To fix, float or take a third option?

Westpac chief economist Dominck Stephens looks at the fixed v floating debate and says there are three sides to the argument.

Monday, March 19th 2012, 10:28PM  1 Comment

1 Comment

It is fair to say there is a bit of confusion around the New Zealand interest rate outlook at the moment.

The Reserve Bank acknowledged the economy is getting better, but in the same breath issued a dovish Monetary Policy Statement and signalled lower interest rates for longer.

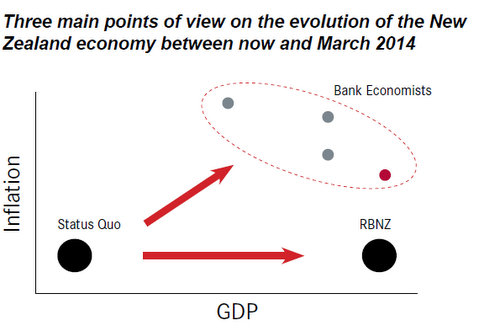

The confusion may have arisen from the fact that the RBNZ's current thinking does not lie anywhere along the usual simple continuum of views on interest rates.

The RBNZ's view forms the third point of a triangle. And that fact throws up fascinating possibilities about the year ahead.

At one end of the conventional continuum is what we call the "status quo" view. It is frequently expressed by financial market participants and the business community, and is probably priced into interest rate markets at present.

It basically says that the global outlook is poor, inflation is well contained, the New Zealand economy is in a debt-reduction funk, and any meaningful stimulus from post-earthquake rebuilding in Christchurch is either years away or will fizzle. This view says the economic status quo will persist and therefore interest rates will remain low for a long while yet.

Most New Zealand-based bank economists, including Westpac, are towards the other end of the conventional continuum. They are cautious on the global economy but expect stronger New Zealand GDP growth over the next couple of years, as the Christchurch rebuild ramps up.

The "bank economists" view says that stronger GDP growth will provoke inflation pressure in the normal way, and the RBNZ will respond with OCR hikes.

Economists at all four main banks project that by March 2014 New Zealand will have higher GDP growth and higher inflation than it has today. All are forecasting at least 150 basis points of OCR hikes by that time. And all expect a persistently high exchange rate.

Naturally, not everybody fits neatly into either category. Some are between the two views so far described, and some are more extreme.

But by and large, those who anticipate the strongest New Zealand growth are usually the ones with the highest inflation forecasts or the most hawkish OCR expectations. The Reserve Bank's view falls nowhere on the usual continuum. The central bank broadly agrees with the local economists that GDP will accelerate.

In fact, the RBNZ's GDP forecast is stronger than any of the local banks, as it expects almost 30% per annum growth in house building for two years running. But unlike the local bank economists, the RBNZ believes that the coming construction boom will not translate into higher inflation. The RBNZ believes that economies of scale make the Christchurch rebuild different from previous construction booms, so more work can get done with less cost pressure.

The RBNZ also emphasises the inflation-dampening effect that a persistently high exchange rate will have. Essentially, the RBNZ is forecasting growth without inflation pressure, and therefore sees little need for OCR hikes.

The contrast between the RBNZ's view and the market's "status quo" view throws up interesting possibilities for the year ahead:

- If we are correct and GDP accelerates, markets could be quite surprised. Interest rates would tend to rise. But the RBNZ would regard accelerating GDP as unsurprising and might continue sending dovish signals.

- Conversely, if growth remains low markets will be unsurprised and interest rate pricing will not necessarily change. But the RBNZ may well shift in an even more dovish direction.

- The RBNZ will react strongly to changes in the exchange rate. That might make its responses to global events seem counter-intuitive to markets. Suppose some global event causes a spike in risk aversion. The NZD would tumble. But the RBNZ might see the lower exchange rate as inflationary and adopt a surprisingly hawkish stance. (Pretty-much the converse of the past three months).

Signs of inflation, or lack thereof, will continue to have a strong influence on RBNZ behaviour. RBNZ-watchers would do well to watch price gauges carefully. Focusing single-mindedly on activity indicators could prove misleading.

Our own view is that growth will accelerate along the lines that the RBNZ expects, but inflation will remain low this year.

Hence we firmly regard the OCR as "on hold" until December. But we expect to see signs of cost pressures emerging from the Christchurch rebuild in 2013.

That's why we expect more OCR hikes next year than either the RBNZ's projections or current market pricing suggests.

If Westpac expects the OCR will remain on hold until December, why are we suggesting that fixed mortgage rates are better value?

Floating mortgage rates may not rise until December, but fixed rates could rise earlier. Today's fixed rates are barely higher than the floating rate.

Fixing now guarantees a low rate of interest through the difficult years ahead. The risk of waiting is that fixed rates go up, and a less favourable rate of interest is locked in for the 2013 to 2015 period.

Some might point out that an even better strategy is to float until the last possible moment, and then fix just before markets send fixed rates higher.

Sounds good in theory, but in reality it is not possible for the majority of mortgage borrowers to all beat the market. First of all, most people don't watch the economy and wholesale rates closely enough to anticipate the moment when market sentiment is about to change.

Second, a rush of people attempting to fix their mortgage rate at once would itself send fixed rates higher - if everybody rushes for the door at once, only a lucky few will squeeze through. So our suggestion is to pay a little extra now, sleep easy, and be absolutely sure of beating the crowd.

Of course, our suggestion is based on our economic view. Those on the other two points of the triangle - who believe either that the status quo will persist or that there will be strong growth without inflation - will be roughly indifferent between fixing or floating.

They will believe that the risks on either side of today's fixed rates are roughly balanced.

A full PDF of this article and more can be found here

| « D Day looms for NZMBA | Banks rely on Aussie generosity » |

Special Offers

Comments from our readers

Commenting is closed

| Printable version | Email to a friend |