Market Review: May 2009 London Commentary

Fiscal stimuli worldwide may have averted the worst economic scenarios. However, they are expensive - "Uncle Sam is running out of money". Andrew Hunt comments on the improvement seen in world markets. And how this is likely to be temporary.

Wednesday, May 6th 2009, 9:07AM

Taking a Holiday from Austerity

A quick trip to the US last month revealed numerous points of interest. Firstly, and least positively, the horse-trading, politicking and general level of nastiness surrounding the budget process for the various financial bailouts that have so far been mooted is at least as severe - and downright Machiavellian - as at any other time in recent history and it is now clear that Capitol Hill has little more stomach or ability to pass further ‘bailout bills'.

It seems that the much hyped Obama fiscal response and the various Paulson and Geithner rescue plans have exhausted not only the country's ability to finance these programmes but probably the politicians' ability to pass them as well.

The US private sector is, therefore, effectively now on its own with regard to deciding its own future - it seems that Uncle Sam is now running out of money despite the Fed's efforts at "printing more", as the rather twitchy behaviour of the Treasury bond markets has been signalling for some time now.

Despite signs of potential price deflation in the economy and the Federal Reserve's promise to start buying bonds, government bond prices are drifting lower at present, a rather worrying trend that will potentially increase borrowing costs across the economy at a most inopportune moment.

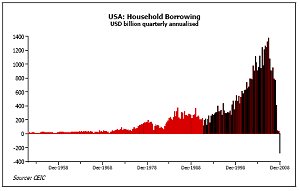

As for the situation within the US private sector itself, we find two quite opposing trends at present. In the short term, US households are evidently pleased to have simply survived the tumultuous events of the final quarter of last year and to have succeeded, despite the awful economic environment, in the task of raising their cash flow into positive territory for the first time in over a decade.

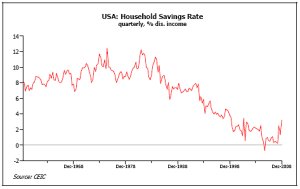

After years of deficit spending (i.e. total expenditure was well above post tax income receipts), US households are now in aggregate saving once again, although the cost of this transformation in their financial position was of course an unprecedentedly weak level of consumer spending in the economy during late 2008.

Perhaps unsurprisingly, households chose to use their new-found "positive free cash flow" to pay down some of their debt in the closing months of 2008 and this achievement (the first net debt repayment by the sector in three generations), coupled with the promise of tax cuts and an increase in government spending from Obama's existing fiscal package, seems to have encouraged households to feel a little better about life and spending at present.

Perhaps unsurprisingly, households chose to use their new-found "positive free cash flow" to pay down some of their debt in the closing months of 2008 and this achievement (the first net debt repayment by the sector in three generations), coupled with the promise of tax cuts and an increase in government spending from Obama's existing fiscal package, seems to have encouraged households to feel a little better about life and spending at present. Consequently, they have now stopped reducing their level of expenditure, with an obvious and seemingly positive impact on the retail sales data. In fact, we have seen some signs of a modest revival in spending within the economy and this event has unsurprisingly led to an obvious pickup in investor sentiment.

In reality, we doubt that the ‘consumer revival' will exert a significant impact on actual production trends (or, more particularly, on employment trends) in the economy, since it seems that the majority of the increase in sales will likely be supplied from existing inventories of unsold goods but nevertheless even this will be a useful event for the US's now cash-strapped corporate sector.

Unfortunately, as we note above, even this relatively modest ‘improvement' in the economy has come at the expense of a stalling in the on-going and much needed process of raising the savings rate. Although US households are now modestly cash flow positive and able to repay some of their existing debts, they are not yet generating sufficient free cash flow to be able to retire enough debt to repair their balance sheets to any significant extent.

Hence, negative home equity and high debt ratios remain common place and, if the household sector is to make headway in repairing its still weak balance sheets, then it will need to save even harder. Consequently, we believe that the current vacation from austerity can only be a temporary event.

Unfortunately, when the sector does finally seek to move its savings rate up to the 8-9% rate that we calculate is necessary, it will likely be doing so against a background of still very weak labour market conditions, even weaker wage trends and a lack of Federal assistance, given the authorities' own now more pressing financial constraints.

Unfortunately, when the sector does finally seek to move its savings rate up to the 8-9% rate that we calculate is necessary, it will likely be doing so against a background of still very weak labour market conditions, even weaker wage trends and a lack of Federal assistance, given the authorities' own now more pressing financial constraints. In fact, we estimate that in order to raise the savings rate back up to the 8-9% that we believe is necessary, consumers may have to cut consumption spending by a further $700 billion or more. Such a reduction in the level of spending would seem likely to result in a return to recession-like conditions and we suspect that this ‘second stage' of the slowdown will occur during early 2010.

It seems that in order to repair their balance sheets and to correct their (admitted officially encouraged) financial over exuberance of recent years, US consumers must endeavour to save even more and this action will ultimately cause a further bout of economic weakness, potentially as early as the first part of next year.

However, as if to prove that economic variables rarely move in straight lines, it seems that the US household sector has taken a quick break in its austerity programme, a break that the equity markets have naturally welcomed.

Such ‘holidays' are not without precedent; a similar ‘rebound' in Japan's then still debt-ridden economy in 1993-1994 had many convinced that interest rates would have to rise in the near term in order to prevent the economy overheating but, in reality, the need to raise private sector savings rates in the medium term ensured that Japan's economic revival of 1993-4 proved to be nothing more than a bump on the road to sustained economic weakness, although the optimism that it generated was sufficient to cause a classic bear market rally, a rally which saw a temporary but powerful forty percent rise in equity prices in late 1993.

Having just visited the US, we were struck by the similarities which exist in that country compared to the situation that prevailed in Japan during its own austerity period. Consequently, we feel that although the current US equity rally may have a little further to go, we also suspect that as the prospects for 2010 begin to disappoint, investors may face a more challenging time as 2009 draws to a close.

Andrew Hunt, London

| « Sec Comm thoughts on setting adviser competence standards | Market Review: May 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |