Market Review: December 2008 Commentary

The magnitude of events in the financial markets this year make it unusually difficult to even do a traditional year-end reflection.

Monday, December 15th 2008, 1:03PM

Markets have broken records across all sectors. Most in the wrong direction. The world economy has navigated through a period of profound and grave crisis. While the first half of 2009 will see deepening economic recession, there is cause for some positive reflection. Governments are acting decisively to support their economies and financial markets. As a consequence, the financial sector is intact. This is particularly true for Australia and New Zealand, where confidence is strong in our Banks. Westpac’s early December equity issue is clear evidence of this strength.Greg Campbell, Tyndall managing director

Santa, Can We Please Have Less Volatility Next Year?

Yesterday, my daughter sat on Father Christmas’ lap and asked for a dog for Christmas. She is not going to get one (sorry sweetie), but the world is likely to receive a metaphorical dog for next year’s global economy. Incidentally, my daughter asked for a trampoline last year and if I can extend this metaphor; using a preschooler’s Christmas requests, for world financial markets, then 2008 brought us the most bouncy tramp we have ever jumped upon.Volatility was rife throughout the year and several measures broke records in the final three months. While uncertainty remains, volatility will stay high. This will continue to play havoc with equity markets because, as we have seen in the last few months, when uncertainty is extreme, sentiment overtakes fundamentals and rationality in the pricing of stocks and even bonds.

December is always a time of reflection on the year nearly over and I will continue this tradition by trying to recap what investors experienced in 2008. I could probably write a book (fortunately, far more eloquent authors than me will do exactly that about the 2008 financial crisis), but I will just look at the return highlights (or lowlights, as they often were).

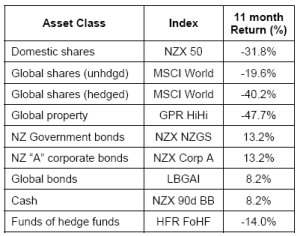

The following table sets out the returns for the various markets (as represented by indexes) for the year to the end of November. It is not pretty reading. With the exception of New Zealand bonds, global bonds and cash, everything else has been relatively weak. Of course, in the scheme of things, 11 months is a relatively short period, but what a period!

Let’s have a look at these in more detail. New Zealand was supposed to have avoided the worst of the financial crisis (and it may well have), but we are in the middle of major recession that could continue for some time.

New Zealand’s sharemarket started falling in May 2007. After a fairly disappointing 1.4% return for the NZX 50 Gross Index in 2007, though, it has fallen nearly a third in value ( 31.8%, including dividends and imputation credits) since December 31. Such a poor return is no surprise, given that the 11-month period includes the four worst months since 2001 and, in June, the worst monthly return since 1998 (over -11% in that month alone). The annual result is heading towards similar levels as in 1990 (where the 11-month to November result was -34.6% and the 1990 year return ended at -35.1%). Recessions and sharemarkets are not the best of friends.

Global shares have been among the worst performing asset classes, as the financial crisis took a strong hold and then, just as measures were put in place to resolve the crisis, the global economy moved into its anticipation of a recession, for which there is still a great deal of uncertainty about its length and depth. In hedged to NZD terms, the asset class has fallen over 40% for the year to date. The MSCI World Index has been going since 1969 and there has never been any twelve month period that has reached -40% yet (previous worst: twelve months to September 1974, where it fell -37.4%). In fact, if you look at the S&P500 Index in the US (down -39% for year-to-date), it is heading for its worst calendar year since 1931, when it fell -47%. Global small caps (down 43.9%) and emerging markets (down 48.3%) have performed even worse – in both cases heading for their largest ever annual falls in value.

For a New Zealand investor, though, the extent to which you have been hedged has made a massive difference. A completely unhedged global equity investment has resulted in a 20% positive difference in returns. The NZD finally ended its long rise (started 27 October 2000 at USD0.3914) on 13 March 2008 (at USD0.8184, although intraday trading went higher than this). Since then, it has tumbled significantly in the wake of RBNZ rate cuts and flights of capital out of New Zealand down to its end November level of USD0.5498. This is a 33% fall from the NZD’s peak and nearly a 29% fall since the start of the year. Admittedly, other currencies have not been as strong as the USD, so the fall has not been as dramatic against the Euro or the Pound, although it has fallen 37% against the Yen since 1 January. Again, this is heading for the biggest calendar year fall on record, including in the mid 1980’s when the dollar was floated.

Global property rounds out this sorry year of woe for the equity markets, with the high yield global property securities index down almost 50% since the year started (a non-high yield index returned almost the same). Most of this loss has come in the second half of the year with, in particular, a staggering -30% return in October and a -15% return in November. This comes on the back of a 8% loss in 2007 and basically erases all of the gains made since 2003. That October return is by far the worst monthly return ever recorded for global property (previous worst: -10.7% in October 1997) and means that 2008 will be easily the worst year in global property since our records began in the 80s (previous worst annual return: -19.2% in 1994).

Then we have the other side of the coin. Government bonds have had a tremendous run in 2008. The New Zealand Government Bond Index has risen 13.2% so far, with a 4.2% return in the month of November alone. This is the best monthly return for bonds since mid-1986. We are headed for the best annual return since at least 1993 (when New Zealand bonds returned 13.5%) or even 1991, when they were up 20.5%.

Incidentally, the A-rated corporate bond index is also up by 13.2% for the year to date, but has achieved that result through a different route. There were three months during the year when either of the government and corporate bonds was negative, with the other being positive. The November return of 3.3% for corporate bonds was its best monthly return since September 1998 and the best annual return for corporate bonds was 14.3% in that 1998 year.

Global bonds are also having a strong year-to-date, but (as compared with the NZ situation) the difference between the returns from governments and non-governments is very large. In hedged to NZD terms, global governments have returned 12.4%, whereas the credit index has returned 4.6%. Incidentally, emerging market debt is not having a great year – down 20-4% to date for the year.

Then there is cash. This most “boring” of asset classes has had a big year. The OCR, which was introduced in 1999, started off the year at its highest level (8.25%, where it had been since July 2007) and stayed there until July 2008. There must have been some consideration to increasing it when inflation looked to be skyrocketing in early 2008 (remember when oil was shooting up towards USD150 a barrel and fruit and dairy prices were increasing rapidly?), but how times have changed. The second half of the year has seen oil prices fall to below USD50 a barrel, inflation fall markedly around the globe and interest rates tumble. The RBNZ has now made four successive rate cuts, an unprecedented feat, and the cuts have been large – 0.25%, 0.5%, 1% and 1.5%, respectively. The RBNZ had never cut rates more than 0.5% before, so October and December’s 1% drops were unprecedented. There is likely to be further cuts in the first half of next year, taking the current OCR at 5.0% down to what? 4%? 3.5%? Even less? My pick is that there will be cuts next year that take the OCR down to below 3.5%. Even at a level of 3.25%, it will likely be above most other Western economies’ interest rate levels.

So cash has performed very well in 2008, returning over 8% for the year to date. It is likely heading to its best performance since 1996, when it returned 9.8%.

Hedge funds had their worst ever year since records began in the late 1980s. The HFR Fund of Funds Index had fallen by over 14% to the end of October. There has only ever been one year before where hedge funds (according to the HFR index) had a negative return (1994), but the second is only a month away. Of course, the actual returns achieved by individual hedge funds diverged markedly. I am aware of some that are up 80% for the year while several others went bust. But the environment in general took its toll and the short selling restrictions in particular (that were enacted in several markets in September) removed one of the hedge funds’ strongest insurances against large falls in equity markets. Hence the returns in September and October have been by far the worst monthly returns that funds of hedge funds have incurred.

So it has been a year of records in almost all asset classes. In addition, several volatility indexes have risen to levels that were almost unimaginable a year ago. The well-known VIX index (representing the volatility of the S&P 500 Index) reached a new record high of over 80 in late November (usual range is 12 to 26). The MOVE index (which is roughly the bond equivalent to the VIX) reached 264.6 on 10 October (its usual range in 70 to 125). This is yet another all-time record.

It would be wonderful if we had a much quieter year in 2009, but I have my doubts. It may not be as volatile as 2008, but we should be prepared for continued ups and downs in investment markets until some end to the global recession is apparent. My picks are that global equities will struggle in the first half of next year, before recovering somewhat in the second. Remember that sharemarkets tend to lead economies, so the market will turn before the recession ends. Government bond yields will continue to fall as interest rates tumble.

Next year, I have to work out how to get my daughter to ask for a bull for Christmas. That would seem to be a much better omen than a dog. On behalf of all at Tyndall, I wish readers and their families a happy and safe Christmas and a positive New Year. Hopefully you cannot think about these markets for a while.

Peter Lynn, CFA, Head of Strategy, December 2008

| « Market Review: London December 2008 Commentary | 2009 Investment predictions discussed » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |