Market Review: July 2009 London Commentary

In this edition of Tyndall Comment, we explain why our research indicates that recent market rally optimism is premature. Production is now beginning to track lower demand levels, households are saving more and spending less - and, governments across the world are less able to provide fiscal support for their economies. Even with "hold-out" countries like Australia, the outlook is notably weaker.

Tuesday, July 7th 2009, 1:11PM

In the early part of 2007, there was a widespread belief amongst many economic forecasters and even some policymakers that the global economy was slowing and that interest rates would therefore soon decline. This notion of falling interest rates was used by both borrowers and lenders as rationale to extend the credit boom for yet another few months and thus there was a further unwelcome increase in household indebtedness and the quantity of structured finance (i.e. the now infamous CDOs) outstanding.

Unfortunately for those involved in this final part of the credit expansion, the ‘global slowdown' of early 2007 proved to be nothing more than a feint in the data caused by a significant but temporary downturn in the manufacturing sector's inventory cycle.

By the second quarter of 2007, it was clear that not only had the global economy not slowed in the way that had been anticipated but that inflationary pressures were rising, particularly in Asia. Consequently, market-determined interest rates tended to drift upwards in the second quarter of 2007 and this event was to prove fatal to not just the credit expansion, but in some cases to the credit system itself. The usual oscillations in the inventory cycle had created so much noise that the fundamental condition of the global economy had been obscured, albeit only temporarily.

We relate this historical experience because we believe that a similar event has occurred over recent months, albeit in reverse. Perhaps as a result of excessive levels of optimism created by politicians' promises of an early recovery, many manufacturers - particularly in Asia - entered the second half of 2008 with a relatively high level of inventories.

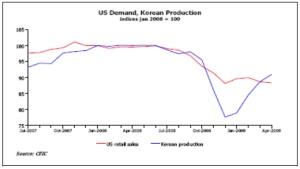

However, when global demand continued to weaken in the closing stages of the year, many of these companies were obliged to reduce their production levels not just so that they were in line with the weaker final demand trends but to levels that were far below demand so that they could clear their bloated inventory positions. Hence, many countries in Asia witnessed a 30% decline in production despite the fact that final demand for their products was only down by 10% or so.

However, as we entered the second quarter of this year, it appears that many of these excessive inventory positions had been reduced, particularly in the electronics and tech sectors, and in parts of the auto sector. Consequently, the companies operating in these sectors were able to move production levels back up to levels consistent with current demand trends, weak though the latter were.

However, as we entered the second quarter of this year, it appears that many of these excessive inventory positions had been reduced, particularly in the electronics and tech sectors, and in parts of the auto sector. Consequently, the companies operating in these sectors were able to move production levels back up to levels consistent with current demand trends, weak though the latter were.

For those commentators watching the progression of the monthly data, the shift by companies from a heavy destocking bias to a more neutral inventory accumulation rate appeared to be a strong recovery. However, we can argue that this is in fact not the beginning of a sustained period of output growth but simply a one-off step-wise adjustment in production levels and, unfortunately, since final demand trends remain weak, we can further hypothesise that once this adjustment process was finished, the monthly production data would simply fade again as production levels declined modestly along with final demand trends.

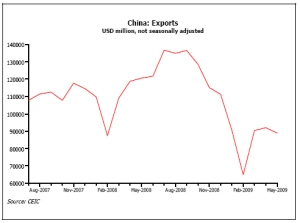

In fact, the latest data from Asia and elsewhere has generally confirmed this trend. Recent export, production and orders figures from many of the world's manufacturers have begun to soften as production has once again begun to track demand lower and consequently we are witnessing a fading of the ‘green shoots of recovery'.

Certainly, on the demand side of the global economy, there are few signs of a recovery. US households are continuing to raise their savings rates in an effort to rebuild their balance sheets in the wake of the housing market crash - as indeed are New Zealand households. Unfortunately, the act of raising savings at a time of weak income growth has implied weak consumer spending trends, particularly in cash terms.

In Japan, rising concerns over conditions in the labour market have encouraged Japanese households to reduce their spending and hence we are seeing few - if any - signs of a recovery in the world's second largest economy. Although many stock brokers like to talk up the prospects of a recovery generated by efficiency gains and cost cutting in the corporate sector, the reality of such deflationary policies are weaker household incomes and less consumer demand, as Japan is currently proving.

In Germany and much of the rest of Continental Europe, there are currently no signs of a domestically-led recovery. Domestic income and credit trends remain very soft in the region and in some countries, most notably Spain, the unemployment situation seems to be becoming critical. Within a year, Spain's rate of unemployment may reach 25% and this can be expected to depress the economy for the foreseeable future. Consequently, we see few signs of Green Shoots in Europe and even the IMF-sponsored stabilisation of Eastern Europe seems to have yielded little new growth for the region, perhaps because it is likely to only be a temporary event - next year Eastern Europe will finally have to deal with its fundamental lack of competitiveness and over-consumption problems.

Therefore, in the majority of the global economy we see few if any signs of a recovery in demand and this can be expected to constrain overall production and employment trends for some time to come, particularly now that many governments have apparently exhausted their ability to provide fiscal support to their countries. Governments in not only the US but Japan and parts of Europe as well are beginning to encounter difficulties in placing their financing bonds into the debt markets and this seems likely to limit their ability to offer fiscal support to their economies over the next few years. Even in New Zealand, the authorities apparently feel that their actions are constrained by the country's existing foreign debt burden.

Naturally, within the global economy, there are a number of countries that do appear a little stronger despite this weak aggregate situation. India's response to the global slowdown was so aggressive that far from slowing down, India's economy seems set to overheat in the near term. Therefore, we expect interest rates to rise in the medium term and this event can ultimately be expected to lead to an economic slowdown there within a year or so. In Indonesia, Brazil and some of the other emerging markets, a recent influx of foreign capital inflows appears to have re-invigorated the domestic credit systems and this has provided something of a modest stimulus to the countries concerned. In some cases, such as Hong Kong, we expect these inflows to have very positive effects but in some, most notably Brazil, the extra stimulus may be unwanted given the current inflationary pressures in the labour market.

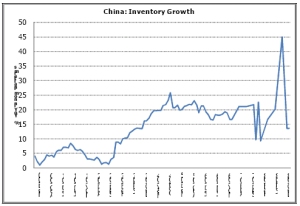

Over recent months, there has been much talk and indeed excitement over the outlook for China. Unfortunately, we are convinced that China's recent better production data has been primarily the result of huge government subsidies and the provision of de facto subsidised credit to companies, in the hope that the latter will continue to maintain production and hence employment growth. The shortcoming with this approach is relatively simple to discern however: China's increased level of production has not been absorbed by an increase in demand and consequently inventories of both finished goods and commodities have soared over recent months in China. Since this excessive inventory accumulation clearly cannot continue ad infinitum, we expect China's production sector to soon have to slow once again and in so doing puncture the ‘China Bubble' that has recently formed in markets.

Finally, there would appear to be two ‘hold-out' countries that appear determined to continue with the previous credit boom process. With the explicit encouragement of their respective governments, households in both Australia and the UK seem determined to continue to borrow and to supplement their still remarkably buoyant income growth so that they can continue to ‘deficit spend'. However, these relatively firm trends simply cannot be sustained given the sectors' weak balance sheets and we suspect deteriorating income outlooks for 2010. Therefore, although these economies remain relatively strong in the near term, we see this strength as being a slump "postponed not avoided" scenario - both countries are likely to be notably weaker next year.

For the financial markets, we suspect that the third quarter will pose a few challenges.

The large and looming supply of government bonds that must be placed into the financial markets over the next few months may constrain bond prices, even as the global recovery story wanes. We therefore find it difficult to be optimistic over the outlook for government bond markets over the next few months, although a fourth quarter rally remains a possibility given the weak global economy.

For equities and other risk assets, the current rally evidently has considerable momentum but we suspect that a combination of weak data from the economy and the heavy issuance calendar in the debt markets will put some pressure on equity prices towards the end of the quarter. For the currency markets, we see little to choose between the major currencies - each has its problems but in times of stress, the US dollar's safe haven status may lend it some support.

Certainly, we would expect the NZD to soon lose ground against the USD as the failure of the global economy to recover becomes more apparent. Elsewhere, the GBP and AUD may continue their recent rallies in the near term, but we expect significant weakness in both as 2010 looms.

Andrew Hunt,

International Economist

London

| « Market Review: June 2009 Commentary | Market Review: July 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |