Advisers should spend more time understanding fixed interest investments

Advisers need to spend more time understanding their fixed interest portfolios, especially in this changing market environment.

Thursday, August 23rd 2018, 7:04AM  3 Comments

3 Comments

Daintree Capital portfolio manager Justin Tyler says "if you want yield, you need to know where is it coming from. Advisers are busy and tend to spend more time on the riskier parts of client portfolios, because this is where volatility will emanate from.

Advisers at the recent Meet the Managers where asked "how much additional return would you need, compared to a term deposit, to consider investing in a fixed income fund?"

Thirty eight percent of respondents said a fund would need to be delivering an additional 100 basis points.

Organiser Clayton Coplestone and Tyler were surprised at that result especially if it was at commensurate risk to a term deposit.

Tyler says a fund with a cash plus 4% return target is "typically not defensive."

"It is possible to have defensiveness in the context of a 2% over cash/0.75% over TDs return. That is the sort of portfolio you can put in the bottom drawer and not worry about it too much.

"A fund with a return target above that needs more due diligence and more active monitoring."

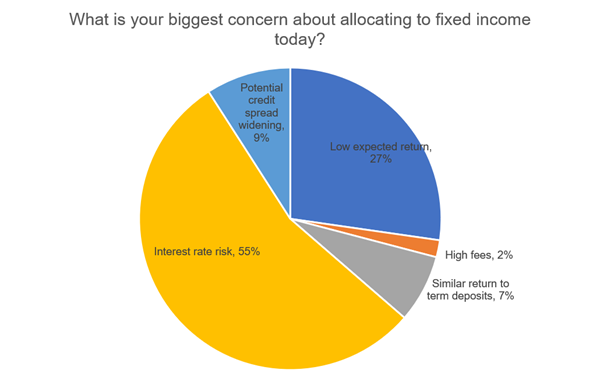

Advisers were asked what their biggest concern was when it comes to allocating to fixed income. Just over half (55%) identified interest rate risk, while 27% said low expected returns.

“In the survey I did when presenting in NZ, interest rate risk was perceived by advisers as the most relevant risk in fixed income right now and I agree with that assessment," Tyler says.

He says many fixed interest funds in New Zealand are heavily exposed to interest rate risk.

"It is common in New Zealand to see funds with a duration exposure of around six, which means that if interest rates rise 1% the fund will lose 6% of its value. Income returns will offset that to an extent, but investors are likely to experience much lower returns than what they have experienced over the last several years."

He says this point is equally applicable to exchange-traded products. "These are likely to become more prevalent through time, but for the most part they are duration-heavy and hence poorly structured given the rising rate environment we are in."

"If investors want a defensive exposure that can be expected to earn a decent return in excess of cash, absolute return fixed income funds are an option that should be considered," he says.

| « Fund manager research: Where to from here? | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

Brent - I agree with you... the fees on defensive portfolios are simply too high. Managers charging 75bps mgmt. fees..... are they adding that much value? Why are managers not asking themselves that question anymore.... its seems to be "how much can we get away with?"

If you have an outperformance target of 100bps and have some chance of making it.... id pay 20-30 bps for it.....75bps? thanks, but id rather manage it myself.

Sign In to add your comment

| Printable version | Email to a friend |

For a start let’s look at the numbers: Mr Tyler says “it is possible to have defensiveness in the context of a 2% over cash return”. Really?

Cash currently yields 2.2%. What low risk bonds yield more than 4.2%? But that is not even the full story.

We need to subtract at least 75 basis points in fees including trading costs so really we need to achieve 275 basis points over cash. The only way you can get anywhere near this sort of return is extremely long dated bonds or junk.

The first scenario isn’t an option because, predictably, all of the bright sparks here were worried about interest rates rising.

I particularly liked the inevitable ETF criticism that ETFs “are duration heavy and hence poorly structured given the rising rate environment”.

Hello I think interest rates have been falling for quite a while in NZ … from 2.26% as at 31 December to 1.96% yesterday, for five year governments.