Nikko takes out top Award

Nikko Asset Management received the top award as Morningstar's New Zealand Fund Manager of the Year.

Thursday, March 1st 2018, 6:10AM

“The winners in the Morningstar Awards have all shown themselves to be first-class stewards of their investors’ capital,” said Chris Douglas, Morningstar Director of Manager Research Ratings, Asia-Pacific.

“Markets posted great returns in 2017, and the select list of fund managers nominated all demonstrated an ability to add value over the year and consistently reward over the long-term, too. New Zealand investors have an increasing source of high-quality investment options to choose from, with Nikko Asset Management being the stand-out asset manager for 2017.

Douglas says Nikko Asset Management "richly deserves Morningstar’s overall award for excellence in funds management in 2017."

The firm was a finalist in all the sector categories illustrating the impressive consistency of performance across all the major sectors. Nikko has had a busy few years, investing into its investment teams and the local product line-up, which includes some strong global strategies.

"We applaud the focus on investor engagement and transparency. These traits led to a great experience for their investors, solidifying Nikko’s case as the outstanding fund manager of 2017."

Harbour Asset Management took out the domestic equities award. Douglas says the firm "continues to prove they are the one of the preeminent Australasian equity managers."

"The team has been in a favourable market environment in recent years and they have taken full advantage of this. We particularly like the smart and insightful analysis and shrewd portfolio construction process."

Harbour's international equities fund, T. Rowe Global Equity Growth fund, has "an impressive global pedigree that few can match."

Douglas says the fund has "paid off handsomely for investors."

"The hard work is carried out by United States-based portfolio manager Scott Berg. He’s an astute manager who travels extensively to uncover the best company ideas. We believe this is a very good global equities approach with many strong characteristics and will continue to reward investors in the future."

Russell Investments won the global fixed interest award. Douglas says Russell is "the premier global fixed-income option for New Zealand investors."

"Few can match the firm’s depth of analysis in this asset class and multi-portfolio management expertise. This approach has been a mainstay of the New Zealand market for many years and has shown an ability to consistently tweak out returns above the global index over all time periods, which is no easy feat."

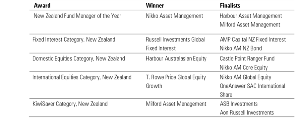

The winners of the New Zealand Morningstar Awards 2018 are:

| « FMA still waiting for first robo applications | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |