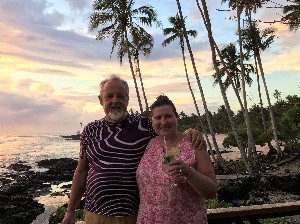

Getting to Know: Lyn McMorran

Lyn McMorran is a familiar face to many in the industry - an AFA, executive director of the Financial Services Federation and a former IFA president. Here she admits her worst investment yet...

Friday, October 13th 2017, 11:00AM

Who are you and what do you do?

I am the Executive Director of the Financial Services Federation, the voice of New Zealand’s responsible finance and leasing companies. I was president of the New Zealand Institute of Financial Advisers from 2008 to 2010 and am still a fellow member of the IFA. In that role I represented New Zealand financial planners at the Financial Planning Standards Board Council, which I still have a bit to do with, and I have a background in the banking industry.

How did you get into the industry?

I fell into a financial services career completely by accident, after having been offered a permanent job with Westpac when I completed a temp typing assignment there too many years ago to be able to count.

What do you think are some of the misconceptions held about entering the finance industry as a career?

One of the most common misconceptions people have about careers in financial services professions – and particularly in financial advice – is that you need to be some kind of mathematical genius to be able to have one. I am living proof that that is absolutely not the case. The key to success in these professions is in being able to build relationships through a genuine love of people. A basic understanding of numbers is helpful so you can recognise whether they look right or not but everything else can come out of a machine.

If there is one thing you would like to change about the finance industry, what would it be?

I do believe strongly that consumers are always better off when they have received good financial advice. The value of advice cannot be underestimated in terms of what it can do for people’s long-term financial wellbeing. I have always said that the financial planning or advice relationship should start when a young person first takes on debt so that they come to think about how, with debt comes a need to protect themselves from the possibility of not being able to repay it due to unforeseen circumstances. Then it carries on right throughout their lives as they grow older, take on more responsibility and their needs change.

What do you think of financial advisers' education standards, are they high enough?

I definitely see the current Level 5 qualification as being the entry level if all you want to do is provide advice at that level and that’s fine but anyone who aspires to being the best and most professional adviser they can be – and provide that whole of life financial relationship to their clients – should be aspiring for a much higher level of qualification than that. I totally support the idea of a degree programme for financial advisers on that basis.

What’s the best advice you have ever received?

When I was a young and silly temp typist and thought the next pair of ridiculously high shoes was far more important than my retirement, I joined Westpac and their compulsory defined benefit superannuation scheme. They saved me from myself.

What have been the benefits of regulation, is New Zealand’s regulatory system working?

With our financial services sector having gone through the biggest regulatory reform ever there would be days when it would be tempting to say “what benefits?” particularly when it’s after the fact and those players, for example the finance companies, that survived the GFC were arguably the ones who were acting responsibly in the first place. Putting aside the costs and time-consuming nature of compliance though, New Zealand and New Zealand consumers is in a better place now than we were before as a result. It’s been a painful process at times and not without its issues in terms of getting it right but the fact that we can go through a review process such as the one we’ve been undergoing with the Financial Advisers Act (whilst also not without pain) gives us the chance to get closer to doing the right thing for all parties.

What have been your own worst and best investments?

Best has to have been the Westpac super scheme. I don’t know that there is a worst unless you count years of weekly Lotto investments that have led exactly nowhere (but we live in hope!).

What do you think are the biggest financial risks to New Zealanders at the moment?

Low levels of financial capability – as ever. People can’t make informed decisions about any aspect of their financial lives without basic financial capability.

What could be done to improve New Zealand’s financial literacy levels?

Teaching it in schools is the obvious answer so kids come out equipped to get on with their lives. The question is who teaches them. And how do we get to their parents who came out of school without their own basic knowledge? I sometimes wonder whether we need to work backwards – provide financial literacy to adults who can then provide the training needed in schools.

What do you see as the role of professional associations - is there anything they could be doing better?

In the financial adviser space I’m a huge supporter of Financial Advice New Zealand. To me our population is too small to support more than one professional body in any space. It makes sense to be speaking as one voice to the public, regulators and other stakeholders.

Are you a KiwiSaver member? If so, what’s your investment strategy?

Absolutely – a total no-brainer. Growth (I’m still young enough for a bit of growth!).

Outside of work what do you do?

I’m kept busy on the board of the Skylight Trust, a fabulous organisation which provides specialised grief and trauma support for young New Zealanders and their families and helps build resilience so young people are equipped to deal with stress and loss and to make the right decisions. I’m also on the investment sub-committee for the National Council of Women, and a member of the Commission of the Insurance and Financial Services Ombudsman Scheme. A chunk of my private life also is influenced by a small committee of delightful members with an insatiable appetite for pancakes and zoo visits – my grandchildren. I enjoy the odd overseas holiday, especially when there is fabulous food, wine and company. But I’m also just as happy hunkering down at home with a NZ pinot and a good TV murder mystery.

What is one thing people may be surprised to know about you?

I’d like to think I’m a pretty open book – no surprises. Someone once almost fell on the floor when they found out I’m a huge Meatloaf fan – no idea why!

If you weren’t in this job what would you be doing?

I actually can’t think of anything I’d rather do – and that makes me an extremely lucky person.

| « Kiwi investor experience improving: Morningstar | LVR restrictions to be reviewed » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |