Commercial returns out in front

Continuing strong demand for tenants, along with increasing rents and low vacancy numbers are expected to maintain good returns for commercial property investors, despite a predicted softening of returns for the remainder of 2008.

Monday, June 16th 2008, 10:33AM

by The Landlord

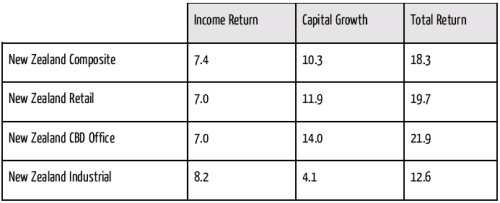

The latest available figures from the Property Council’s IPD Index for the year ending March 2008, show returns of 18.3%, down a little from 19.7% in the previous year, but still well ahead of the bonds returns of just 5.8%.However, commercial property commentators warn that these figures don’t take into account the full effects of the worldwide credit crunch in the first half of this year, with strong returns in the back half of 2007 lessening the impact of the credit crisis in the first quarter of this year.

Despite a predicted softening Connal Townsend, Property Council CEO, says the strong market fundamentals are the culmination of several years of strong economic performance.

“We don’t expect these excellent returns to continue, but we can still have the confidence that the fundamentals for New Zealand’s commercial property markets are sound,” he said.

Alam McMahon, Property Council research chair says, “It is likely that as we progress through 2008, and these robust 2007 data drop off, that capital returns will reduce. However, fundamental tenant demand, illustrated by indicators such as increasing rents and low vacancies, continues to be strong.”

Below are the results for the various investment sectors’ generated returns, for the 12 months ending March 2008:

| « Trust's Chews Lane purchase questioned | Money@Work » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |