Inflation risks skewed to the downside

In a finely balanced decision, the RBNZ cut the Official Cash Rate (OCR) to 2.50% as part of its December Monetary Policy Statement (MPS).

Wednesday, December 16th 2015, 11:26AM

by Harbour Asset Management

Rather than the headline decision, the overall message and signal for future policy are often more important to the market.In this respect, the MPS was interpreted by the market as a ‘hawkish cut’.

In the first instance, the market focused on the lack of further cuts in the 90 day bank bill projection, and the lack of a dominant alternative downside scenario in the document to pave the way for the next cut. However, we believe that the next MPS in March is still very much a ‘live meeting’, with downside risks to the inflation outlook continuing to skew the balance of risks towards further OCR cuts.

It is understandable that the RBNZ sought to present a balanced outlook in the December MPS. Having cut the OCR from 3.50% to 2.50% over a six month window, it provides the opportunity for the Bank to take a breather. With the economic outlook not looking as bad as feared back in September (when dairy prices and business confidence were at their lows), there is less immediate urgency to cut rates. It also provides time for the RBNZ to assess whether the Auckland housing market is indeed beginning to cool, helping to ease their financial stability concerns.

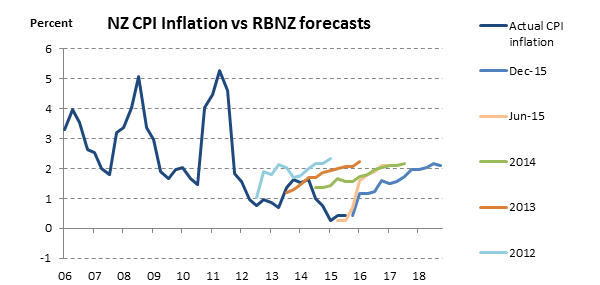

In our view, the most important part of the MPS was the Bank’s outlook for inflation.

Source: Reserve Bank of New Zealand.

The RBNZ are not forecasting annual CPI inflation to return to the 2% mid-point of their target range until Q4 2017, some nine quarters into the future. Part of this is mechanical, as economic models typically provide a smoothed path to a medium-term resting place. If this forecast plays out, annual CPI inflation would be below 2% for a total of 6 years, running from 2011 to 2017.

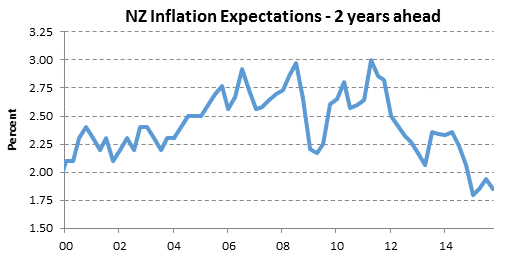

The big question becomes what happens to inflation expectations in an environment of prolonged low inflation? During the Alan Bollard era, NZ inflation expectations sat a little above 2.5%. Under Graeme Wheeler’s governorship, they have settled near the 2% mid-point of the target range. However, the trend has been one of falling inflation expectations.

Source: Reserve Bank of New Zealand.

As a hint to the amount of uncertainty facing the economy, the MPS included four offsetting risk scenarios – stronger immigration, stronger consumption, lower export prices and a drought. An important risk scenario that wasn’t included in the MPS is the danger that inflation expectations continue falling and settle around 1-1.5%. This would create a real challenge for the RBNZ to lift inflation back to the mid-point of the target range, and require looser monetary policy to kick-start that process.

Indeed, it is already starting to look difficult for the RBNZ to achieve the CPI inflation projection set out in the December MPS. In response to the “hawkish cut” the NZ dollar appreciated sharply, and now sits around 5% above forecast. A stronger currency will keep downward pressure on tradeables inflation. At the same time, oil prices have continued to slide to new lows, delaying the long awaited lift in CPI inflation as previous sharp falls drop out of the annual measure.

Looking ahead, we believe the market is underestimating the chance that the RBNZ will need to cut the OCR in 2016. While there is very little chance the RBNZ raise the OCR in the year ahead, in our view the probability of the OCR falling below 2.50% sits near 50%. In that spirit, after a period of reflection through January, we see the next MPS in March as very much a ‘live meeting’.

Christian Hawkesby, Director, Head of Fixed Interest & Economics

This column does not constitute advice to any person.

www.harbourasset.co.nz/disclaimer/

Important disclaimer information

| « Active managers must be better... | Finally » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |