In force premiums up nearly 10%

Market statistics for life insurance at the end of June 2008, recorded an increase of 9.6% in the total premiums paid for in-force life policies from $1.35 billion to $1.48 billion over the past year.

Friday, August 22nd 2008, 12:39PM

"The huge success of KiwiSaver attracting over 750,000 savers should also provide a trigger for New Zealanders to assess their life insurance cover, particularly for families. Individuals should take the opportunity to ensure that they have adequate cover against premature death and also protection of their ability to work and earn an income. Becoming unable to work through long-term illness or disability will throw any well-planned savings programme off course, but this can be easily protected. Income replacement insurance is one of the fastest growing insurance products," Investment Savings and Insurance Association chief executive Vance Arkinstall said.

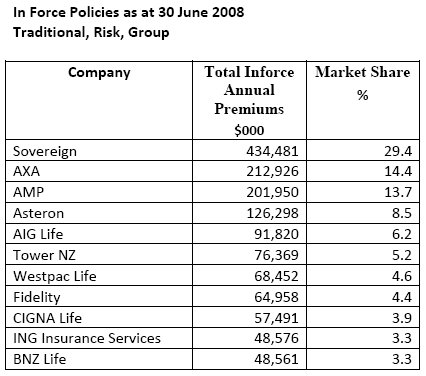

The market share of total premiums of the leading companies has remained relatively consistent over the past 12 months with Sovereign 29.4%, AXA (NZ) 14.4%, AMP 13.7%, Asteron Life 8.5% and AIG 6.2%, holding the leading positions.

During the year ended 30 June 2008, life insurance companies paid out $425 million (last year $412 million) in death claims, a further $209 million ($211 million) in maturities and a $202m ($200 million) in other benefits including income replacement claims and surrender values. In total, life insurance companies have returned $936.7 million to support the families and dependents of their policyholders which is a significant contribution to the New Zealand economy.

| « Research: Stepped vs level – there's more than one right answer | Mixed reviews from advisers on FMA regulation » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |