Manawatu: Rural riches

The Manawatu region is a major agricultural power, leading in beef production. Located half way between Rotorua and Wellington, the region combines the charm of rural New Zealand with the urban appeal of one of the country’s largest provincial cities – the university city of Palmerston North. Manawatu is also renowned as a science and research centre.

Monday, September 1st 2008, 12:00AM

by The Landlord

Economic development agency, Vision Manawatu, has identified three key areas of growth for the region: bio-industry, integrated education and smart business. Based on international trends, these major economic priorities have substantial potential for growth and of achieving more value-rich jobs.

The tertiary sector, which comprises more than 16% of the city's economy – compared with four% in Wellington – also adds value to the region. Tertiary providers include Massey University, Universal College of Learning (UCOL), International Pacific College (IPC) and Te Wananga o Aotearoa.

Short-term outlook

Yet despite this, Gareth Kiernan of Infometrics says the short-term outlook for Manawatu is pessimistic. The effect of the summer drought has impacted on the sheep industry. Due to shortage of feed more sheep were sent to the works and farmers now have to rebuild stock levels. Meat production will be lower as a result.

Offsetting this is dairy production, which is holding up at good levels. “Meat prices will improve,” says Kiernan. “The exchange rate coming off will help returns. By 2010 a definite improvement will be seen. Growth will be more pronounced in light of what is predicted for New Zealand generally.”

Manawatu has been less sensitive to rising interest rates than some other regions. Lower house prices mean servicing costs don’t rise as much, compared to larger centres.

Petrol prices are predicted to impact on Manawatu, however. Being a provincial area it has fewer public transport options so there is often less choice about using a vehicle. Along with having to meet petrol costs, rising food costs may also negatively affect discretionary spending in the region more than in some other parts of the country where incomes are higher. “Incomes in Manawatu are lower than the national average, certainly below Auckland, Wellington and Christchurch,” says Kiernan. “But in the longer term, the prospect is good. Manawatu is an agricultural area and when incomes increase for farmers, the economy will improve. Spending has a multiplier effect.”

Recent Trends

The economic standard of living in the region, measured by the real GDP Per Capita indicator, increased by 3% last year and has risen by 23% over the last five years.

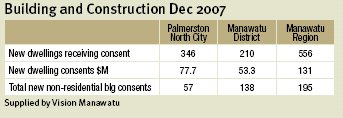

According to Vision Manawatu’s report, the region’s best economic indicator gains over the past year were in relation to new non-residential building construction, retail sales and employment.

Advertised job vacancies in the Manawatu-Wanganui region fell 5% over the year, while unemployment increased by 4.6% following a steady fall over the previous five years.

In December 2007, the rate of unemployment in the Manawatu stood at 4.4%, compared to 4.8% a year earlier.

Industry employment change in the Manawatu last year was strongest for wholesaling, construction and property services.

Population growth

The latest Statistics New Zealand population estimate for the Manawatu region is 107,900, comprising Palmerston North City 78,800 and Manawatu district 29,100. The population of the combined area increased by 400 or 0.4% over the June 2007 year, compared with the 400 or 0.2% fall at the Manawatu-Wanganui regional level and the 1% gain nationally.

Manawatu district's population rose by 100 or 0.4% over the latest year, with Palmerston North's increasing by 300 or 0.4% also.

The region’s population is projected to increase by 18,600 or 17.3% over the 2006-2031 Censal period.

Property market

Gareth Kiernan says residential property sales have fallen roughly in line with the national drop of 40-50% drop compared to a year ago, and the drop in sales activity is now being translated into lower sales prices. “These price falls are coming through after a strong period of growth. Up to now, people haven’t been forced to sell, but the emergence of price falls may be a sign that the pressure to sell is starting to increase.”

Kiernan expects Manawatu to experience price falls of 10% over the coming year in line with that of rest of country. The region will not be under as much pressure as neighbouring Wanganui though, which has experienced a much bigger building boom over last four years. Manawatu has a broad based economy with a strong rural influence, plus education, which is a staple for Palmerston North’s economy. As the labour market softens, Kiernan predicts an increase in people seeking tertiary education. This will positively affect the Palmerston North economy and demand for rental accommodation, which will feed through into the local property market.

With consumer confidence knocked by increasing interest rates, fuel and food prices, the widespread trend of falling property values is expected to continue to fall. “Manawatu is similar to most other parts of New Zealand with buyers generally holding off making a decision to purchase,” says Mark Dow, QV Valuations national operations manager.

Some buyers appear to be waiting for vendors to come under pressure so that they can, in turn, put pressure on to reduce prices.

Manawatu has not seen a dramatic change in the number of mortgage sales, but there are more properties advertised as, ‘bank says sell.’ While these are not strictly mortgagee sales, it does show the pressure is coming on from lenders.

Dow says spec builders have been seriously affected by the current market. “The number of new homes under construction has dropped dramatically. There are very few, if any, spec homes being started. There are a few that are in the process of construction where a commitment to construction occurred prior to the down-turn.”

The number of sales of vacant sections has dropped, but as yet, QV Valuations has not seen too much evidence of section prices dropping. “With lower demand, we would expect pressure to come on prices,” Dow says.

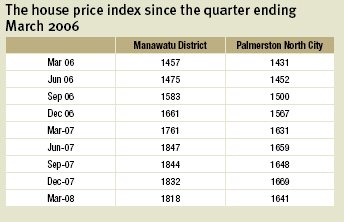

QV’s latest quarterly residential property statistics publication for the quarter ending March 2008 show current property values for the Manawatu area, including Palmerston North city and Manawatu district, have grown steadily over the last few years. The publication reports changes in the QV House Price Index. “This index is a representation of the value of properties in each area, and is independent of the properties that happen to be selling at that time,” says PropertyIQ marketing manager, Jonno Ingerson.

“If a higher proportion of low-end or high-end properties are selling then that can skew average and median price.”

The statistics show growth in value for both areas through until June 07 when values began flattening and/or declining. Percentage changes in the index represent percentage changes in house values. For example, if the index went from 1000 to 2000, then the values have doubled. “So the change in values in Palmerston North from March 06 (1457) to March 07 was 21%. However, since the December 07 quarter values have declined 1.7%. Manawatu values have declined 0.8% over that same period,” says Ingersen.

PropertyIQ’s slightly different RPM method compares year on year values. Those numbers show that year on year Palmerston North has declined 1.5% since the same time last year, and Manawatu has grown 1.1% since the same time last year.

Ingersen says that in terms of the actual property values, PropertyIQ can approximate that from average sales price, though this can be skewed by certain ends of the market being accurate. “However, the average sales price in Palmerston North over the last year has fluctuated around the $300,000 mark, with our latest release putting the average sales price at $291,950 for Palmerston North, and Manawatu generally at around the $230,000-$240,000 mark with the latest average sales price at $245,306.”

The volume of sales in Palmerston North was relatively stable during 2006 at between 200-250 sales per month. A peak occurred in February 2007 of 271 sales followed by a steady decline and over the last few months the volume of sales has been around 110 per month. The trend in volumes of sales was very similar for Manawatu, with a peak of around 90 sales in February 2007 declining to around the mid-thirties for the last few months.

Housing sector

Vision Manawatu’s regional economic report recorded a fall in new dwelling construction last year by some 3.3% in volume terms and 6.4% in value terms. The total volume of new commercial building increased by 10.2%. Total new construction activity fell by 2.1% in volume terms and by 8% in value terms over the year.

Rental market

Long-time investor and former president of the Manawatu Property Investors Association, Dennis Dickinson, likens the current property market to a rudderless ship. He says that where previously there had been a lot of residential building, many houses are now for sale, many of which have been on the market for quite some time. “It appears the people who can’t sell their homes are renting them. There’s a lot of stock on the market, including silent listings. Sales volumes have dropped dramatically. It’s a very slow market. But the drop is comparable to other centres.”

He says real estate agents are reporting that people are putting in ridiculous offers hoping to buy from desperate sellers. “A heck of a lot of buyers are hoping that prices will drop further.”

Dickinson predicts that a lot of investors will be hurting when their fixed rate mortgages come up for renewal and they face a 2% hike in interest rates. “People who have not been in the property market long-term are getting nervous. The increase in rents over the past 5-7 years hasn’t kept pace with property prices. As a result the actual rates of return on investments have been drastically cut.”

Given today’s market, renting rather than buying, is an attractive option. According to figures released by Property Investors Federation vice-president, Andrew King, a 25-year mortgage for 90% of the cost of the country's median-priced house, worth $345,000 last month, would currently cost a new home-buyer $745 a week, including rates, maintenance, insurance and an allowance for other costs. By contrast, the national median rent last month was only $305 a week.

A $250,000 three bedroom house in Manawatu, serviced at a 9% interest rate, would incur $22,500 in interest-only repayments per year, not withstanding other outgoings. That same house, rented at $300 per week, would only cost $15,600 per annum.

The ratio of mortgage costs to rents is higher in New Zealand than in five similar countries, and buying a house now is almost two and a half times as expensive as renting.

Kathryn McEldowney, director of Property Management for LJ Hooker Palmerston North, says a large amount of rental stock available is currently available, more than this time last year. “This obviously results in the tenants having a lot more choice in the

property they live in.”

The company reports that tenants are becoming much more selective and have higher standards. With increases in fuel and the cost of living, tenants are appraising homes in view of insulation, types of heating, dvs systems, situation for sun, and so on. “Well maintained properties will always be in demand especially in good locations,” says McEldowney. “It is becoming increasingly important to keep properties maintained and well presented.”

To secure good tenants and retain them, landlord needs to consider the ‘tenant friendliness’ of the property. This will minimize their downtime and increase their chance of gaining maximum rent. McEldowney says tenants will move on, and quickly, if they find a home isn't meeting their needs. Tenants will no longer put up with sub-standard housing.

The best areas to buy investment properties are in the Palmerston North Boys’ and Girls’ High School zonings, as well as new areas such as Savannah with its modern, warmer, low-maintenance homes.

McEldowney stresses that landlords consider the package a property offers. “We are finding overall rents have moved since this time last year and are holding currently. We have seen some landlords who are perhaps not considering these issues having to drop their rent to secure tenants.”

Palmerston North is a popular location to settle, especially among English and South African immigrants. Some major businesses and organisations, including Fonterra, Toyota and Massey University, are located there, along with NZ Army and Air Force bases. “This provides us with an excellent base of clients and prospective tenant pool,” says McEldowney. “The outlook is always good for property investors looking to buy here. Palmerston North is a fantastic consistent market to buy in.”

| « Hamilton: Dabbling in the river city | Nelson: Under the sun » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |