Market Review: August 2009 Commentary

Markets are seldom efficient at learning lessons. Peter Lynn takes stock of the extraordinary year, so far, for investment markets. And he shares some perspectives on what the remainder of the year holds in store for investors.

Tuesday, August 11th 2009, 2:41PM

Half-Time Wrap Up

This seems about a month late, but I felt it was appropriate to stop and just have a look at where markets went in the first half of 2009 (well, actually now the first seven months). I am pleased that I waited an extra month, too, as July 2009 was another extraordinary month in what has been a pretty extraordinary year so far.

For most of the past five months returns seem to have been sensational and it has been easy to forget the absolute horror of the first nine weeks of this year, when it seemed that 2008's annus horribilis was going to repeat itself.

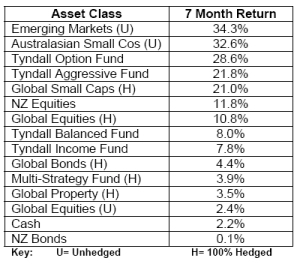

The numbers for the seven months to the end of July are in the table below. They are market (index) returns for all asset classes, with the exception of the specific Tyndall Funds' returns that do not easily fit within traditional asset classes (the latter are gross of tax and fees returns).

There are certainly some surprises here. Perhaps the biggest is that there isn't a negative number in sight. Every sector is positive, which probably wouldn't have been expected after the end of the first quarter.

There are also some staggering returns for a seven month period, not least the Balanced Fund return. Emerging markets are the big winners, although they did fall 38.5% last year, which, if you do the maths, requires a massive 63% return to get back to the starting point. In fact, the return I have shown above for emerging markets is the unhedged NZD return. If I had used the hedged to NZD return, the performance over the first seven months of 2009 is 44.7%.

This shows how much the impact of currency has had on returns this year. The emerging markets difference is mainly related to USD movements, where the NZD started off the year at USD0.5844, before falling below USD0.5000 but then rising to USD0.6583 at the end of July. So hedging has proved a real benefit since about early March, although over the preceding 12 months, it hurt a lot as the NZD fell from about USD0.8000.

On a global currency basis, the difference between global equities hedged and global equities unhedged is also very dramatic. A fully hedged global equity return rose over 10%, whereas an unhedged return delivered a paltry 2.4% over the seven months, barely eclipsing cash.

Actually, the ranking of the asset classes themselves offer a relatively ordered listing that decreases in return with a decrease in risk (with the exception of unhedged global equities and global property). This simply shows that the rally since early March has mainly been the result of a repricing of risk.

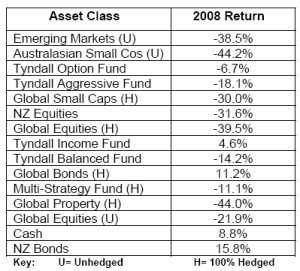

The table below shows how those same asset classes/funds performed in 2008 calendar year and, with some exceptions, it roughly follows an inverse ordering. The worst performer over the whole period since the start of 2008 up until July 2009 (both tables combined) has been global property, which still has a long way to go to recover the large losses of last year. Unfortunately, there is little expectation of a resurgence in listed property security values, particularly on commercial properties, for some time, while the economic conditions remain so uncertain.

The best performer over this period has been the Tyndall Option Fund. This fund came through some fairly horrendous interest rate volatility in 2008, losing only a relatively small amount of value. It has certainly rebounded strongly, though, on the back of strong option premia in the highly volatile environment while not being impacted as much from interest rate volatility.

The question, of course, is how will these asset classes fare over the remainder of 2009. If only we knew. Most pundits seem to have an expectation that emerging markets will continue to deliver the highest returns. I have sympathy with that view, as some emerging markets have shown better-than-expected economic data, such as China and India, and there is still increasing demand for commodities and also expansions in manufacturing activity.

China still seems to be getting what it wants, which means that shares leveraged to China and other emerging markets should do well. However, anyone who expects another 20%+ return from emerging markets in the remainder of the year is possibly a bit too optimistic. The reality may be that emerging will hold onto the strong returns made so far (probably with a lot of volatility), whereas others may not.

Likewise, the Tyndall Aggressive Fund offers strong prospects to benefit from whatever the Australasian equity market will throw up. The Fund's ability to select stocks, regardless of whether they are in the index or not, gives it a huge advantage over more benchmark-tied options, especially passive funds.

I also expect the New Zealand domestic equity market to continue outperforming its global counterparts. This is in complete contrast to what some other New Zealand fund managers have recently been predicting, but I still have a few question marks over the global situation, which could result in a late third-quarter setback. While New Zealand would be affected by implication (and sentiment), its reaction may well be more muted than that in, say, the US and Europe.

Finally, the Tyndall Option Fund should also continue to offer outsized returns, unless there is an unexpected bout of Treasury yield volatility. Otherwise, it should be able to continue to collect relatively strong premia and thus produce reasonably solid returns.

As alluded to previously, I see a lot of challenges ahead for the global property asset class. The outlook for commercial property is not particularly rosy, given the continued economic malaise and rising unemployment. If there is a sentiment change for global equities, global property could well turn south again as well.

Of course, we don't know what lies in store for us in the second half of 2009, although we are praying that we don't receive anything like the turmoil that was the second half of 2008. Time will tell.

Peter Lynn, CFA

Head of Strategy

1 August 2009

| « Market Review: August 2009 London Commentary | Australian economic downturn 'shallower', rates will rise, Stevens say » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |