Advisers account for bigger share of ANZ's home loans

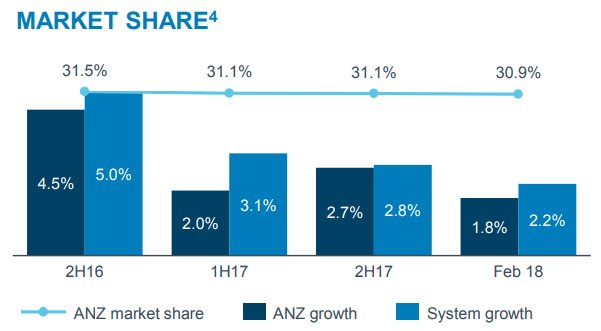

ANZ's home loan market share fell in the six months to March 31, however mortgage advisers accounted for a greater proportion of the loans written.

Thursday, May 3rd 2018, 8:47AM

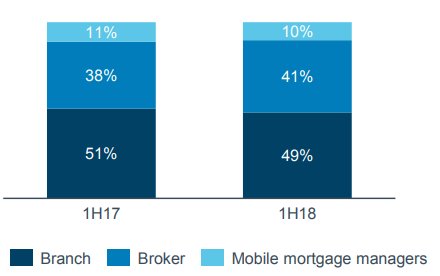

The bank remains the number one home loan lender in the market, however its market share fell from 31.1% to 30.9% during the period. In the first half of the year advisers accounted for 41% of loans written compared to 38% in the corresponding period last year. This growth largely came at the expense of branch distribution, although mobile mortgage managers were down from 11% to 10%.

ANZ chief executive David Hisco said "a while back we slowed down our appetite a little bit when the market was out of control."

"But we're back in the game now."

He says big banks are a bit like an oil tanker; "they take a while to wind up, but when they get going they move along nicely.

ANZ grew its loan book 3% in the first half of the year, but that was still below system growth. Hisco said that the decline in market share will hopefully come to an end.

"We are aiming for at least system growth for this half," he said.

Mortgage advisers are "an important part of our flow," he says. However, he doubts third party distribution will ever get to Australian levels where more than 50% of home loans are originated through advisers.

He says New Zealand is structured differently with more branches and "more feet on the street".

"I'm not sure it would get there (to 50-plus%), but you never know.

COMMISSION MODEL

Hisco says he is "pretty comfortable" with its model of paying upfront commissions only, even though competitors were now offering trail commission to advisers.

"We're pretty happy with what we are doing. It seems a reasonable way to go."

He says upfront was easier to manage from the bank's perspective and advisers "seem to have accepted that too."

| « General Finance founders target funding gap with EMortgage | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |