Asian property prices still far below peak levels

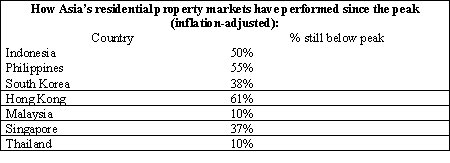

Despite gleaming reports of recovery, Asian house prices are still below their pre-Asian Crisis levels.

Wednesday, December 13th 2006, 12:00AM

by The Landlord

Asia’s real estate markets seem, on the surface, to have recovered from the Asian crisis and to be back on their feet. Most of the world seems to have enjoyed a residential property boom over the past decade – Europe, the US, Australia and New Zealand have seen property prices soar.

But in Asia residential markets have performed poorly once the price rise figures are adjusted for inflation, according to a report released by the Global Property Guide, a research publication and web site providing information about the process and benefits of buying property in any country.

When adjusted for inflation, the happy picture changes remarkably from the good news about property price rises.

The Global Property Guide suggests that a combination of inflation, widespread subsidies of housing markets, political troubles, and overbuilding have made the outcome in Asia quite different from other ‘boom’ markets. Asia’s present apparent property boom is a “construction boom – not a property boom”, it says, warning investors against following the tempting siren song of the real estate professionals.

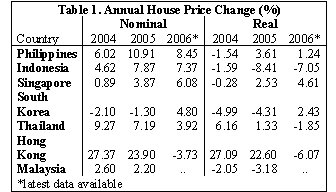

Indonesia, for instance, is having a difficult time battling inflation. Corrected for inflation, Indonesia’s house prices actually fell 8.4% in 2005 and 7% y-o-y during 2Q 2006.

This year’s mild nominal price fall in Hong Kong (3.7%) is amplified by considering inflation. Hong Kong dwelling prices have actually fallen by 6% in real terms.

The (modest) apparent price rises in South Korea, Singapore and the Philippines actually become price falls, or are greatly moderated, once inflation is factored in.

“There have been few less profitable investments than Asian residential property over the past decade,” says Matthew Montagu-Pollock, publisher of the Global Property Guide.

“And if the present construction boom continues across Asia, the next decade isn’t going to be much fun for property investors either.”

He says rental yields are quite high in Indonesia, Thailand and the Philippines, while Asian countries benefit from strong economies. But their real estate markets’ rise has been limited, primarily by government missteps.

“Asian real estate markets would have been stronger had it not been for government mistakes,” says Prince Cruz, chief economist for the Global Property Guide. “If it is not a coup, a protest rally or runaway inflation, then it is government meddling in the housing markets that has killed performance”. Cruz’s study points to the housing markets of Singapore, Hong Kong and South Korea as victims of government subsidies and intervention, while the housing markets of the Philippines, Indonesia and Thailand have suffered from political instability.

| « Property investors refocus on cash flow | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |