Residential property still picked as top performer

Investor confidence has jumped up, after falling recently, however there has been a significant turn around in views on asset classes and their expected returns.

Monday, October 9th 2006, 12:00AM

by The Landlord

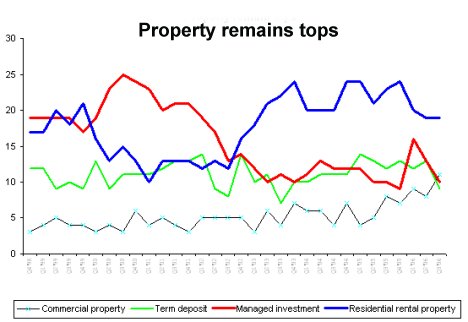

Traditionally residential property investment is the asset class which tops the ASB Investor Confidence survey as the one likely to provide the best returns.

It has remained in the top place in the latest survey and return expectations have stayed steady – with 19% of respondents picking it as the highest returning asset class.

This is despite rising interest rates, a cooler housing market and lower rental yields.

However, term deposits and bank savings accounts, which recorded big increases in recent surveys, have take a hit. They down four percent and one percent respectively.

“It is a real surprise to see drops in confidence with savings and term deposits, given the rates currently available in the market and the continued success of high interest call accounts,” ASB head of investment services Jonathan Beale says. “It will be interesting to see what confidence levels are like in the final quarter of 2006, particularly with residential rental property, given the number of mortgages that will be re-fixed over coming months.”

When splitting investors by region and asking them what investment gives the best return between residential rental property and managed investments, regional variances continue.

The lower North Island shows the biggest single change in sentiment - having been neck and neck for the last few quarters a noticeable gap in confidence by investors in the lower North Island has opened up between residential rental property (a net 20%) and managed investments (a net 12%).

Meanwhile investors continue to have more confidence in residential rental property in the upper North Island and South Island.

“There has been a fair degree of volatility in this measure over previous quarters and, other than a correction by North Island investors in line with the rest of the country, it is difficult to speculate on the cause of this change.”

Overall investor confidence rose in the third quarter, up three points to a net 19%. The main cause for this rise in confidence was people changing their outlook from worse (down from 14% to 12%) to the same (up from 43 to 46%). Those who expected their net return from investments to be better in the next 12 months rose marginally from 30 percent to 31%.

(The dates in the above graph start in Q4'98 and end in Q3'06)

| « Property investors refocus on cash flow | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |