Responsible investing: Is there a cost?

The most popular argument used by investors that are resistant to the concept of responsible investing is that “returns are lower, it will cost me money”. Well, times have changed.

Friday, September 8th 2017, 9:09AM  1 Comment

1 Comment

by Pathfinder Asset Management

The alleged return gap is demonstrably not true and now with a proliferation of data, easily proven to be untrue. When you next hear someone claim that returns from responsible investing are lower, you are literally hearing a blast from the past. Overseas, in larger markets that have moved more readily into the acceptance of RI as a legitimate investor choice, the conversation has moved on. Five or ten years ago, the question being asked was “Will Responsible Investing cost me return?”. This quickly moved on to an acceptance that RI returns are certainly no worse than traditional investing. Now the questions being asked are “How much additional return can I get from RI investing?” and “Is responsible investing an investible factor?”

An ESG focus makes for better investments

In New Zealand, though, we are some way behind the overseas experience. There are very sound, rational reasons why a portfolio built with Environmental, Social and Governance (ESG) concerns at the fundamental level should outperform the wider market. Certainly, it is not revolutionary to believe that companies with higher than average governance standards will do better than companies with lesser governance standards. Well-governed companies should make better decisions, assess risk, and manage resources more efficiently. Companies that rank highly in social outcomes should also do better. Staff will be more engaged, more productive and are less likely to leave. Customers will value more and engage with the brand and customer experience. On the environmental side, again, it is no radical thought to imagine that companies with strong environmental practices will have fewer litigation and compliance costs, more efficient use of resources, and contribute positively to their brand perception.

None of these ESG ideas fail to pass the logic test. If a company strives to achieve good ESG practice and outcomes, why would better profitability not follow?

ESG and investment returns

At a conceptual level, it is an easy argument, but if investors are still not convinced, there is data. Sustainalytics Ltd (disclaimer: Pathfinder subscribes to Sustainalytics research products) is a global research company that focuses on the ESG characteristics of thousands of companies worldwide. One of their products scores companies on their implementation of good practices in the Environmental, Social and Governance areas. Morningstar produce numerous indices in their index family, and helpfully, as well as the standard large all country all cap indices, they also produce a sustainability version. The sustainability indexes are constructed using the top 50% of stocks in the universe ranked by Sustainalytics ESG score.

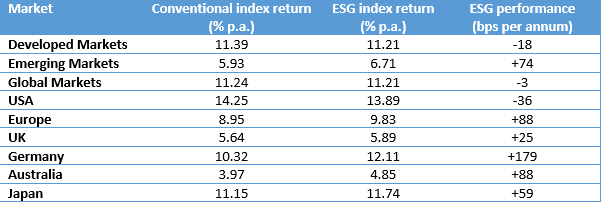

How do they look? In most cases, pretty good. If we break down global markets into several blocks, we can see that there is very little difference from an indexing approach that uses ESG criteria to choose stocks versus the traditional passive “pick everyone approach”). Here’s a comparison of five-year returns between the Morningstar traditional indexes and the ESG based indexes for various markets:

Over five years (the longest period shown on the Morningstar website for the sustainability indexes), only the US sustainability index underperforms it’s market cap weighted peer. Japan, Germany and Europe all show outperformance in the other direction.

ESG and long-term returns

Over longer periods than the five years for the US market, we can turn to the MSCI KLD index which was established by MSCI in 1994. This index selects 400 US large and mid-cap stocks on two criteria – firstly by excluding companies whose products have negative social or environmental impacts, but more importantly, it then rewards companies with outstanding Environmental, Social and Governance performance. How does this index stack up over a longer (23 year) period? The most apt comparison is with the MSCI IMI US Index:

Concluding thoughts

So, the choice is no longer “am I prepared to give up return in order to invest responsibly?” Investors can now work in the assumption that “Responsible Investing” no longer carries a penalty. In fact, investors and advisers wanting to maximise their return should see responsible investing as the base line starting point.

Paul Brownsey

Paul Brownsey is a founder of Pathfinder Asset Management Limited. This commentary is not personalised investment advice - seek investment advice from an Authorised Financial Adviser before making investment decisions.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « Don’t bank on those dividends | Note From A Big Country » |

Special Offers

Comments from our readers

Sign In to add your comment

| Printable version | Email to a friend |

Second argument is something emotive like weapons (for example); as bad as you say or is its the misuse by governments in exporting them to 'bad' hombres! Personally I'm glad we have good weapons like ships and planes and guns and missiles in NZ even though we shirk much of this cost by a free ride on Australia. Try being defenseless!

And does depriving equity capital actually work better than say....investors electing to take X% of their returns and invest them into lobby groups and NGO's (many of which have a proven record of effectiveness- unlike this approach) of their choice.

How about a fund that follows the airline and utility industries' tactic, you can pay more to fly 'Green" and power your home 'Green'.

Reality is few do when given the choice preferring to have more money left in their wallet.

And where do you draw the line; a bank that lends money (more effective than equity) to bad places and people? And my line in the sand is probably different to yours.

What if one was to openly abuse UN Charter of human rights on women, refugees, cliamte etc... MR Trump's nation of wiling corporate accomplices- most passive and some at arms length who may also be operating in fields also doing really good things that even the PC brigade can accept. Drawing that line keeps getting harder- WHEN you think about it.

Perhaps remove the biggest nation exporters of weapons the USA, Britain and others from your hunting grounds for stocks and all their suppliers of critical inputs. They are the demand generators. How about Shell for being in Africa? Buy into hydro perhaps with dams that stuff communities in poor countries (proven not to help them just the richest in those nations), with the concrete involved that produces one of the top polluters on the planet for instance.

ESG is nice and also worthwhile but not applied at an arms length pooled equity investor level. There are other more effective ways and means. The FUM numbers often quoted when you strip out the 'G' is way way less, and for good reason.

Just where do you draw that pesky line? You see its sounds good but is just a populist band-wagon of W.M.C people.There are better ways to effect change.