RBNZ having second thoughts

The main event for the month was the RBNZ’s April OCR Review, coming hot on the heels of its March decision to cut the OCR to 2.25% that took many local economists by surprise.

Wednesday, May 11th 2016, 1:47PM

by Harbour Asset Management

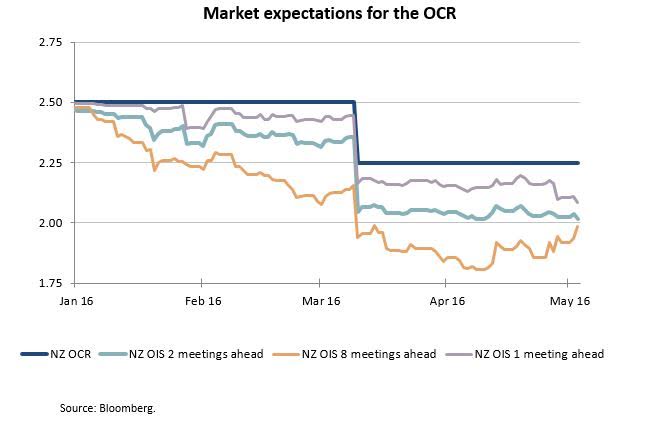

Going into the April decision, markets had placed around a 50% chance of another 25 basis point cut at that meeting. This was driven by the culmination of a number of factors. Back at the March MPS, the Bank had indicated that “further easing may be required” and had included another 25 basis points of cuts by the middle of the year in their 90 day bank bill rate projections. Subsequent to the March MPS, the economic data had been mixed: the stronger TWI pointing to more cuts needed sooner; with the main offset being the stronger March housing market data.

Not only did the RBNZ leave the OCR unchanged at the April Review, but the accompanying statement seemed to have much less conviction about the outlook for the OCR heading lower. The RBNZ stuck with their phrase that “further easing may be required”; whereas the market had been expecting a more definite statement that “further easing seems likely”, which usually sets up a move at the next meeting. When added to the three references in the statement to global and domestic policy already being accommodative, it hinted at the RBNZ being hesitant to add more stimulus unless really required.

However, the most noticeable revision in the press release from March was the treatment of the housing market. This changed 180 degrees, moving from “house price inflation has moderated” in the March statement to a reference that “there are some indications that house price inflation in Auckland may be picking up” in the April statement.

While factually correct, by singling out Auckland and changing their view in one month, the RBNZ risks feeding the market perception that they are hyper-sensitive about the housing market, almost at the expense of their primary objective of targeting future CPI inflation. (A more neutral approach would have been to note that housing market data has been volatile in recent months, and reserve judgment until there is a clearer signal available.)

With the RBNZ sounding less enthusiastic about further cuts, the market is now only placing a 60% chance of a 25 basis point cut in June, with expectations for the terminal OCR around 2.00%.

In our view, looking forward, data on CPI inflation and inflation expectations will be one of the most important drivers of the RBNZ’s actions. Through most of the 1990s and 2000s, data on CPI inflation was relegated to secondary importance, as inflation expectations had become so firmly anchored around the inflation target. In that environment it made sense for the bond market to focus on the cycle in economic activity, as the role of the central bank was to merely lean against that cycle with its OCR settings to moderate any inflation pressures towards the target.

However, in the current environment the RBNZ is facing a new challenge. That is, after nearly 5 years of inflation running below the 2% mid-point of the RBNZ’s target, the objective is to avoid inflation expectations becoming permanently stuck below 2%. In March, the RBNZ was prompted into action, in part by the surprise of a range of inflation expectations surveys lurching lower. While the RBNZ may be having second thoughts about the merits of cutting the OCR further, its hand may be forced by CPI inflation continuing to surprise on the downside. Indeed this seems to be the primary driver of the decision by the RBA to cut rates in Australian in early May.

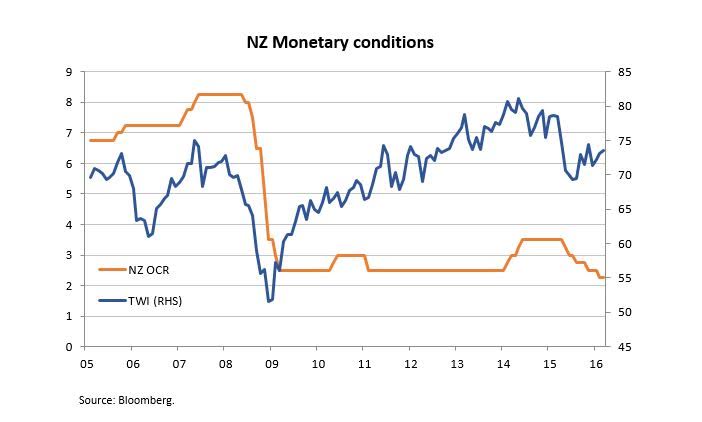

A potential source of ongoing downward pressure on the CPI inflation is the elevated NZ TWI, which is now around 4% above the RBNZ’s assumption for Q2 2016 of 70.9. Some of the upward pressure on the NZ TWI has come from continued monetary accommodation and further easing by foreign central banks. This was illustrated yet again in early May by the RBA’s surprise decision to cut rates to 1.75%, sending the NZD/AUD exchange rate higher.

Longer-term bond yields were relatively stable in April. The US 10 year government bond yield remaining with its recent 1.75-2.00% range.

In its April FOMC statement, the US Federal Reserve provided very few clues on its thinking. On the one hand, the Fed appeared slightly less concerned about the fragility of global markets; while on the other hand the Fed seemed a little disappointed with domestic GDP growth. There was no specific indication that they intend to continue removing stimulus at their next June meeting; but equally lifting rates at the next meeting was not ruled out. The path for normalizing US interest rates remains data dependent, and subject to navigating looming risks to markets, such as the chance of Brexit in June. There is only one further 25 basis point rate hike priced by March 2017.

Despite the RBNZ failing to deliver a rate cut, New Zealand government bonds continued to be in favour with global investors over the course of April. In an environment where bond yields are near zero percent in Europe and Japan, the New Zealand government bond market reportedly had appeal to those investors searching for reliable yield. As a result of this demand, the NZ-Australia and NZ-US 10 year government bond differentials narrowed in April.

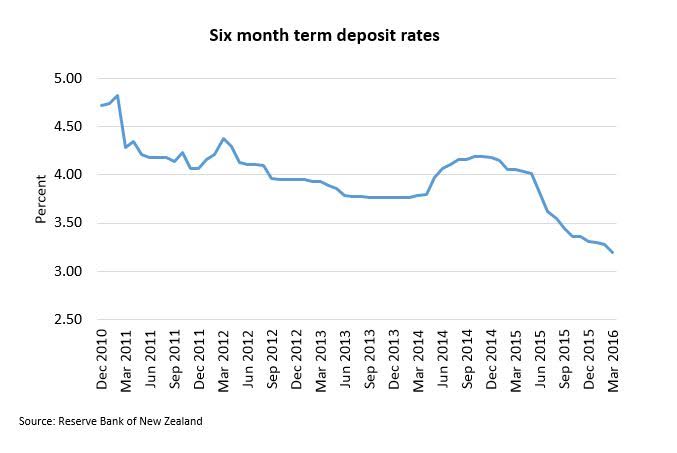

The appetite for yield was also evident in the corporate bond market during April. New deals by Chorus ($400m) and Westpac ($700m) were notable for their size and there were also Kauri NZD bond issues by offshore entities such as the Asian Development Bank. Issuance has been solid since the New Year and more is expected. Demand is coming from wholesale investors, as flows into funds have been solid, while retail investors are faced with lower deposit rates now that the official cash rate has fallen.

Christian Hawkesby

christian@harbourasset.co.nz

This column does not constitute advice to any person.

www.harbourasset.co.nz/disclaimer/

Important disclaimer information

| « Competition Takes Many Forms | Managing investment risk » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |