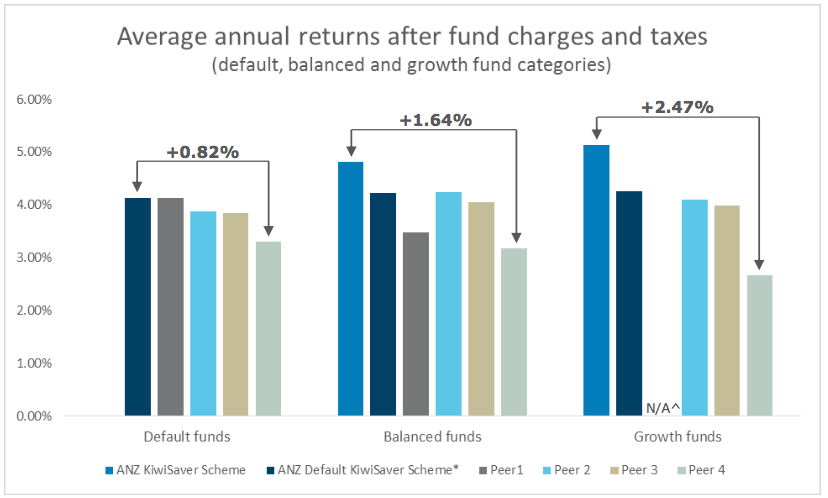

Don't choose KiwiSaver funds on fees only (+ GRAPH)

ANZ general manager Wealth Products, Ana-Marie Lockyer, says the focus with KiwiSaver should be on returns-after- fees, rather than just on finding the provider that offers the lowest fees. +GRAPH

Tuesday, October 17th 2017, 5:06PM

She says ANZ is concerned that KiwiSaver members are choosing a fund purely on fees, and by doing so members may miss out on greater returns and therefore a larger KiwiSaver balance in the long term.

"We believe that active management can add value over time and disagree with the view expressed by AUT recently that all managed funds are likely to be equal after a 10-year period.

"KiwiSaver has now been in existence for 10 years so we can objectively look at the 10 year returns (after fees and tax)."

She says it is important that members are made aware of what they are paying for and make the right choice for themselves.

"For example, if we look at ANZ’s actively managed funds and the five default KiwiSaver providers who commenced in 2007 the results show that everyone doesn’t gravitate to the same position over the long term."

With growth funds the attached graph shows there is a disparity of 2.47% between the highest and lowest return funds. This could deliver more than a $260,000 difference (not adjusted for inflation) in a member’s nest egg at retirement.

"Consumers need to have choice and understand the different costs that are incurred by different funds, offering different levels of service.

"We believe it is also important to remember that different fund managers offer different levels of service to their clients."

She says active managers research stocks and select the ones they believe will deliver higher returns. Therefore active management involves a higher level of decision making and analytics as these managers select specific investments, which translates to higher operational costs.

"On top of that, not all providers have the same services. Do you want access to advice? Do you want to easily view and transact on your KiwiSaver account online?"

"We fully support improving disclosure of fees and look forward to full transparency next year across all providers, however don't believe KiwiSaver fees should be prescriptively regulated in recognition that providers manage investments differently and offer varying levels of services and tools. What is important it that alongside the fees that providers articulate what members will receive for their fees and we would encourage continued education for members about returns after fees given that will drive retirement outcomes."

Notes to graph

- The graph above shows the average annual return for each fund since inception. Returns are for the period 1 October 2007 to 30 June 2017. All returns are after deductions for fund charges and tax at the highest prescribed investor rate for an individual New Zealand resident. The data shows fund returns for the original default scheme providers who were appointed in 2007 [^one of the growth funds has been excluded as it launched in 2015]. We have also included the ANZ KiwiSaver Scheme funds in the balanced and growth fund categories to show the performance of our flagship scheme.

- *Prior to 1 July 2014, the ANZ Default KiwiSaver Scheme followed a different investment philosophy to the ANZ KiwiSaver Scheme. As a result, returns after fund charges and taxes since inception will show a variation between these two schemes. Since 1 July 2014, the investment philosophies across both schemes have been aligned – this has also aligned the returns.

- Returns are sourced from the 30 June 2017 Fund Updates published by each provider. All Fund Updates are publicaly available on each provider’s website and the Disclose register.

- Within the default, balanced and growth fund categories, each fund may have a slightly different target investment mix.

| « Should lawyers give financial advice? | Lessons from RBOHA » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |