Residential property market continues to flatten out

August provided further evidence that the residential property market’s price growth curve is flattening out, according to the Real Estate Institute of New Zealand (Inc).

Friday, September 15th 2006, 12:47PM

by The Landlord

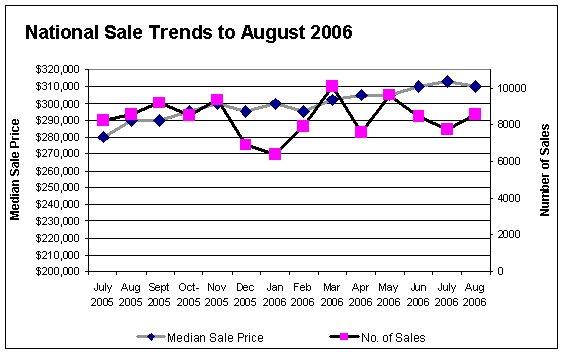

The national median price returned to the June figure of $310,000 in August, having reached $313,000 in July, according to REINZ National President Howard Morley.

Although the median was down a little August saw the property market shrug off the traditional winter ‘blues’ with an increase in sales and a reduction in days to sell from 35 to 33, indicating confidence is returning to the market.

“The heat that was evident a year or two ago has gone out of the market but equally we continue to believe there wont be any wholesale reduction in property prices. The market is simply reflecting the ongoing demand for housing and while prices aren’t surging in the way they did in 2004, demand is largely underwriting prices at current levels”.

Mr Morley said that the latest statistics should provide some confirmation and comfort to the Reserve Bank, that the property market is continuing to level out.

“The decision to leave the Official Cash Rate at 7.25 per cent, on Thursday, but with an implied threat that it could be increased if inflationary pressures don’t abate, will ensure interest rates remain at least at current levels and that is an inhibiting factor in the property market.

Sales rose from 7,771 in July to 8,562 in August, comparable with the figure of 8,591 in August 2005.

In the 12 regions surveyed, sales were up across the board but when compared to last month prices were less consistent with seven regions experiencing increased medians, two regions saw their medians unchanged and three saw falls.

Auckland provided some surprise with an increase in the median from $390,000 to $395,000 on sales up from 2,757 in July to 2,887 in August.

The Auckland median days to sell figure fell from 34 to 32 reflecting improved confidence and liquidity in the market, according to Mr Morley.

Northland’s median was down from $268,250 in July to $265,000 while Waikato and the Bay of Plenty region was unchanged at $285,000.

Hawkes Bay enjoyed a small increase from $253,000 to $255,000 but Manawatu/Wanganui was down from $205,000 in July to $200,750 in the latest month, while Taranaki was unchanged at $240,000.

Wellington continued its recent strength with an increase in the median from $330,000 in July to $335,875 but Nelson/Marlborough came to the end of its recent run with the median slipping from $297,500 to $293,000.

Further South, all regional medians increased with Canterbury/Westland up from $270,000 to $273,250, Central Otago Lakes was up from $398,500 to $465,000 (due to a jump in sales of higher priced properties) Otago was up from $212,000 in July to $220,000 in August and Southland was stronger too, up from $143,500 in July to $149,500 in August.

In percentage terms the market is now 7.26 per cent higher than a year ago, down from the figures of 10.99 per cent to July and 8.96 per cent to June, confirming the levelling trend in prices, according to Mr Morley.

Central Otago Lakes big median price jump this month has propelled that region into the lead with a 34.78 per cent increase over August 2005, followed by Manawatu and Wanganui up 16.04 per cent with Taranaki next on 11.11 per cent.

Auckland region is up 5.33 per cent, Wellington is up 9.05 per cent, Canterbury/Westland is up 5.09 per cent and Otago is up 9.69 per cent.

Click here to view list of stats. (18 pages, pdf)

| « Property investors refocus on cash flow | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |