Market Review: October 2009 London Commentary

We are enjoying increasing optimism over prospects of a global economic recovery. We are less than convinced. In this month's Tyndall Comment, Andrew Hunt explains how much of the recovery in financial markets can be attributed to strong liquidity. This is driven by central bank programmes rather than any improvement in our 'real' economies, which remain weak.

Friday, October 9th 2009, 9:39AM

An Unconvincing Recovery...

Optimism over the prospects for a global economic recovery has increased markedly over recent months, particularly as asset prices have recovered around the globe. In practice, we have observed that there is often a tendency to assume that an equity market recovery does indeed signal an impending economic recovery, perhaps because rising asset prices seem to ‘pressure' forecasters to move their anticipated growth numbers upward. We, however, are less convinced in the equity and the other financial markets' predictive powers, instead believing that there are other processes driving asset markets at present.

It has become very apparent over recent months that the global financial system, far from shrinking and becoming a mere ‘utility' for the real economy as some believed that it would following last year's crisis, is once again expanding in size and if anything becoming further divorced from the real economies. During a recent visit to an Asian central bank, the staff with whom we met expressed amazement that despite their domestic economy still being weak and suffering from a marked degree of profit-sapping deflation, they were experiencing record capital inflows into their domestic equity and high-end property markets. Unfortunately, this story seems not to be unique: the seemingly awkward juxta position of large capital flows and resurgent asset markets with still weak or weakening real economies appears remarkably common - obvious as it is in South Africa, South America, Eastern Europe and much of the OECD.

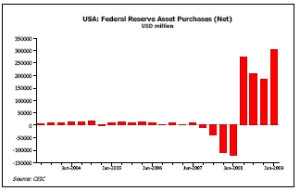

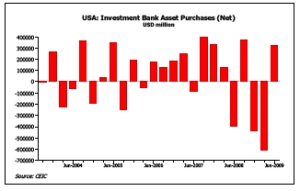

We believe that the primary reason for the recovery in financial markets is simple cash flow: the massive asset purchase programmes now being operated by a number of central banks, including the Federal Reserve, the ECB, the Bank of England and the Bank of Japan, coupled with a politically ‘incorrect' and perhaps rather surprising resurrection of the investment banking sector has led to a situation of strong liquidity within the financial systems.

We believe that the primary reason for the recovery in financial markets is simple cash flow: the massive asset purchase programmes now being operated by a number of central banks, including the Federal Reserve, the ECB, the Bank of England and the Bank of Japan, coupled with a politically ‘incorrect' and perhaps rather surprising resurrection of the investment banking sector has led to a situation of strong liquidity within the financial systems.

For example, as a result of the central banks' actions, the commercial banks have ample reserves, some of which they are expending by purchasing fixed income securities within the debt markets. Similarly, the investment banks have been provided with a seemingly elastic supply of ‘cheap funding' and hence they have been re-expanding their balance sheets through aggressive securities purchases. Most surprising of all, however, is that the US Federal Reserve's massive purchases of mortgage securities seems to have reliquified the former owners of these securities and allowed them to go on an equity and corporate bond buying spree, both within the US and externally. Faced with such huge flows, it is not surprising that financial markets have benefited and apparently flourished.

However, what is also abundantly clear from the economic data that little of the activity in the financial system is spilling out into the real economies. Equity markets may be booming and perhaps creating some positive ‘wealth effects' for their owners but there is little or no new equity issuance, a situation which implies that real world companies are not materially benefitting from the boom in share prices. Moreover, even when investors sell their existing stocks of financial assets to the authorities, they seem to be re-investing the proceeds in other financial assets or using the money to pay down their own debts, suggesting that their ‘spending power' within the real economy is not rising as a result of the financial markets' recovery.

However, what is also abundantly clear from the economic data that little of the activity in the financial system is spilling out into the real economies. Equity markets may be booming and perhaps creating some positive ‘wealth effects' for their owners but there is little or no new equity issuance, a situation which implies that real world companies are not materially benefitting from the boom in share prices. Moreover, even when investors sell their existing stocks of financial assets to the authorities, they seem to be re-investing the proceeds in other financial assets or using the money to pay down their own debts, suggesting that their ‘spending power' within the real economy is not rising as a result of the financial markets' recovery.

We also find that the recent boom in corporate bond issuance has been used by the companies which were lucky enough to issue new debt to acquire a ‘rainy day' stock of financial assets, rather than to boost employment or investment. Meanwhile, in the commercial banking system, there are currently no signs of a pickup in lending to either households or small companies, both of whom usually depend on credit flows from this source. Quite simply, although activity and even credit growth may be returning to the financial sector, it has yet to leak out into the real world and therefore we expect the global economy to remain weak over the next year.

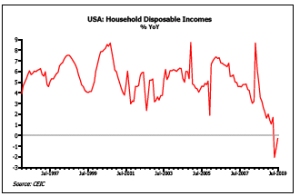

Nowhere is the dichotomy between financial versus real world clearer than in the USA. Although the economy is enjoying odd months of stronger activity in response to specific fiscal measures such as the Bush tax cuts of 2008 or the latest ‘Cash for Clunkers' car subsidies, underlying trends remain soft in the economy, particularly with regard to household incomes. Indeed, US disposable income growth has now turned profoundly negative which, given the household sector's now well established preference for saving (something which it must do if it is to repair its overstretched balance sheets), implies that consumer spending cannot rise on a systematic basis. Certainly, there may be odd months of strength, such as that which we are experiencing currently, but in general we expect consumer spending and hence overall economic growth to remain resolutely sluggish.

In Japan, one might have expected the domestic economy to have fared relatively well during the slump given the private sector's low debt burden and generally strong balance sheets but the authorities' weak fiscal position and the challenging demographic situation within the economy seem to have resulted in a severe domestic slowdown alongside the more predictable weakness that has occurred in the export sector. With both the domestic and external sectors facing headwinds, we can expect little growth in Japan in the medium term.

In Japan, one might have expected the domestic economy to have fared relatively well during the slump given the private sector's low debt burden and generally strong balance sheets but the authorities' weak fiscal position and the challenging demographic situation within the economy seem to have resulted in a severe domestic slowdown alongside the more predictable weakness that has occurred in the export sector. With both the domestic and external sectors facing headwinds, we can expect little growth in Japan in the medium term.

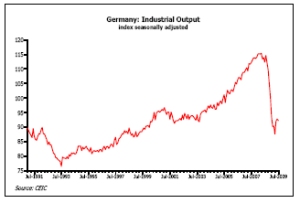

In Europe, fiscal policy has been used very aggressively in some countries to insulate the economies from the slump but, as the scope for this fiscal largesse is exhausted, we can expect renewed economic weakness as the fiscal stimulus is removed, particularly in countries such as the UK in which fiscal policy has been incredibly expansionary until recently.

In Southern Europe, there may still be some leeway for further fiscal action but even here the governments will find themselves constrained in the years ahead. Unfortunately, as the regional economy remains soft, so too will Germany's export-dependent economy. We therefore believe that a sustained recovery within Europe is still some way off and that the period of maximum weakness for the UK lies ahead of us, a factor that should continue to weigh on sterling's external value.

One economy that has attracted considerable optimism of late has been China. China's authorities reacted albeit quite belatedly to the global slump by launching an unprecedentedly large domestic credit boom which appears to have been successful in reviving production trends in the economy as well as stimulating the local asset markets. Unfortunately, the revival in production does not seem to have been accompanied by a revival in domestic demand with the result that inventories have piled up at an unsustainable rate. Given the inventory situation and the authorities' stated desire to rein back the credit expansion in order to protect both the balance of payments and ‘cost push' inflation pressures (although Chinese demand is weak, the rise in production is already encountering some supply bottlenecks which could lead to higher inflation in 2010), we feel that China's economy is much more likely to slow in 2010 than remain strong, as indeed is India's economy.

In India, inflation and current account deficit problems have emerged of late and the authorities are clearly signalling an imminent monetary tightening in order to cool the economy. Brazil, meanwhile, has proved to be very successful in recycling its recent large capital inflows into a domestic credit boom which should keep domestic spending growth reasonably firm over the next year or so but, in aggregate, we expect growth in the BRICs to slow in 2010 rather than accelerate.

For investors, the failure of the global economy to recover in 2010 will clearly pose a threat to corporate earnings but on a more positive note, the lack of an economic renaissance should allow the major Western central banks to continue their accommodative stance, a factor which should be supportive for both bond and equity markets. Therefore, on a medium term view, we expect the recent cash-flow-driven revival in asset markets to broadly continue, although there may well be substantial ‘air pockets' along the way.

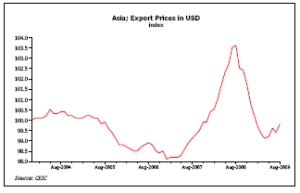

For example, the combination of rising government sales taxes, an ending of Asian export price deflation (itself caused by the removal of last year's ‘emergency discounts') and some specific supply shortages in some markets (such as toys and beer - areas in which the credit crunch has destroyed more ‘supply capacity' than ‘demand') are all likely to combine to cause a substantial jump in headline inflation rates in early 2010. The announcement of higher inflation and weak economic growth could well pose a substantial test for asset markets but, as these inflationary ‘special factors dissipate as 2010 continues we would expect financial markets to regain their composure.

It seems that both bond and equity markets may therefore be ‘choppy' over the next six months, as could currencies. In particular, we suspect that the US dollar's increasing role as a funding currency for foreign investors will keep the US currency weak while asset markets are inflating, but strong when they are falling, with the result that its trend over the next year or so is relatively flat against the major currencies.

Andrew Hunt

International Economist

London

| « Listed property trust sector set to soar | Market Review: October 2009 Commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |