More Heat than Light: Discussions about currency hedging

There are several discussion topics that are absolutely guaranteed to generate a lot of comment on websites like Good Returns. Performance fees, Active/passive management and currency hedging. Pathfinder director Paul Brownsley presents his view on currency hedging.

Thursday, October 1st 2015, 6:57AM  4 Comments

4 Comments

by Pathfinder Asset Management

Recently a press release from the NZ Super Fund generated a significant amount of discussion with respect to currency hedging which has prompted this article.

As a firm we regularly look at currency hedging from a quantitative perspective. We understand the big picture, somewhat emotive arguments around currency hedging, and understand why people like to fall back on these: “Most of your assets are in NZD, you should hold FX currency assets to balance these”, “A lot of your future expenditure is linked to foreign currency, you should hold assets in foreign currency”, “What about catastrophic NZD risk like Foot and Mouth disease, earthquakes etc?” They all make intuitive sense in a fuzzy big picture way, but unless accompanied by some hard risk analysis are a poor foundation for building a portfolio on. Should those risks be explicitly hedged? Are there cheaper or more effective ways to hedge this kind of risk than the blunt tool of a naïve hedging policy?

Any discussion should start with a look at actual data. While past performance is no guarantee of future performance, past performance can provide us with useful information for assessing what may happen in the future. One caveat though, that is beyond argument: Professional commentators have a really, really bad track record at predicting short term movements in the New Zealand dollar (there is plenty of evidence to support this, email me if you would like to see it).

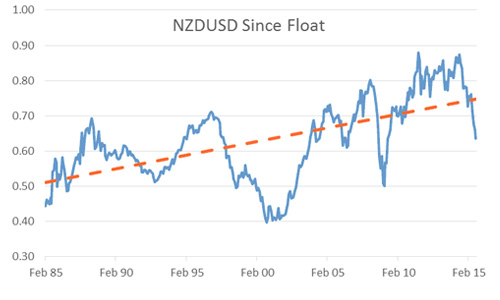

So what does the data on currency hedging tell us? Let’s start with a simple analytical review of currency management from a NZ investor perspective over the last 30 years. The NZD dollar was floated on 4 March 1985 at a rate versus the USD of 0.4444. Here is the path that the NZDUSD has taken since floating:

Before digging deeper into the data a quick refresh on currency hedging. Let’s assume we are a NZD investor and we want to invest in a USD asset. If we do that without currency hedging, we convert our NZD into USD at today’s spot rate and invest in our USD asset. Over time, our investment return in NZD terms is a combination of the return of the USD asset as well as the impact of changes in the NZD. So if the NZD rises by 10%, this will be a drag on the performance of our asset of 10%. Equally if the NZD falls in value by 10%, our overall return will be boosted by 10%.

What is slightly more difficult to do, is invest in that same USD asset but also hedge out any foreign exchange risk. We do this by entering into a forward contract to sell an amount of USD equal to our investment at a future date. This “short” position of USD neatly offsets the “long” position in our USD investment. So if the currency rises by 10%, we still have a 10% loss on our investment, but this is now offset by a 10% gain in our short USD position, effectively insulating us from FX risk. When it comes time to settle that forward FX transaction with our bank, we have to buy USD from the bank at the then future exchange rate and sell them NZD. We can then close out the original short USD position with our new purchase of USD. The difference between the original forward NZD position and our closing out transaction is the profit (or loss) from hedging. If the NZD has rallied this will be a positive amount i.e., a hedging gain (to offset against an equivalent loss on our USD investment).

There is another twist though, and that is in how the forward FX rate is determined. This is simply a matter of math. If we ask a bank to quote us a forward rate to sell USD In 1 year, they will calculate that rate by determining the cost of transactions to create the cash-flows we are looking for. In short, this would involve borrowing money in the US for 1 year and investing in NZ for 1 year. As a rule of thumb, the forward rate will be lower than the current rate by a percentage amount equal to the difference in interest rates between NZ and the US. Right now, for 1 year that difference is around 2.2%. The end result is that if you hedge from a NZD perspective, you will gain around 2.2% per annum which you can add to whatever the USD return is for your US investment.

Now back to the data. From the previous graph we can that since floating in 1985 the NZD has generally appreciated (see the dotted orange trend line) but with occasional big falls. Evidence perhaps for two oft repeated anecdotes about the currency: “Up by the stairs, down by the elevator” and “currency washes out in the long run”. Perhaps the first is true, but the trend would not support the second.

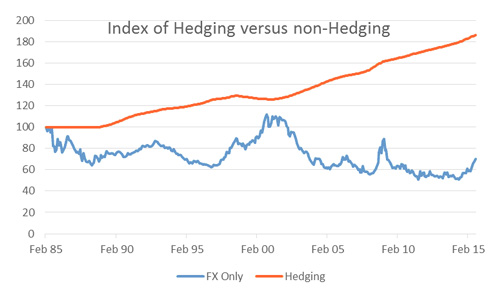

When hedging, your analysis of risk and return must take account of the interest rate differential pick up from hedging. The following chart shows in blue, the cumulative return component for a USD investment that comes purely from currency impact. When the line is high that means the NZD has been falling in value. The orange line shows the incremental return from always being fully hedged. As you’d expect, given NZ interest rates are usually higher than the US, it’s a steadily increasing line, and not impacted at all by volatility in NZDUSD. The difference over 30 years is staggering – a difference of nearly 170% in the value of your USD investing adventure.

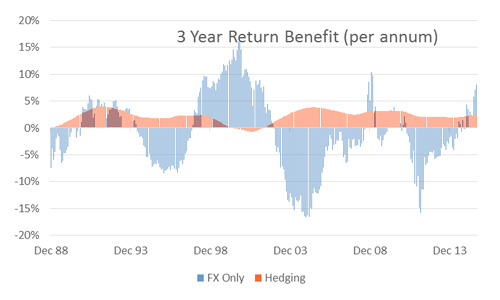

The next graph compares the same data but for rolling 3 year periods. This shows that there was a period for a few years either side of 2000 where being unhedged was a significantly beneficial strategy (remember the low in NZD of 0.3922 in November 2000?), but for most of the rest of the time it has usually been better to be hedged.

This is just step one of a more thorough analysis but has hopefully already provided enough information to start a conversation. Where we as a fund manager really find currency management useful is as a risk mitigation tool. The NZD often behaves in a particular way when US equities are rallying or plunging, and using this relationship provides another handy tool in the managers risk management toolbox.

To finish, I will make few statements that will be addressed in a future column.

- It is demonstrably difficult (impossible?) to predict short term movements in the NZD. Having said that, it doesn’t take an unusual amount of skill to understand that when the NZDUSD is at 0.4400, the NZD is more likely to go up than down. The converse is also true, when at 0.8800 it is more likely to go down than up

- For equity investments, a fully unhedged or a fully hedged policy is unlikely to be the best or even most logical base position.

- Capturing the hedging premium is one of the only free lunches out there. Although technically it’s not a free lunch, but rather it is compensation for assuming other portfolio risks (including the risk of not being unhedged, higher volatility), but thus far in NZ it has been a pretty good bet to take for a long term investor

- If you really are worried about catastrophic NZD risk, there are cheaper ways to hedge that risk than by being naively unhedged 100% of the time

- New Zealand investors are fortunate that the hedging math works in our favour. If it didn’t (i.e., NZ interest rates become lower than the US) then we might reassess whether hedging is quite as useful

- The real benefits of hedging (or not hedging, or having some static/dynamic combination of the two) are how – in differing market environments – different hedging strategies can significantly alter the risk profile of the asset you are investing in offshore

Lastly I would suggest that anyone who argues for or against hedging from an entrenched, black and white, only one answer is correct perspective is guilty of a financial form of fundamentalism. The correct answer should be “it depends…..”

Paul Brownsey

Director

Pathfinder Asset Management

Note: NZDUSD exchange rate data is sourced from Bloomberg. 1 month forward exchange rates are also sourced from Bloomberg, from 31/12/1988. For the period March 1985 to December 1988 we assume 1 month forward points of 0. This is more conservative than actual calculated rates as for this entire period NZ 1 month interest rates were significantly higher than the equivalent US rate. We also assume transaction costs of 0.05% per month.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « White Smoke at No.2 The Terrace? | Nikko's new house view on global equities moves to neutral » |

Special Offers

Comments from our readers

Actually it is now possible. Our 3 equity funds all have the currency hedging taxed on an FDR basis, so this matches the tax treatment on the global equities.

It is however quite complex administratively to fit the different tests that you must meet in order to use the FDR treatment.

Because of that complexity, a lot of managers don't bother with FDR treatment of hedging, which does result in different after tax hedging rates for different PIR investors.

For an investor in a fund with a high hedging ratio - e.g., property, the FDR hedging treatment becomes quite important to reduce the after tax variability for different PIR's.

http://www.ird.govt.nz/technical-tax/legislation/2013/2013-52/2013-52-dividend-rate/leg-2013-52-dividend-rate.html

Sign In to add your comment

| Printable version | Email to a friend |

By this I mean that I think it is flawed to say client A should hold more currency exposure than client B simply because they have a higher exposure to global shares. This is why advisers and clients need access to hedged and unhedged funds, as the best approach depends on lots of factors - as you have highlighted.