Market Review: November 2009 London Commentary

Taking stock a year on: According to the consensus, a global economic recovery has begun.

Tuesday, November 10th 2009, 9:22AM

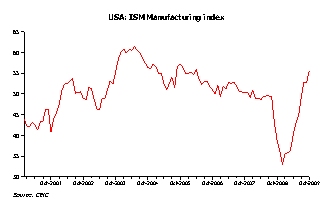

Crucial to this belief is the fact that this month's manufacturing confidence surveys (such as the US ISM index and the Euro Zone purchasing managers' surveys) have moved into ‘expansionary territories', while the US economy reportedly expanded at a three percent rate in the third quarter and China's apparently did even better, with a near 9% rate of growth in real terms. Based on these observations at least, it would seem that the G20's co-ordinated policy response to last year's global financial crisis has finally borne fruit.

On a practical level, we have always found it of interest that, although financial markets place great stock in such ‘high frequency' indicators as the US ISM Manufacturing Index, the indices may only have limited relevance to the economy as a whole. These confidence indices typically ask if conditions got ‘better or worse?' in the latest month and, while it is true that manufacturing sector conditions are deemed to have improved in the latest three months, these three months represent the only periods of expansion in the last 20 months - in the other 17 months the manufacturing sector declined and, given this almost unprecedented contraction, some form of rebound was always to be expected particularly in light of the various governments' "cash for clunkers" car subsidies. It remains to be seen, however, whether the recent manufacturing sector revival will extend into the remainder of the year now that the car schemes around the world have generally ended. However, this is not the only reason that we would not read too much into these manufacturing surveys.

On a practical level, we have always found it of interest that, although financial markets place great stock in such ‘high frequency' indicators as the US ISM Manufacturing Index, the indices may only have limited relevance to the economy as a whole. These confidence indices typically ask if conditions got ‘better or worse?' in the latest month and, while it is true that manufacturing sector conditions are deemed to have improved in the latest three months, these three months represent the only periods of expansion in the last 20 months - in the other 17 months the manufacturing sector declined and, given this almost unprecedented contraction, some form of rebound was always to be expected particularly in light of the various governments' "cash for clunkers" car subsidies. It remains to be seen, however, whether the recent manufacturing sector revival will extend into the remainder of the year now that the car schemes around the world have generally ended. However, this is not the only reason that we would not read too much into these manufacturing surveys.In any given month, roughly a third of the commonly observed economic indicators released in the USA or many other countries refer to the manufacturing sector but, in reality, the manufacturing sector only accounts for a little over a 10th of the US economy and similar minorities of most other OECD countries. The service sector indicators, which cover much more of the economies but which are less numerous, have been notably more downbeat of late. Indeed, the US service sector confidence index showed a further sharp decline in employment conditions.

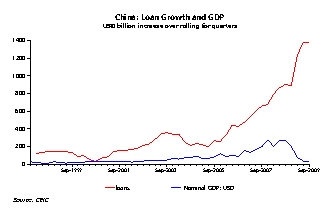

The seemingly optimistic third quarter GDP figures seem to have been helped by a number of special factors (including some implausible assumptions over the state of the revival in the construction sector and a presumably one-off drop in the savings rate, connected with the cash for clunkers scheme). Even China's ‘right-on-cue' GDP data contained a mixed message: the estimated real rate of growth may have been 8.9% but nominal GDP growth (i.e. the actual amount of spending in the economy measured in ‘cash prices') only rose by 6%, one of the lowest rates seen in China in many years.

We have calculated that for every dollar of nominal GDP growth in China, the level of debt in the economy increased by $7 - a lack of ‘productivity' that exceeds even that experienced by the US and others at the peak of the ill-fated mid 2000s credit boom. Of the 6% growth in China's economy recorded in the third quarter, it appears that the vast majority of the benefits accrued to wage earners rather than to profits, a situation that emphasises that the first half of 2009 boom in share prices (and even the more recent recovery) has been driven by the sheer weight of money connected with the credit boom. As events in 2007 in the West have proved, such credit boom sponsored rises in asset prices - and economic growth - cannot be sustained in the long term.

We have calculated that for every dollar of nominal GDP growth in China, the level of debt in the economy increased by $7 - a lack of ‘productivity' that exceeds even that experienced by the US and others at the peak of the ill-fated mid 2000s credit boom. Of the 6% growth in China's economy recorded in the third quarter, it appears that the vast majority of the benefits accrued to wage earners rather than to profits, a situation that emphasises that the first half of 2009 boom in share prices (and even the more recent recovery) has been driven by the sheer weight of money connected with the credit boom. As events in 2007 in the West have proved, such credit boom sponsored rises in asset prices - and economic growth - cannot be sustained in the long term.In Europe, meanwhile, far from an excess of credit, we are finding evidence within the official data series that the credit crunch that began with the Lehman Bros debacle is intensifying, rather than easing, and this clearly argues against there being a domestic economic recovery, as many companies can testify at present. Even in the UK, where the Government has been trumpeting recovery for months, we find that the credit situation remains weak and that retail spending activity is losing rather than gaining momentum currently, as household incomes wilt under the pressure of the weak labour market and rising taxes.

We have considerable doubts over the validity of the current global economic recovery hypothesis. While we acknowledge that there are very real signs of improvement in Australia and Korea for example, these are probably special cases within the global economy caused by particular specific factors. In addition, while it is also true that both Brazil and India have also witnessed better domestic trends of late, we suspect that both of these countries are facing cyclical overheating pressures that may constrain their growth in 2010.

Nevertheless, what is clear is that regardless of the true state of the real economy, parts of the global financial system have been booming. Not only do the ‘bumper results' of some of the resurgent investment banks bear testament to the strength of their recovery, so too does their balance sheet data. Indeed, far from contracting their balance sheets, as was advocated by many only nine months ago, these institutions are once again in full expansion mode - just as they were in late 2006.

Intriguingly - or perhaps disconcertingly according to some - much of the funding for the investment banks' renewed growth model has come not from private investors but from the various central banks through the medium of the "Quantitative Easing Policies". For example, in the US alone, we have estimated that in the second quarter the US investment banks created some US$100 billion of new demand for financial assets ‘from thin air' by borrowing ‘short duration funds' from the Federal Reserve in order to buy primarily longer duration bond market instruments.

On top of these flows, the Federal Reserve created an even larger sum through its own purchases in the debt markets and we estimate that, if we were to aggregate each of the transactions of the various global central banks and investment banks, we would find that the numerous QEPs now in force around the world have implicitly created at least US$1000 billion of net new demand for financial assets (chiefly bonds) per quarter since March this year - and perhaps very much more. In the face of such fund flows, it is not surprising to find that global asset prices have risen given this tidal wave of new liquidity.

In practice, it is a fact of life that QEPs tend to cause asset price bubbles and indeed we could suggest that they are designed to do so. Distilled to their lowest form, a QEP is not about ‘printing money' but about creating a leveraged boom in the bond markets (usually but not exclusively in the sovereign bond markets) that ultimately becomes so powerful that the ‘new money' created by the boom in the bond markets permeates into the other asset classes, such as equities. From there, it is hoped that the new funds will ‘leak' into the real economies through the medium of corporate fund raising in the securities markets or improved credit flows to households. So far in the current cycle, there has been an obvious credit / leverage boom in the debt markets as a result of the Federal Reserve's and others' actions. This has permeated into the other asset classes, including in the emerging markets, but what the funds have clearly failed to do as of yet is to find their way into the real economies - hence our cynicism over the stories of a global recovery.

The Achilles' heel of any QEP process is, however, a change in bond market sentiment. If sentiment were to turn against bonds, then investors would not leverage themselves into the debt markets and this could sabotage or negate the QEP processes that we noted earlier. Typically, bond market sentiment can be adversely affected by more hawkish central bank policy statements, concerns over the likely supply of bonds in the future and, most prominently of all, a change in inflation expectations. Unfortunately, our recent trips to Asia and to the USA have revealed a near perfect storm of these factors. Japan's government is clearly facing acute funding problems at present and conditions are only a little better in the West. The bond markets therefore are facing something of a supply glut in the months ahead. Furthermore, both the US and Euro Zone central banks are hinting at tighter policy regimes in 2010 (mistakenly in our view) and this is also a negative factor for bond markets.

However, most concerning of all, our recent trips to Asia have revealed a slight resurgence in export price inflation in the Emerging Markets, a factor that previously played a key role in the important and globally destabilising bond market declines of 1994, 1999 and 2007. While we doubt that Asia is on the brink of a new sustained upturn in inflation, it is clear that even the modest easing in the global crisis that we have witnessed has allowed some companies to reduce some of the discounts that they previously offered and this has resulted in a rise in reported inflation rates that will nevertheless raise Western companies' import costs.

Given the recent advent of these clearly negative factors for bond markets, we must wonder whether the leveraged boom within the fixed income markets that currently lies at the heart of the functioning of the QEP regimes can be sustained for many more months. Specifically, if bond market sentiment is indeed turning more negative, then there would seem to be no reason for the investment banks and others to continue to borrow funds ‘at the short end of the yield curve' in order to buy longer maturity assets - a situation that will tend to reduce the amount of liquidity within the overall financial markets themselves. Moreover, if this latest iteration of the global credit boom process falters, then ‘risk' markets such as the share markets may find that, without the support offered by the resulting funds flow, they will have to confront the reality of the lacklustre global recovery.

Andrew Hunt

International Economist

London

| « Consumer Survey: Ban Commissioned Advisers | Market Review: December 2009 London commentary » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |