Equities versus Bonds?

The often-used phrase "margin of safety" is usually attributed to famous value investor and Warren Buffett’s teacher, Benjamin Graham. Its definition varies widely.

Monday, October 30th 2017, 11:00AM

by Castle Point Funds Management

In its weakest form, it is used to describe the difference between the price of a security and an investor's view of the security's intrinsic, or true, value. If the assessment of intrinsic value is made using subjective measures, such as forecasts of the future, then an optimistic enough forecast of the future can give any investment a large margin of safety.

This does not appear to be what Benjamin Graham was meaning. His core premise was that companies should have exhibited enough earnings to ensure that value could still be attained, even in the event of future setbacks. While he didn't rule out using forecasts of the future for a growing company, they need to very conservative forecasts.

Chapter 20 of Graham’s book, Intelligent Investor, is a must read. In it, he provides some simple rules for assessing the margin of safety for bond or equity investments. He also discusses his rules for determining when to invest in equities versus bonds. Graham summaries this in a later lecture that he gave in 1972 where he said, “The margin of safety is the difference between the percentage rate of the earnings on the stock at the price you pay for it and the rate of interest on bonds, and that margin of safety is the difference which would absorb unsatisfactory developments." The percentage rate of earnings on the stock price, or earnings yield, is calculated by dividing a stock's earnings per share by its price. It is, in fact, the inverse of the commonly used Price to Earnings, or PE, ratio.

At the time of the 1965 edition of the Intelligent Investor, the equity market was selling at 11 times earnings, giving about 9% earning yield against 4% on bonds. Graham noted that the earnings yield for an equity portfolio should twice cover the bond interest rate. In the 1972 lecture, he noted that equity prices had risen so high that there was no difference between the earnings yield and the interest rate, and that there was no margin of safety.

So where are we now?

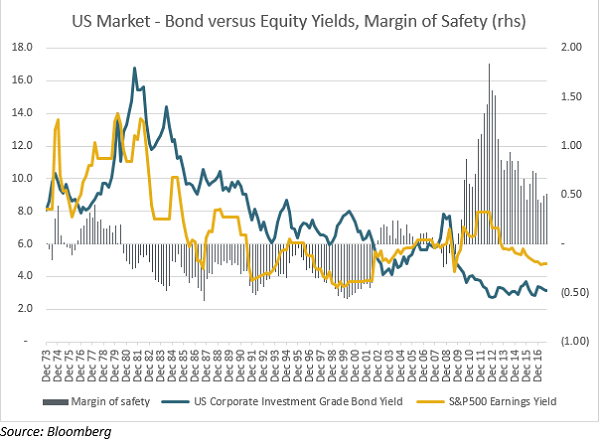

The below chart shows historic bond and earnings yields in the United States. The bars indicate the margin of safety. Bars above the zero-line show times when earnings yields are higher than bond yields and there is a positive margin of safety. Lines below the zero-line show times when bond yields are higher than earnings yields and there is a negative margin of safety.

Mr Graham would have waited a long time to get an investable margin of safety for equities. In fact, remarkably, equities have yielded less that bonds for a large portion of time. The current margin of safety doesn’t look too bad compared to history dating back to 1973, but it is still a long way off twice covered, at 0.5x.

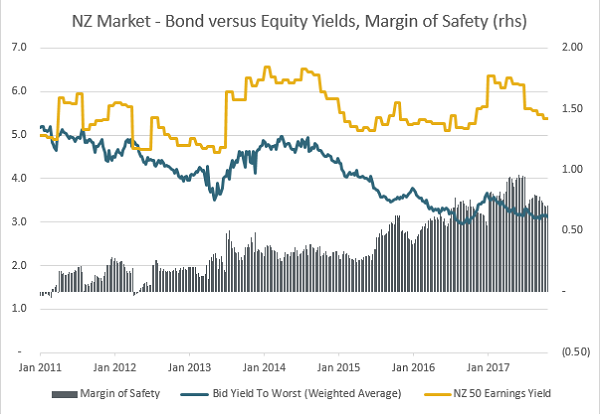

Closer to home, the below chart shows the situation in New Zealand. Note that there is less history than the above chart.

The above charts indicate that equities present better value versus bonds than they have for some time, mainly due to falling bond yields. Perhaps this is why Warren Buffett said in a recent interview that the record-breaking U.S. stock market isn't as expensive as it might appear given the low level of interest rates. "Valuations make sense with interest rates where they are," Buffett said.

Investors wishing to use this as a reason to invest in equities might also want to consider a few caveats. First, the duration of the US Bond index is longer than the New Zealand Index, meaning the average yield is skewed to longer duration bonds. This might make the New Zealand margin of safety look better than it really is compared to the US. Second, companies are currently exhibiting unusually high profit margins. If these margins revert to historic norms the earnings yield will fall and so will the margin of safety.

Finally, and most importantly, if you subscribe to the view that bond yields are at unsustainable lows due to government intervention, your margin of safety will quickly evaporate once market forces normalise bond yields.

Disclaimer

The commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique funds management business established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment.

About Richard Stubbs

Richard Stubbs is a partner of Castle Point. He has a Master of Commerce in Finance and a Bachelor of Science from Auckland University and has published academic articles on long run returns in New Zealand.

| « Lessons from RBOHA | When price and value diverge » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |