Solving Japan’s financial problems…and creating some for New Zealand

Japan is in some ways the poster child for the developed world's current financial problems. In 1989 its huge equity and property bubbles burst and, rather than aggressively addressing the resulting problems, Japan’s government propped up its financial system, creating zombie banks, persistent deflation and the very high level of Japan government debt that we see today.

Tuesday, June 12th 2018, 6:00AM

by Castle Point Funds Management

Japan now has the industrial world’s heaviest debt burden at more than twice the size of its economy. Even at low current interest rates, debt-servicing costs account for roughly a quarter of the annual government budget. If interest rates were to rise by 2%, it would take more than 70% of total tax revenue just to pay the interest!

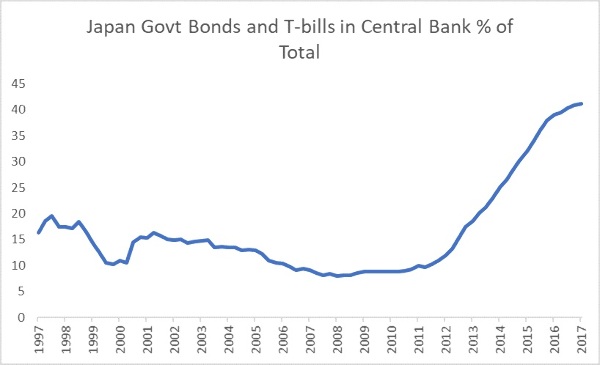

The Japanese government also needs to borrow more as it is currently running a substantial budget deficit, requiring an estimated 33.7 trillion yen of new bond issuance in 2018. This looks like an unrecoverable position. However, we have a solution. Mainly due to Japan’s quantitative easing program, the Bank of Japan currently holds over 41% of the Japan government's debt. What if it kept buying and took its ownership to 80% of its own debt, and then wrote it all off?

Source: Bloomberg, Bank of Japan

The theoretical answer should be "inflation" as this would be money printing in its purest form, but in a world where no one believes that inflation is possible anymore it appears that this might be considered costless. Desirable even, if it stomps out deflation.

Without this interest burden the government’s books would be closer to being balanced. If capital markets were convinced that this was a one-off Japan might not even lose the confidence of international investors. The debt is held by the central bank, so no individual or entity loses money. Any currency weakening would be highly beneficial to Japan's exporters, and might help stimulate some inflation, which Japan actually wants.

At Castle Point we believe in aligning ourselves with the interests of the decision makers. It appears to us that, as long as money printing continues to appear costless, governments will continue to print money whenever they fear a financial crisis might be looming. Ultimately money printing should be inflationary which, if left to run rampant, is highly destructive to an economy. But even if the decision makers understand this, when it comes to choosing between certain economic turmoil now from default and deflation, or possible economic turmoil in some years' time from high inflation, we feel incentives align to the latter… when in doubt, print!

However, this potential solution for Japan and other indebted countries might not be so good for New Zealand. Historical evidence suggests that economies with loose monetary policies and inflation experience (for a period of time) undervalued currencies, while the opposite is experienced for economies running tight monetary policies.

If the loose money policies of other countries start to induce inflation New Zealand will face a dilemma. Should it:

1. maintain traditionally prudent interest rate levels to keep inflation at bay at the cost of a stronger than expected exchange rate, or

2. lower interest rates to weaken the currency at the cost of high inflation?

Currently, the Reserve Bank of New Zealand is mandated to avoid the second option which could result in a tough time for New Zealand's exporters.

| « Italy: A bigger threat than Brexit? | Interest Rate Cycles: Endings and Beginnings » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |