeping the NZD high). The main causes of inflation, as outlined on the previous page, are all controlled by foreign influences. As much as it may wish to, the RBNZ has little power to solve world food shortages, the price of oil or the costs of Chinese exports.

Therefore, the RBNZ should instead look at what it can influence – the NZ economy. By cutting interest rates sooner rather than later, it may be able to prevent NZ from entering either a fully-fledged recession or recession-like conditions. When there is high global inflation around, all possible should be done to ease the effects on New Zealand's consumers and businesses.

Peter Lynn, CFA, Head of Strategy

| « Market Review: June 2008 London commentary | ASSET - Doing the distribution reshuffle » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |