Steepening NZ yield curve

Wednesday, May 13th 2015, 10:56AM

by Harbour Asset Management

RBNZ introduces an easing bias

As expected, the RBNZ left interest rates unchanged at its OCR Review at the end of April. However, the key news was the RBNZ moved from a neutral bias where interest rate movements could be “either up or down” to an official easing bias, but stating that:

- “The Bank … is not currently considering any increase in interest rates.”

- “It would be appropriate to lower the OCR if demand weakens, and wage and price-setting outcomes settle at levels lower than is consistent with the inflation target.”

The RBNZ’s change in tone had been paved by recent speeches from key officials.

In mid-April, Deputy Governor, Grant Spencer, highlighted that the RBNZ did not feel it could do much more to cool the Auckland housing market, and that job really fell to the government to consider its own policies on resource management and tax. The following week, Assistant Governor, John McDermott, highlighted NZ inflation has been stubbornly low, justifying NZ monetary policy to remain stimulatory for longer.

While the RBNZ has moved to an official easing bias, we still believe that the RBNZ has a high hurdle to either hike or cut interest rates. That said, the recent soft New Zealand labour market data will force the RBNZ to seriously consider the prospect of cutting the OCR sometime this year.

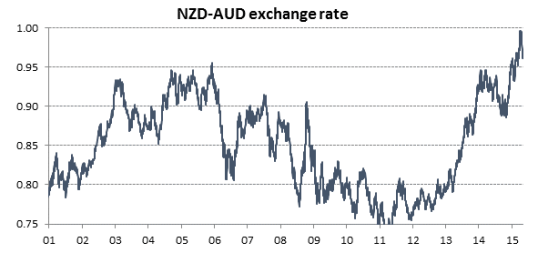

One of the catalysts to prompt a rate cut from the RBNZ abated during the month, with the NZD/AUD falling back towards 0.95 after flirting with parity a number of times during April. The RBA surprised markets by not cutting interest rates in April, and this helped the NZD to weaken versus the AUD.

Source: Harbour, Bloomberg

The US Fed drops its forward guidance

The RBNZ’s shift to an easing bias stood in stark contrast with the US Federal Reserve’s policy statement released a few hours earlier.

In its communication, the US Fed looked through the recent transitory, weather-related moderation in US economic growth, and continued to conclude that it plans to raise interest rates when it has seen further movement towards its dual labour market and inflation targets.

Importantly, whereas in March the US Fed explicitly ruled out the chance of a move in April, this time around the US Fed was silent on the prospects of a move at its next meeting. While the chance of the US Fed lifting interest rates at its next meeting in June remains low, it does highlight that it is looking to keep the options open and that every meeting is “live”. The onus is squarely on the strength or weakness of economic data.

As a result, the US 10 year government bond yield rose around 10 basis points to 2.05% in April, and has continued to rise in May. This upward momentum was helped along by a rise in core European yields. After toying with the zero bound and reaching a record low of 0.05%, the German 10 year government bond ended April higher at the less abnormal level of 0.35%. This has been put down by most commentators to profit taking from those investors that have benefited from the trade of front running ECB QE. European data has also continued to improve.

While US yields rose over the month, markets are still placing a low probability on the US Federal Reserve lifting the Fed Funds rate in 2015, meaning there is still some scope for surprise if the US Fed decide to press ahead and start the normalisation process this year.

| United States | PRICING | |||

| Current | Incremental change | Cumulative change | ||

| Fed Funds upper bound | 0.25 | |||

| Fed Funds effective | 0.08 | |||

| 3 months Eurodollars | 0.18 | |||

| 3 month Eurodollars - 1st contract | Jun-15 | 0.31 | 0.13 | 0.13 |

| 3 month Eurodollars - 2nd contract | Sep-15 | 0.44 | 0.13 | 0.26 |

| 3 month Eurodollars - 3rd contract | Dec-15 | 0.63 | 0.19 | 0.45 |

| 3month Eurodollars - 4th contract | Mar-16 | 0.83 | 0.20 | 0.65 |

| 3 month Eurodollars - 5th contract | Jun-16 | 1.03 | 0.20 | 0.85 |

| 3 month Eurodollars - 6th contract | Sep-16 | 1.24 | 0.21 | 1.06 |

Source: Harbour, Bloomberg

NZGS Index extension creates relative value opportunities

The other main local event in April was the maturity of the NZ government April 2015 bond, which lengthened the duration of the NZ Government Stock Index from 4.1 to 4.6 years.

On previous occasions this has occurred, there has been significant intra-month volatility, as fund managers who like to keep close to their benchmark have been forced to buy long-dated nominal NZ government bonds. This has often created relative value opportunities for active managers, when this involuntary demand has moved related asset prices out of line with each other.

April 2015 proved to be no exception, although the impact so fairly modest and short-lived.

Firstly, demand for NZ government bonds helped to reduce the NZ-Australian 10 year bond spread, from around 100 basis points to nearly 70 basis points. NZ government bonds had looked cheap on a relative valuation basis, and the index extension worked as a catalyst to bring this into line. The RBA surprising markets by not cutting interest rates in April added further impetus to close the valuation gap.

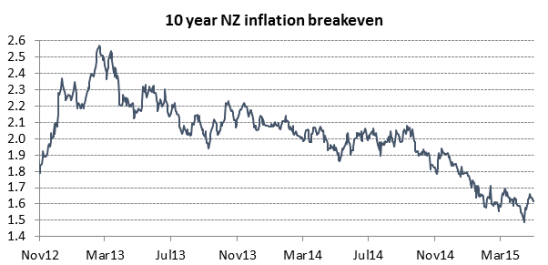

The second relative value opportunity was in NZ inflation linked bonds. Given that those managers looking to extend duration were buying traditional nominal bonds, this narrowed to spread between the 10 year nominal and inflation linked bonds – the so-called “10 year inflation breakeven”. In the middle of the month, this got pushed below 1.50%, far below the 2% mid-point of the RBNZ’s inflation target. By the end of the month, as the anomaly corrected, the inflation breakeven finished closer to 1.65%.

We view NZ inflation-indexed bonds as being very cheap versus nominal bonds. At as current breakeven of 1.65%, this equates to saying the RBNZ will fail to achieve inflation at the middle of the target band on average over the next 10 years. With the RBNZ recognising that inflation has been surprisingly low and shifting to an easing bias, this should help reverse the previous downward trend in inflation breakevens.

Source: Harbour, Bloomberg

Market outlook

At the short end of the yield curve, while the RBNZ has moved to an official easing bias, we still believe that they have a high hurdle to either hike or cut interest rates. That said, the recent soft New Zealand labour market data will force the RBNZ to seriously consider the prospect of cutting the OCR sometime this year.

The long end of the curve will largely be influenced by growth and inflation data in the US and Europe, and expectations of monetary policy in the US.

Our central view is that the Fed will start to normalise rates this year with all windows now open and dependent on data. A September US rate rise seems most likely, and this may tend to place some upward pressure on bond yields.

If macroeconomic data in Europe continues to recover over the next 6 months, and optimism builds that the ECB’s QE has been successful, then this opens the door to bond yields rising over the medium term.

Christian Hawkesby

Director, Head of Fixed Interest & Economics

Harbour Asset Management

Harbour research is available at www.harbourasset.co.nz

Important disclaimer information

| « Private equity – a role for KiwiSaver? (Part 2) | A Global Savings Glut? Or Just Deflationary Forces? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |