The RBNZ easing cycle begins

Thursday, July 9th 2015, 2:27AM

by Harbour Asset Management

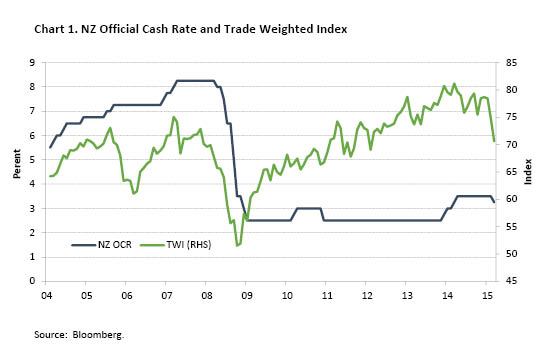

• The RBNZ surprised markets with a 25 basis point cut in the Official Cash Rate, on a more pessimistic view of export prices, and a more determined strategy to lower the NZ dollar.

• The NZ 2 year swap rate fell around 25 basis points to 3.10%, consistent with the market pricing an additional 50 basis points of cuts over the next 6 months.

• The NZ government 10 year bond yield finished the month broadly unchanged at 3.65%, with more accommodative local monetary policy offset by the drag of global yields rising around 25 basis points.

• The US Federal Reserve has kept the door open to start lifting the Fed Funds rate in September.

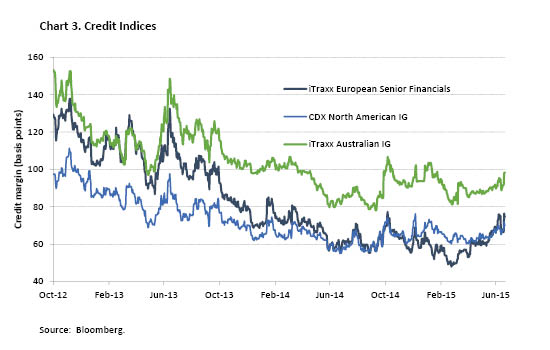

• Credit spreads widened marginally on the month, reflecting ongoing risks from political uncertainty in Greece and market instability in China.

The RBNZ’s June Monetary Policy Statement was always going to be an interesting OCR decision, with economists and the market roughly split 50:50 on whether they would cut interest rates by 25 basis points. While softening economic data suggested that they “should” cut, it wasn’t clear that they “would” cut given the pre-conditions they set out in the April OCR Review.

As it turned out, the RBNZ tore up the previous script, not only cutting by 25 basis points, but opening the door to lower the OCR further. The biggest change in the RBNZ’s economic view was around export prices, which dominated its discussion. Not only had the RBNZ been surprised by the fall in dairy prices to date, but it was much more pessimistic about the prospect of dairy prices bouncing high enough to justify Fonterra’s current forecast for the dairy pay-out in 2015/16. That represents a significant hit to New Zealand income, at the same time that import costs have risen following the rebound in petrol prices.

However, there was also a tactical element to the RBNZ interest rate decision and forecasts. For a number of years now, the RBNZ (and market) has been surprised by inflation undershooting its forecasts. The June MPS seemed to mark a change in mindset, with the RBNZ now deliberately trying to lift inflation quickly back to target, and appear comfortable risking an overshoot to the upside – anything to finally get away from the bottom of the target range.

Subsequent to the MPS, the political pressure faced by the RBNZ Governor became apparent with some uncharacteristically pointed comments from Bill English published in a Bloomberg interview: “He’s been out of the zone for years now, below the midpoint for quite some time”, “He’s meant to be following the Policy Targets Agreement”, “one day somebody will start asking the Minister of Finance questions about whether he’s actually following the agreement or not”.

The quickest way to generate inflation is to get the NZ dollar to fall, which has an immediate pass through into higher prices for imported consumer goods. By delivering a surprise OCR cut, signalling more to come, and repeating calls for a significant adjustment in the currency, the RBNZ was successful in driving the NZ dollar down to its lowest level since 2011 on a trade-weighted basis.

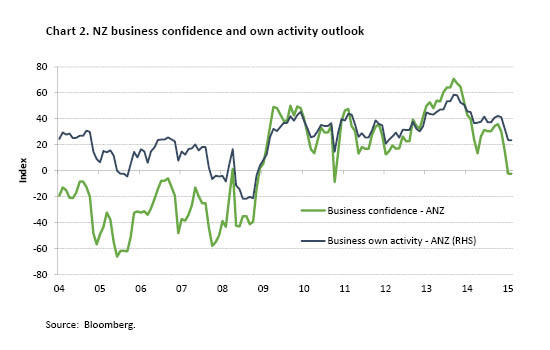

The data released since the MPS seems to have justified the RBNZ’s more cautious outlook for the NZ economy and more accommodative monetary policy settings.

Importantly, NZ GDP growth for Q1 came in at only +0.2% for the quarter (+2.6% yoy) vs market expectations of 0.6% (and +3.1% yoy). Furthermore, forward looking indicators continue to soften. In particular, the ANZ business confidence survey slipped into the red for the first time since the Canterbury earthquakes, with the agricultural sector downbeat, construction weakening, and sentiment in Canterbury flat or negative.

Given the recent data, another interest rate cut to 3.00% at the 23 July OCR Review looks at this stage like a near certainty, and is around 80% priced by markets. The bigger question is how far the OCR will fall as part of this interest rate cycle. Most economists are picking the OCR to fall to 3.00-2.75%, but the balance of risks make it plausible that the RBNZ removes all the rate rises of 2014 and takes the OCR back to 2.5%. With an absence of inflation pressures, there is also a chance that the RBNZ may revise down its long-run assumption for the neutral cash rate from around 4.50% to closer to 3.50%.

US FED STILL READYING TO HIKE

While the RBNZ has embarked on an easing cycle, US economists are increasingly confident that the US Federal Reserve will begin removing stimulus this year, most likely September.

After a soft US Q1 GDP number – affected by weather, port strikes, and problems with seasonal adjustments - more recently the economic data has reinforced the view that a rebound is taking place. Labour market data remain strong. High frequency data on tax receipts painted a very positive picture of economic activity. And the most recent consumer confidence and retail sales numbers highlight a boost to US consumption.

Coming out of the GFC, tight credit conditions from the banks had been a key headwind for the US economy. More recent surveys - in particular the Federal Reserve’s Senior Loan Officer Survey - had shown that banks were easing lending conditions for consumer and business loans. Pulling together various demand factors, economists were picking the US economy to grow at a modest underlying rate of around 2.5% over 2015, still enough to eat up a little more spare capacity.

As a result of this stronger recent data, most US economists have converged on a consensus view that September will see the first rise in the Fed Funds rate, with scope to hike twice by the end of the year if the US economic data remains robust.

However, there are a couple of risks to this view, which could cause the US Fed to delay until there is a more resilience financial market backdrop.

First, the situation between European authorities and Greece is strained to say the least. Near the end of June, the Greek government shocked markets by announcing that it will hold a referendum on 5th July, asking the Greek people whether they agree with the latest bailout conditions imposed by European negotiators. Regardless of the result, the road ahead for Greece looks unpleasant, with scope to rattle financial markets.

The second risk is China, where strains are showing in the financial system. In mid-June, the Chinese sharemarket rose to a 7 year high, only to fall around 20% by the end of June. Chinese authorities have taken action, including cutting interest rates and relaxing bank reserve requirements. Reflecting these strains, the global credit indices have widened, as the market has priced-in the more fragile backdrop.

MARKET OUTLOOK

The RBNZ began its easing cycle at the June Monetary Policy Statement, reducing the OCR by 25 basis points to 3.25%. With NZ economic data continuing to soften, at the moment a further cut at the July OCR Review looks like a near certainty, and 80% priced by the market. The bigger questions are whether the OCR will be cut all the way back to 2.50%, and whether the RBNZ will further revise down its estimate of the neutral cash rate from around 4.50% to closer to 3.50%. All this adds up to an environment where local interest rates look set to stay lower for longer.

Conversely, global interest rates still appear biased to rise from their ultra-low levels. In particular, the US economic data has been encouraging, dispelling fears that the slowdown in Q1 was something more than a weather-related blip. This paves the way for the US Federal Reserve to potentially lift interest rates in September and December, subject to economic indicators remaining robust. At the moment, the market is not fully pricing this outcome; something that may have to wait until markets have successfully navigated their way beyond the immediate global risks in Greece and China.

Important disclaimer information

| « Questions to ask fund managers | Our summary on a complex world » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |