High tide - sectoral leadership changing

Tuesday, April 14th 2015, 12:59PM

by Harbour Asset Management

The New Zealand equity market valuation remains stretched and the market is showing signs of rotation. In a world where the risk free rate is around zero for cash and money is being printed at such a fast pace it is difficult to discuss absolute valuations. The NZ market is expensive in aggregate. Valuations for yield based stocks are expensive as investors react to low (and negative) interest rates. While interest rates may increase from current ‘Zero Interest Rates in Perpetuity (ZIRP)’ policy influenced levels we expect the increase to be measured given global structural change (for example changing pace of Chinese activity, Middle Eastern geopolitical instability and aging western demographics) that may restrain inflation and growth.

Most capital markets remain in a ‘bad economic news is good capital markets’ frame of mind. We saw this with the recent US employment data which was lower than expected. The US equity market responded with a stronger performance as the market moved to delay rate rises. The significant flow of capital that has been triggered by global monetary policy easing has increased the pricing of defensive assets, including those equity sectors that provide high earnings certainty. We think current valuations leave limited room for disappointment.

So what should investors do?

They could do nothing. Patience and earnings growth can reward investors. However, history suggests that the starting point matters. At a Price Earnings multiple tipping close to 18 times the NZ market is expensive.

Figure 1: Average New Zealand Price to Sales (P/S) & Price to Earnings (P/E) valuations full

The Australian and US equity markets are also fully priced, albeit less so than New Zealand. While sales growth may remain below average, at an aggregate level there is potential for earnings growth to improve as a result of ‘self-help’ productivity actions, lower interest rate costs and capital management (including share buybacks). Balance sheet leverage levels remain low, providing company management with a relatively low risk mechanism to grow earnings. Limited organic growth and low debt costs means industry consolidation and M&A activity is likely to continue to support stock market valuations. But all equity markets also need sales and earnings growth to support further gains. The Australian market is seeing strong margin expansion - sales growth is weak, but EBITDA growth in the high single digits.

Figure 2: Australian P/S & P/E valuations full

Figure 3: S&P500 P/s & P/E valuation full

Harbour’s composite equity valuation indicators, which include a wider range of valuation measures, show that while the New Zealand market (illustrated in figure 4) remains fully valued the Australian market (shown in figure 5) is undervalued and the Global market (shown in figure 6) is fair value. Importantly these composite valuations highlight that the Australian and Global equity markets remain attractively valued against fixed interest securities. We expect interest rates (bond yields) to move up but they will likely stay below historical averages, potentially supporting above-average equity valuations.

Figure 4: New Zealand composite equity market valuations full

Figure 5: Australian composite equity market valuations attractive

Figure 6: Global composite equity market valuations fair

While a ‘rising tide’ of quantitative easing stimulus has seemingly lifted all equity ‘boats’, there remains a broad range of return and earnings momentum experiences across equity markets. There are stocks that have run hard on little more than the valuation uplift from QE and easy monetary policy settings, even where earnings momentum is negative. These stocks are most at risk of a price de-rate should forward earnings growth expectations not be met.

Figure 7: Growth prospects don’t match valuations

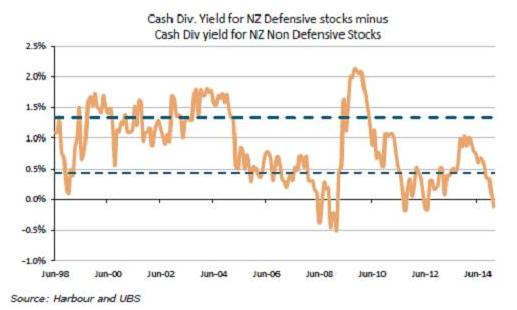

A further unusual aspect of the current market is the yield differential between the defensive sectors and the rest of the market. You might expect that the infrastructure, utility and property sectors would have a significant yield premium. In actual fact this has faded to nothing. With the yield for the defensive sectors falling to only 4.9% compared with the rest of the market sitting on 4.7%. When we roll this forward, the defensive sectors have a slightly lower yield.

We expect earnings growth, rather than yield, to increasingly become the key determinant of relative stock price performance. Modest gradual increases in long term bond yields may reduce the valuation support for stocks that have been driven by Price to Earnings ratio expansion, particularly low growth defensive stocks.

Figure 8 shows that while Price to Earnings ratio expansion (as shown by the dark blue fill) in Australia has been large influence on the markets performance over the last three years, earnings growth (as shown by the pale blue fill) is increasingly driving performance.

Figure 8: EPS growth beginning to take over from PE expansion as a driver for the Australian

Overtime companies that are growing earnings may provide better relative returns from today’s starting point. For instance as we have been pointing out for several months, the property and utility sectors have low earnings growth. They have benefited by being bond proxies. We remain cautious of these sectors at current valuations.

Figure 9 Watch out for Real Estate Investment Trusts and Infrastructure sectors

The New Zealand equity market now has a high percentage of defensive stocks – 43% of the index (across 17 stocks) reflects the Telco, Utility and Property sectors. These sectors trade a premium of 15% above their last 5 year average valuation and earnings per share (EPS) growth is expected to average 1.7% per annum between 2014 and 2017. The balance of the market is also trading at a small discount to average valuation multiples, estimated to be -2% relative to the last 5 years. However, for the cyclical and growth sectors EPS growth is expected to average 13.6% pa in the next three years.

The market focus on yield has created these conditions. What appears to be irrational pricing on earnings and growth, may not be irrational from the perspective of a yield based investor. But even yield based measures are becoming stretched. The defensive sectors are now expensive on a yield basis.

Figure 10 Defensive stocks are expensive

This contrasting view of the market is perhaps best highlighted by comparing expected earnings of valuations of selected stocks. Meridian is expected to generate only 1.8% of EBITDA growth between 2013 and 2016, has a return on equity (ROE) of 5% and is currently priced at 21 times 2016 consensus forecast earnings.

In contrast Diligent is expected to generate 26% EBITDA growth, has an ROE of 27% and is currently priced at 21 times 2016 consensus forecast earnings. In other words in a year these two stocks will be trading on the same multiple, yet one has an expected growth profile which is a large multiple of the other. Note we are not saying that Diligent should trade at a long run premium to Meridian – given the different operational and market risks – but the extent of the valuation compression seems excessive. This compression in technology stock pricing multiples in New Zealand has parallels in the US where the NASDAQ is now trading at one of the lowest relative valuations to the broader US market1. We see relative attraction in a number of tech names at the moment.

Outlook

It is possible to build the case that the risks are building for an equity market correction. Corrections are near impossible to predict. It may be better to say that at current valuations the medium term returns for equities are likely to be lower than average. But that isn’t saying much because returns from all nearly asset classes are likely to be lower going forward.

While we expect the pace of official US interest rate increases will be gradual, market volatility is likely to intensify as investors anticipate a modest increase in US interest rates. Within equity market sub sectors we expect traditional defensive yield sectors that dominate the New Zealand equity market will continue to lose their market leadership. High valuations for such traditional defensive stocks and a change in the behaviour of marginal investors such as the large global equity dividend exchange traded funds (ETF’s) may promote that change. Corporate New Zealand is in good order. The most significant risk to above trend NZ economic growth are likely to come from offshore developments including a potential sharper slowing in Chinese growth and global commodity prices. For NZ stocks, exposure to the soft Australian economy and the weak AUD represents a near term risk to earnings growth forecasts.

In the last month volatility has tended to rise, equity markets have paused and a rotation away from equity yield as a factor appears to have started. Whether this price action is anything more than noise only time will tell.

The recent fall in iron ore and dairy prices continues to point to a deteriorating terms of trade for both Australia and New Zealand. The Australian dollar has partly corrected. The New Zealand dollar remains stubbornly high, nearing parity with the Australian dollar. Fundamentals point to downside risks for both currencies, but global flows chasing yields are maintaining over-valuation for now. We established a 30% currency hedge into the New Zealand dollar in mid – March as interest rate differentials continued to provide strong short term support for the New Zealand dollar.

Our medium term models still point to a weaker NZD and we will continue to monitor the currency risk positioning. Our preference in our growth portfolios is to anchor the portfolios with strong growth franchises like F&P Healthcare, CSL, Amcor, and Mainfreight. We have recently reinforced the growth and yield exposures by lifting Australian listed Goodman Group to a top 10 position. Macquarie Bank, Challenger, Regis Healthcare and Seek round out the large cap overweight positions.

It's a harder call on Australia as resources are cheap globally on most measures (one of the few sectors to be cheap), but we don’t expect iron ore to rally given excessive supply, and while we think oil may stabilise and improve a little this is a low conviction view. We also like several technology companies that are delivering. These companies respond to their own milestones much more than the factor risks of markets. Such companies provide an effective hedge against uncertainty regarding short term monetary policy outcomes and the market's reaction.

Significant parts of the New Zealand market are expensive relative to medium term growth prospects, historical valuation measures and global market gauges. At a stock specific level we continue to see a few compelling medium term investment opportunities in the New Zealand market that score well in our quantitative and analyst rankings – but these are not necessarily large market capitalisation stocks. Equity markets may continue to react more to interest rates and dividend announcements than earnings. However, in February and March there were signs that this trend is changing with some of the larger New Zealand yield stocks under-performing the broader New Zealand market.

Going forward we expect a reversion in return outcomes across equity sectors with quality non-defensives increasingly sought out by investors, and ‘expensive defensives’ giving back some of the last twelve months relative outperformance.

Important disclaimer information

| « Private equity – A role for KiwiSaver? | Loss-protection offer hits target » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |