Residential property prices stage spring recovery

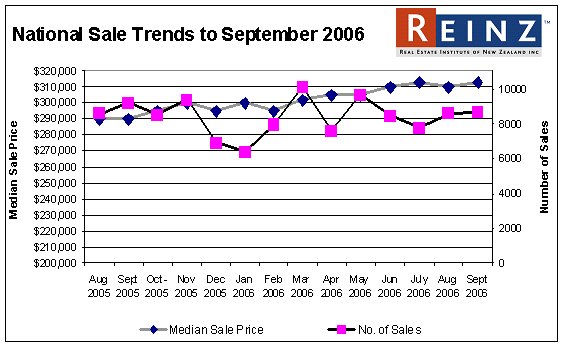

The residential property market’s Spring recovery continued in September with the national median price returning to its previous high of $313,000 recorded in July, according to the Real Estate Institute.

Monday, October 16th 2006, 3:43PM

by The Landlord

The national median has now ‘yo-yoed’ for the past four months, from $310,000 in June, to $313,000 in July, back to $310,000 in August and now returning to $313,000 in September.

“The market is moving in a pretty narrow price band and it would be nice to see it break the habit next month, which is a possibility as historically the market tends to build confidence and strength in the run up towards Christmas”, REINZ president Murray Cleland said.

“One of the biggest threats to the market’s current confidence level will be what the Reserve Bank decides to do on October 26 when it is due to review the Official Cash Rate, and this month's residential statistics certainly won't do anything to dissuade the Reserve Bank if it is considering an increase.”

However, residential property prices were undoubtedly forming a plateau and had been doing so most of the year Cleland said, citing the latest year on year price increase of 7.93%.

“Compare this with the September 2005 year on year percentage increase in the national median price of 16%, and you have to say this is a very different market from even a year ago.

“The inflationary price expectation has gone now and the market is reflecting basic housing demand issues and of course the recent big increases in construction costs which inevitably feed into the price of existing housing stock, as people make that comparison when deciding to build or acquire an existing property.”

Cleland said that while days to sell fell from 33 in August to 31 this month, indicating a more liquid market, this was still well above the 27 days to sell in September 2005 and the September 2003 ten year low of 24 days.

Sales for September were up a little from 8,562 in August to 8,671 in September, although down on the September 2005 figure of 9,186.

Of the 12 real estate regions surveyed, eight regions experienced an increase in medians while four reported decreases, mainly in the South Island.

The Northland median was up from $265,000 in August to $280,000 while Auckland lifted its regional median from $395,000 to $397,500.

The Auckland metropolitan median was up quite strongly from $393,750 in August to $400,000 in September.

Waikato/Bay of Plenty/Gisborne had an increase in median from $285,000 to $287,500 in September while Hawkes Bay was also up from $255,000 in August to $260,000 in the latest month.

Manawatu/Wanganui was up strongly from August’s $200,750 to $210,000 and Taranaki followed suit, up from $240,000 to $250,000.

Wellington lost ground after a relatively strong performance this year with a fall in the median from $335,875 in August to $329,000.

Nelson/Marlborough was up impressively, from $293,000 to $310,000 and Canterbury/Westland increased from $273,250 in August to $278,000 in September.

Central Otago Lakes district median continued to show considerable fluctuations, this month down from $465,000 in August to $441,000, mainly due to sales of lower priced properties in Central Otago and a drop in sales in Queenstown.

The Otago median followed the trend with a dip from $220,000 in August to $216,000 in September while the Southland median slipped back from $149,500 to $140,000.

Manawatu/Wanganui continues to lead the year on year percentage increases table with a 20% increase over September 2005, followed by Nelson/Marlborough on 18.20%, with Taranaki third at 10.98% and Wellington close behind in fourth at 10.96%.

| « Property investors refocus on cash flow | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |