Regan: AMP's conduct unacceptable

[ROYAL COMMISSION] AMP has admitted putting shareholders before customers when it charged clients fees for financial advice they did not receive.

Wednesday, April 18th 2018, 6:00AM  12 Comments

12 Comments

The firm appeared before Australia's banking Royal Commission, which is investigating misconduct in the financial planning sector.

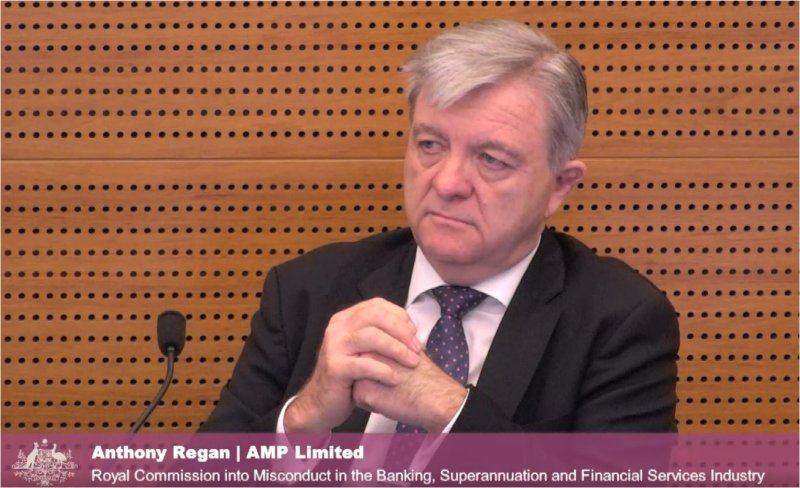

Jack Regan, AMP’s head of advice and New Zealand was questioned on Tuesday as the commission looked at the business’s practice of charging for financial planning services clients did not have access to.

Regan apologised to customers, admitting the company made untrue statements to the regulator.

The enquiry heard it had made a deliberate decision to continue to charge “orphan” clients financial advice fees for three months when they went into a central pool, often after their advisers retired if no buyer could be found for the book.

In that time they received no advice services and AMP was told the move was probably unlawful.

AMP had an administrative call centre but it could not offer any financial advice.

Regan was asked how he became aware of the “fee for no service” problem when he took over the financial planning arm.

“It was a series of emails that were concerning in relation to the knowledge of approving the continuation of fees,” he said. “There were emails related to legal advice about whether fees should continue to be charged if no service was provided.”

Regan said the legal advice was that there was no lawful basis for implementing the 90-day exception.

The enquiry heard AMP had misled the corporate regulator at least 20 times – although at one point Regan lost count of that number.

“It’s clear that we preferenced shareholders in that exchange at the expense of customers,” he told the inquiry.

He said it was “unacceptable”. "It starts with culture ... culture is the invisible hand that ensures people are making the right decisions.”

| « Fees eroding risk premium: Researchers | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

As one of those advisers, my focus is always to operate within the best of my abilities in line with my customers/clients interests. How a corporate management team or board of directors choose to operate is something I have little control over and largely has no impact on my ability to offer my clients exemplary service. These sentiments would be reflective of our channel as a whole.

"The customer pays a series of fees. There's an administration fee of around 2.51 per cent in the case of most AMP customers.

In addition, according to Keating, the financial adviser that sold you into the wrap can take an advice fee. In the case of a client with $250,000 in one AMP wrap, that fee would be $5250.

For your convenience, the platform deducts these fees directly from the customer's cash balance. Oh, and if you don't have the cash to cover the fees, the platform automatically sells the products contained within to cover the fees."

I just looked on the AMP NZ website and note that according to the latest Quarterly Fund Updates (to 31 Dec 2017), the AMP Savings and Investment Portfolio Unit Trusts have annual fees of around 3% p.a. (except the bond fund which is 2.7% p.a.) which I assume is on top of the platform fee and the advice fee.

The AMP NZ Shares Fund, Balanced Fund, Conservative Fund, Dynamic Fund, Fixed Interest Fund, Australian Shares Fund, Asian Shares Fund and Global Share Fund all underperformed their market benchmarks after fees over the 5 years to 31 Dec 2017.

While I'm sure the service AMP advisers provide their clients is top notch and they may not invest in these particular AMP funds, perhaps one of them could enlighten us as the the total fees their clients pay (platform fee plus advice fee plus underlying fund fees) for this service?

On the flip side, you as an AMP aligned adviser, should be asking AMP, why their fees are so high, and if they are justified, what value do they present to you as an adviser.

In this new era of DIY investment, Robo-advice, and passive/low fee mantra, you will have a lot more complicated conversations with your client base, and if not, Advisers that can deliver the same level of advice, value and service, with a cheaper product will remind your clients of what else is on offer.

And I agree, what is going on in Australia, specifically AMP in this case, but let’s not forget the banks as well, is appalling. Their influence in shaping financial advice or financial process in the Australian market, and more to the point, in the NZ market, should be removed.

Despite what we might say, some of us do have sympathy for the AMP foot soldiers. The Gods in whom you have believed have been shown to be mere fault-ridden mortals.

However a joke comes to mind.

What's the difference between the young girls in the Year 6 netball team at the........primary school, and AMP agents

Answer

Nothing they both feel badly let down by their respective heroes.

Frankly if an author had sat down to write a work of fiction about the faults of a big financial institution, the worst they could have come up would probably only be half as bad as what was revealed over the last couple of days.

You would have to think that AMP the entity might be facing some big fines and some the Board and some very senior AMP managers too and the humans might even end up spending a bit of time at Her Majesty's pleasure. A few high powered lawyers might also have some explaining to do in their professional bodies and perhaps the Courts as well.

The only silver lining for AMP might be that after the 4 big banks have had their turn in the interrogation lights, it could well be that AMP will (comparatively) turn out to have been the best behaved of the lot!

You should know that CBA got chewed up and spat out at the Australian Royal Commission yesterday.

The number of their breaches was mind boggling - QC described CBA as "the gold medallist" for compensation payments for remediated breaches, charging fees and not providing the services etc. 'CBA(FP) systems hopeless in 2012' was finally dragged out of the poor lady on the stand, who was told off several times for dissembling and not answering the questions asked - she joins Jack Regan in the special pen for sacrificial lambs, I guess.

Just listened to a livestream of the Royal Commission. A terrible tale of woe from a poor lady who was dreadfully advised by Westpac, and then the BOS. Absolutely shocking ....

I watched too. The Commission's QC surgically eviscerated him without an anaesthetic. She is very impressive - her handling of detailed information outstanding - like the Westpac guy had a ring through his nose and she led him this way and that.

Earlier a very brave lady client whose family life was ruined by a Westpac adviser out for a 5 figure insurance commission for a "non viable plan" bared her soul.

So AMP CBA and WBC all down for the count; NAB and ANZ still to come!

As Whaleoil would say, get lots of drinks and popcorn and settle in for the rest of the show!

Sign In to add your comment

| Printable version | Email to a friend |