New PIGS, the CANNS or SNACZ?

There is currently much talk within the financial markets of the ‘new PIGS’, a group of countries which are widely viewed as having inflated property markets and notably elevated levels of debt that are therefore likely to prove vulnerable to the tightening in global (banking system) liquidity trends.

Tuesday, July 3rd 2018, 9:00AM

by Andrew Hunt

There is currently much talk within the financial markets of the ‘new PIGS’, a group of countries which are widely viewed as having inflated property markets and notably elevated levels of debt that are therefore likely to prove vulnerable to the tightening in global (banking system) liquidity trends.

We are however strangely reluctant to use the PIGS acronym again, having previously annoyed the originals in the course of an article in the Financial Times a number of years ago.

Another prospective name for the group is the CANNS (Canada, Australia, NZ, Norway and Sweden) but we would prefer not to include Norway in this group, and so we are suggesting the use of SNACZ, a phrase dreamt up by an Australian friend of ours (even though it has required splitting the N from the Z in NZ….).

Much more seriously, these economies have suffered severely from the tyranny of global capital flows over the last 15 or so years.

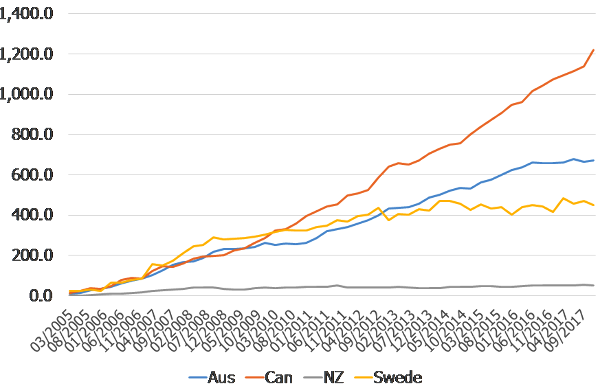

Since 2005, Australia’s 24 million people have experienced cumulative inflows of ‘debt & credit’ that have totaled some USD $671 billion. On the same basis, Sweden’s 9 million people have experienced a massive $450 billion of inflows, while Canada’s 36 million residents have witnessed $1.2 trillion, and NZ’s 4.5 million population has seen $52 billion of inflows.

In simple per capita terms, the average level of debt inflows since 2005 into the SNACZ has been $30,000 – an immense sum even in the context of these developed world economies (in per capita terms, Sweden seems to have been the highest at $49,000 and NZ the lowest at $11,000 – although even the latter must have been significant in the context of an economy in which the level of per capita GDP in 2017 was US $45,000.

We would assert that the arrival of such (disproportionately) large inflows of foreign credit will have exerted a profound impact on the nature of the economies and indeed we believe that these flows have shaped their recent economic histories.

SNACZ: Cumulative Inflows of Foreign Credit

Although no doubt much time and effort were expended in building complex models and analysis of why these flows should have/did occur, in reality we suspect that most of these flows were simply naively responding to the positive interest rate differentials that existed between the countries in question and the low rate/financial sector credit boom afflicted donors during 2000's or the differentials that existed vis-à-vis the QE-affected countries in the 2010's.

In the case of Sweden, we also suspect that there was the impact of the externality caused by the EUR’s mere existence. Crucially, we doubt that the recipient countries actually asked for these ‘mega flows’…..

Naturally, the arrival of such dis-proportionate inflows of capital exerted profound influences on the currencies, the countries’ real exchange rates, the ability of the local central banks to set interest rates, and most of all the ability of the local commercial banking systems to extend credit to their respective economies.

In particular, the ability of the local banks to utilize such plentiful and at times almost limitless supplies of ‘cheap’ foreign financing at a time during which the domestic central banks will have been constrained with regard to their abilities to raise domestic interest rates (for fear of encouraging yet more capital inflows) doubtless played a very significant role in facilitating the dramatic increase in domestic debt ratios that has occurred.

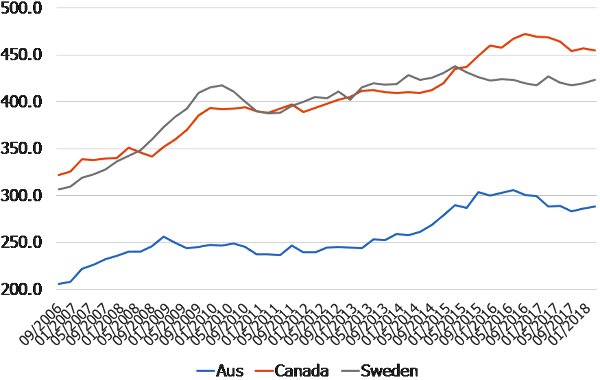

SNACZ: Total Debt % GDP

There has clearly been a very significant increase in the amount of credit that has been extended within these countries and, as is well known, much of this credit has been directed not at producing productive capacity but rather at the property markets.

It is of no coincidence that each of these countries have experienced significant rates of population growth over recent decades and this event naturally provided what might be described as a fundamental basis for an expectation of rising property prices.

However, a combination of abundant credit supply and an initial plausible rationale for rising prices have long been considered as being the necessary foundations for the formation of an asset price bubble and, in the case of the property markets, these bubbles can easily become self-sustaining as rising property prices implicitly provide participants with more collateral (as well as profits) that they can then use to gain more leverage in order to conduct more price inflating speculation.

Property has the unfortunate position as being not only something that is deeply embedded in people’s psyche as being something that they should seek to own (perhaps the result of some survival-related need for shelter?), but also it is something that can be speculated in (often in a tax efficient way) and also it is something which can be used as collateral to facilitate even more borrowing and hence even more speculation….

Given these characteristics, it is not surprising that property booms can become not only intense but long-lasting if credit conditions are not tightened.

Of course, in the context of the SNACZ, it was extremely difficult for the authorities to tighten credit conditions as the housing markets inflated because of the persistence of the capital inflows and the fears that higher rates would trigger ever-larger inflows….

Property is of course not only an object of speculation; its primary role should still be as somewhere to live.

Indeed, the primary subsistence needs for anyone is likely to be food, shelter and energy and this implies that when property prices rise, so too does the cost of living.

In turn, it is a fact companies must pay their staff at least enough to live in their locations and therefore, traditionally, property price booms have tended to be followed by outbreaks of wage inflation and ultimately general price inflation.

This was certainly the case in many economies around the world until the mid-1990's.

However, the world has changed in many ways since the mid-1990's and one of the most significant changes has come as a result of the emergence of North Asia as a price-setter in many of the world’s goods markets.

Until very recently, North Asian economies did not routinely charge the full or ‘normal’ price when selling their wares. Consequently, profit growth in Asia has been very modest over the last 20-30 years despite the rapid rates of headline GDP growth (hence the lacklustre long-term equity market returns) and this is also why economies such as China have needed so much new credit each year in order to support their fundamentally cash flow negative corporate sectors.

Consequently, the emergence or even dominance of these Non-Profit-Maximizing competitors in the Far East implied that companies in those countries such as the SNACZ that were experiencing property-price-led increases in their cost bases could no longer seek to raise their prices in order to reflect their higher costs – in short, they could no longer afford to compete in the markets for traded goods.

It is for this reason that the SNACZ (and others) have been losing their manufacturing bases and the only sectors that could prosper were either their commodity sectors (and even then, only when commodity prices were high enough), or in their industries that did not face foreign competition, such as domestic construction and food services. It is for this reason that it seems to cost so much to go out to dinner in NZ or Australia, or to build a house….

The longer-term macro results of this state of affairs have been all too easy to predict.

The countries have suffered varying degrees of de-industrialization; they have become dependent on foreign suppliers for their goods - a situation that has given rise to their persistent weaker trade and current account positions; their economies have become over-reliant on jobs in construction and low-end services in which average productivity levels tend to be low; and income distributions have become more unequal as a result of the nature of employment in the service sectors (i.e. very well paid or minimum wage jobs…).

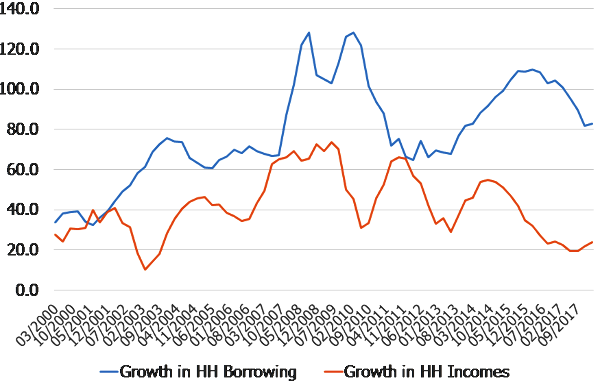

We might also note, more subtly, that the prohibitive cost of living has tended to undermine household sector cash flows, thereby making households ever more dependent on credit simply to fund their day to day living expenses.

Finally, in an escape to improve their own situations, more people will have felt compelled to enter the housing speculation game, thereby necessitating yet more borrowing and of course making the underlying macro-economic situation worse.

Australia: Household Income and Credit Growth

This has been the rather worrying narrative of the SNACZ for much of the last 15 – 20 years but, unfortunately, while the foreign capital continued to arrive, there was very little that the authorities could do to halt the processes.

Moreover, whilst the inflows of credit continued, those that worried about what was occurring to the structure of the economies and even their physical environments (i.e. as beauty spots became speculators’ paradises) were seen as Cassandras or simple kill-joys.

However, this year the world seems to be changing. Following the US economy’s achievement of a 5% rate of nominal GDP growth and a clear degree of overheating, the Federal Reserve has finally begun to tighten its policy stance in a concerted manner.

In addition, a number of technical factors surrounding the US government’s funding and tax policies, and even the regulatory environment, have also conspired to limit the supply of dollar liquidity and the principle casualty in this tightening process seems to have been the flow of credit around the global economy.

Arguably, the countries that have so far been most exposed to this drying up in global credit supply have been the ever-credit-dependent large North Asian economies (hence the equity bear markets in these countries) but, as the tighter credit environment leads to greater levels of enforced austerity in their cash-flow-negative corporate sectors, it is of course likely that they will buy fewer commodities or machine tools and herein lies one side of the jaws that now seems likely to squeeze the SNACZ.

A loss of demand from China et al will depress the SNACZ export receipts and further intensify the squeeze on their real incomes.

However, the SNACZ are themselves also credit dependent. As we have noted, years of capital inflows have so inflated the effective costs of living and operating in these economies that they too are now reliant on an abundant supply of credit, which their banks have of course been funding by drawing on money from the very international credit markets that are now becoming notably less accommodative.

Consequently, the SNACZ are being squeezed between weakening income trends (that will other things being equal tend to increase their own demand for credit by weakening cash flow trends in the domestic economies), and a drying up in their own supply of credit.

This situation is particularly apparent in the case of Australia. In part as a result of a change in the ownership of some of its resource sector companies, and in part as a result of the low productivity growth problem that we described earlier, real household income growth was relatively soft in Australia last year and the economy’s growth in 2017 was probably much more dependent on the use of credit than many realize.

However, any new slowdown in the country’s primary export markets this year will further limit income growth and higher global interest rates will increase borrowing costs and potentially limit the supply of credit that is available.

We are therefore notably downbeat on the prospects for growth in Australia over the medium term and, far from tightening, the RBA may find itself easing in order to ‘rescue’ not only the household sector’s cash flows but also its ability to sustain such high property prices.

However, any easing will likely come at the expense of further weakness in the currency and we therefore judge the AUD to be highly vulnerable at this time

New Zealand faces many of the same issues, particularly as the costs of rescuing Fonterra and rebuilding the stock of cattle erode net disposable incomes in the farm sector.

The NZ credit system will also be affected by the change in the global environment and, while the situation may not be quite as weak as that in Australia, the NZD will likely suffer some fall-out.

The outlook for Canada is a little less easy to discern in that while the economy received perhaps the largest inflows of foreign capital and therefore perhaps has the greatest potential for credit problems, it is nevertheless clear that household income trends are still quite bright, and this may provide the economy and its currency with a degree of relative resilience.

At many times during our career we have found ourselves railing at the ‘tyranny’ of capital inflows – the original Asian Crisis had much to do with the ebbs and flows of global capital but even the UK’s Lawson boom in the 1980's and Iceland’s wild ride in the 2000's suffered from the effects of the unwanted credit inflows.

It is our firm belief that the long and seemingly very resilient economic cycles that have shaped the economies of the SNACZ in both cyclical and increasingly structural ways were largely driven or at least facilitated by the persistent inflows of capital that they experienced (although they were not completely innocent parties – there did have to be credit demand and a willingness to speculate in property…).

However, in 2018, a number of factors have converged to imply that the supply of credit to the global system is waning and these economies will certainly experience some fallout from this development, and of course from a related slowdown in their key (Asian) trading partners.

It therefore seems to us that growth within these economies will weaken (particularly in Australia in the near term) and that this will create some levels of ‘discomfort’ in their highly indebted domestic economies and most of all their property markets.

Hence, we suspect that the much-anticipated tightening moves by their central banks may not occur and if anything, we suspect that the central banks will have to become rather more generous, even if this results in some quite significant weakness in their currencies. Indeed, we suspect that both Australia and Canada will find themselves under pressure to produce current account surpluses, while both NZ and Sweden may need to expand their surpluses and the traditional route by which this will be achieved is by a combination of weaker domestic growth and a fall in the currency that both inflates import prices and encourages higher exports.

We may not be quite as negative as some on the outlook for the SNACZ – and for two of the economies the slowdown may still be some months away – but it does appear that their long credit fueled rides are coming to an end.

Andrew Hunt International Economist London

| « The Right Benchmark is the Bedrock of Strong Active Management | Sector exclusions lazy CIO says » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |