Market Review: March 2009 Commentary

On a few occasions in 2008, colleagues pointed out the “recklessness” and “inappropriateness” of commentators mentioning the possibility of the global economy slipping into a “depression”.

Friday, March 13th 2009, 9:55AM

The “D” Word

Certainly, there is still a body of vocal activists on the internet that attack journalists for mentioning that word, based on the belief that if it gets published enough, it might actually make it happen.

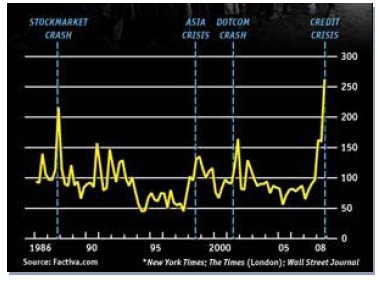

There is actually an index that measures the number of times the word “depression” is mentioned in various newspapers. The chart below came from the Economist a while ago, but it certainly shows the increase in mention of “depression” as the crisis has unfolded.

But what exactly is an economic depression? Surprisingly, there is no accepted definition, such as we have for “recession”. A recession is defined as two consecutive quarters of negative GDP growth. New Zealand’s September quarter GDP was the third consecutive negative quarter, so we have been in a recession since the start of 2008.

Incidentally, the US, as they often do, have their own different definition. They have a range of factors that are applied retrospectively to say, well, that was a recession. That is why, late in 2008, people started saying that the US had been in a recession since December 2007.

But, what makes a bad recession turn into a depression? There is the joke definition, “A recession is when your friends lose your job – a depression is when you lose your job”, but a better possible definition for a depression is a fall in GDP of 10% and/or a recessionary length of three years.

Both these events happened in the Great Depression. It started on Black Tuesday, October 29, 1929 in the US, spread to almost all countries and lasted to sometime in the 1930s or early 1940s, when World War II intervened. Some accounts have the Great Depression ending in 1932 after 43 months (in the US) and a 33% fall in GDP, followed by another major recession in 1937/38; others have it as one long continuous depression.

Regardless, it was a far cry from the comfortable world we now live in. For those whose parents or grandparents have related stories of life in the Great Depression, the hard-ship was unimaginable. For a small agricultural exporting country, the drastic fall in prices and volumes for our commodities meant that New Zealand was severely affected.

Here, there was no dole and with unemployment at extremely high levels, people had to turn to work relief schemes just to put food on the table. Although a lot of these programmes did not amount to much, there were some that have contributed to making New Zealand a better place, such as the Homer Tunnel, the planting of trees in the central North Island to create the forestry industry and the establishment of many parks throughout the country.

Before 1930, though, there was another recession that was referred to as the Great Depression – this was what is now called the Long Depression and lasted from 1873 to 1896.

It occurred at the same time as the Second Industrial Revolution and, while volumes did not fall, prices most certainly did. The UK was probably the worst hit country, losing its large competitive edge over the rest of Continental Europe.

While this depression is usually deemed to last for 23 years, GDP actually increased over the 1880s and 1890s as a result of the increased production. The actual recessionary nature in the US only lasted around 65 months, which is still a very long time.

And so, the $6.4 trillion question is: what is the chance that this current global recession will turn into a depression? Well, 2008 was the second-worst of all equity markets in the US since 1871.

The only worse month than last year’s 38% drop was 1931, when the S&P 500 fell a staggering 47%. Of the seven previous years since 1871 when the S&P500 fell by more than 20%, all of them except two responded with a positive 20%+ rise the following year. The exceptions were 1930 and 1931, with 1932 falling by 15%, before 1933 rose with a stunning 44%, the second-best rise on record.

I suspect that this long historical cycle of recoveries from large market falls is why some commentators are predicting large bear market rallies over the course of this year. I do not believe it will happen this year, though (the US market has already fallen 19% for the first two months of 2009). However, what it shows, though, is that when markets recover from such a rout, they do so with a vengeance.

The average length of a recession is around 10-11 months. We are already at 14 or 15 months into this recession, with no real end in sight – in fact, things seem to be getting worse. So this recession will be both longer and deeper than most other recessions.

I found an article from a Seattle newspaper about a subprime mortgage lender, Merit Financial, going bankrupt in May 2006, which was possibly the first casualty of the current credit crisis. That is over two and half years ago. Things seem so bad because it has been going on an awful long time.

The key, though, to whether this will turn into a depression will be global GDP figures, particularly for 2010. This year (2009) has already been written off (after only two months) as almost certainly being the second consecutive year of negative growth.

Most economic “base case” scenarios have a very small amount of growth (GDP of less than 1%) for 2010. However, you would have to say that the chance of 2010 being another negative year is relatively high, at around 30-40%. Growth, then, would not likely recur until 2011.

By that stage, we would have had three years of recession and, by some definitions, that would constitute a depression. BUT, I am not suggesting that it will be anything like the Great Depression. The circumstances of the early 1930s were significantly different, including:

• Interest rates in the early 1930s were actually raised, rather than being lowered as currently

• Similarly, 1930s US fiscal policy was to reduce spending, rather than increase it as we are seeing with the bailouts and stimuli

• Governments in the 1930s were unable to print money (as they are now) because currencies were tied to the gold standard

One thing to watch out for, though, is the rise of protectionism. In 1930 the US introduced the Smoot-Hawley Tariff Act that resulted in a major increase in tariffs. The resulting trade war prolonged the depression far more than it would have otherwise.

There is now a general understanding of how undesirable protectionism is, but some governments just cannot help themselves. Even in the big US Government Bailout 2.0, the initial draft had an element of protectionism in it, but mercifully that was removed. Similarly, Gordon Brown has been making comments about saving jobs for UK citizens.

So, although protectionism is known to be economically bad, sometimes politically it seems the right thing to do.

The other thing to watch out for is social unrest. If unemployment rises to significant levels, protesting and civil disobedience could rear their ugly heads.

It is likely to most prevalent in places like Spain, where unemployment is expected to reach 30% and Eastern Europe, which is actually suffering worse than Asia did in 1998.

In fact, the financial crisis in Eastern Europe is so severe that it would be making front page news, if only there wasn’t so much else making financial news in the developed world.

There doesn’t seem to be a lot of good news out there at the moment. It is likely, though, in a couple of years, we will be over this and, more importantly for investment funds, sharemarkets will be substantially higher than they are now.

t that time, you will probably look back at 2009 and think, why did I not invest so much more in shares? The reality probably will be that, at the time (that is, now), you had no idea how much weaker things would get.

There will continue to be a lot of volatility. Hence, investors will need to hold on and ride it out. It takes a brave person at the moment to increase their equity weightings, as we probably have not reached the bottom yet.

Similarly, it takes a brave soul (some say foolish) to reduce equity weights at the moment, as the recovery, when it eventually comes, will likely be swift.

After suffering so much loss already, you would be reluctant to sacrifice potential large upsides just to avoid any further losses in the interim. Unless you know how to time markets (and I am still waiting to meet someone who is successful at that), you would be relying on luck to time your re-entry point.

Peter Lynn, CFA

Head of Strategy

| « Market Review: London March 2009 Commentary | Market Review: London April 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |