Manukau City: Face of the future

This young and diverse city is going places – fast. The Manukau City Council has exciting ventures planned that could well see property investors very happy in the not-too-distant future

Wednesday, February 25th 2009, 12:39PM

by The Landlord

Manukau City is the country’s third largest city. It’s also the fastest growing.

The 2006 census put the population at 328,968 – up 16.2% on the previous census in 2001. (Statistics NZ last year estimated it to be 354,700). It’s also a diverse geographic area which covers 55,200 hectares, including rural and urban areas, and extends from the Manukau Harbour in the west across to the Waitemata and Firth of Thames in the east.

Rex de Bettancor knows Manukau City well. It’s been his patch for the past 18 years and, as principal of Quinovic-Newton, he says it’s one of the most diverse in terms of the challenges the company faces as property managers.

“We’ve just let one home in the Howick area for $1,100 a week. And at the other end of the scale we manage properties in Clendon at $190 a week.”

While the affluent lifestylers in Clevedon, and the folk in Otara and Mangere may only have a mayor in common, the city is proud of its diversity and the 165 different ethnic groups which make up the population.

Manukau City Council is focused on the future, with the development of new commercial and industrial areas such as Highbrook, East Tamaki and the area surrounding the airport. “They’re beating other councils hands down by making it simpler for developers”, says de Bettancor.

Manukau aims to be a user-friendly, can-do council, says Councillor Arthur Anae. “We’re the council with the land available and we want to see Manukau become the biggest city in New Zealand, the best developed and the most modern.” Redevelopment of the old commercial and industrial areas will also be an important aspect of the city’s growth.

The Council is also a strong supporter of Flat Bush, ‘New Zealand’s newest town’, which is taking shape across 1,700 hectares in the City’s south-east and will be home to at least 40,000 people by 2020. A town centre is to be built but Flat Bush will also have five smaller neighbourhood centres and feature a mix of housing densities.

Other initiatives that could see an influx of people into the city include the establishment by the Counties Manukau District Health Board, one of the City’s largest employers, of a Centre for Health Services Innovation, which will educate the extra 800 to 1,000 new health professionals they see as essential to coping with the population growth.

People are continuing to head into Manukau City to live and work; that’s good news for property investors, says Jeff Brill, principal Rental Homes. “Long term, I believe Manukau has better growth prospects than anywhere else in Auckland.”

Right now though, the property market in Manukau City is subject to the same challenges as the rest of the country. Brill, however, is philosophical. “It’s the way it is,” he says. And, while some investors are bailing, those who are in it for the long term are sticking it out, he says.

He reports members at a recent Property Investors’ Association meeting were keen to learn about new investment possibilities. “They’ll start coming out of the woodwork once interest rates drop again.” Just give it time, he says.

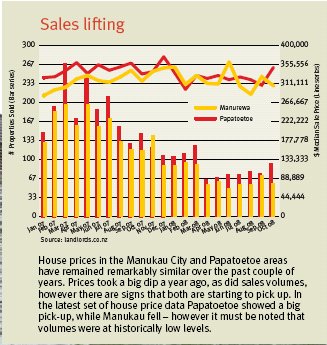

A year ago suburbs like Manurewa and Papatoetoe were investor magnets. Prices had rocketed, albeit from a low base, with Manurewa showing rises of as much as 76% over the previous four years and a median of $342,000 – still very affordable for investors. Median price in Papatoetoe was $359,000.

By September this year, the Manurewa median was $327,000 and sales had dropped from the previous year’s 119 to just 73. In Papatoetoe the September median was $307,500 with a 40% variance in sales.

In light of interest rate falls, these may seem like bargains but banks are tightening their criteria, says David Whitburn of property development company Fuzo. “The fall in interest rates is a good news story and we should see rates continue to drop into next year. The bad news is that lending criteria is being tightened. Some will now only lend 70% on investment property, except in certain circumstances.”

He predicts this will continue into next year. “Investors need to look at making sure their properties stay tenanted and that they’ve covered their risks – you wouldn’t want to not have fire insurance on a property.”

And he says, while business was slower over the winter months, investors in Manukau City are still interested in improvements to properties.

September’s sorry sales figures have been well documented. The beginning of spring and what many hoped would see an upturn in the market, produced more winter woes. Preliminary reports indicate an even more woeful October.

But there’s movement in the middle of the market, says Levani Lumon from Ray White’s Manukau office, with properties in the $250,000 to $400,000 bracket selling, mainly to buyers moving on from their first home, he says.

The action is at auction, says Lumon. “We did no auctions last year. In September this year we did 19 on one day – nine sold under the hammer and four more sold after.”

The company also had a huge one-day auction featuring around 100 properties scheduled for the end of November. And there are bargains to be had; in October sales at auction saw properties selling at 10% to 15% below valuation, he says.

Commenting on the low volume of sales in September, QV’s Glenda Whitehead said this had seen many vendors opting to rent rather than sell. The flow-on effect – an increase in the number of properties available for rent – was particularly noticeable in areas like Manukau City, she said.

“This over-supply is causing some landlords to drop rents in order to occupy their properties.

Anecdotal evidence indicates that potential tenants have the luxury of choice in the market and properties that are not presented in top condition are left vacant for longer.”

Feedback also suggests with prices currently being achieved, many property investors can’t see any sense in selling, says Whitehead. “Indications are they’re sitting on their investments and waiting for the predicted interest rate declines.”

Graham Viall, principal at Harcourts, with offices across south and east Auckland and Manukau, believes “Investors are largely absent from the Manukau City market and only a few first home buyers are playing their hands.”

He says in the past investors had been happy to take a poor return, as capital gain largely overrode the return. “However, with no capital gain foreseeable in the near future, it’s all about percentage returns. This can be seen at most auctions and mortgagee sales of investment-type properties where the price offered is worked out with a calculator not the heart, and with absolutely no regard to previous values.”

Those smart enough to buy are looking for quality, he says, which means poorer quality stock in the older suburbs such as Manurewa West, Papatoetoe North, Mangere and Otara which have been particularly hard hit.

“These properties were the only ones that came close to giving a good return in the past, however, any buyer for one now, is expecting and receiving a bargain, knowing first home buyers are simply not interested in do-ups. The downside to buying cheap is that right now there is an oversupply of rental accommodation and therefore a poor chance of attracting a tenant, let alone a good one.”

The best investments in Manukau City are those selling in the mid-range – under $400,000, says de Bettancor. “You can rent for around $400 to $500 a week and that equates to a return of around 6%. That’s where the investors are focusing. This makes Manukau still very attractive to investors.” Indeed, well-presented homes in Manukau City – including those in the suburbs mentioned above, are still seeing good foot traffic and appear to be attaining fair sale prices, says Viall. “There is absolutely no reason to believe this rental property mecca won’t continue to provide stunning returns for its owners in the near future – as it has in the past.”

The Rent Shop, which recently relocated from Papatoetoe to Botany Downs, manages around 1,100 properties in Manukau City, says principal Warwick James.

He believes the current market offers the good operators some great opportunities. “With prices having come back substantially there’s the opportunity to get a very good cash flow from a lower capital outlay,” he says. “If they’re looking for a rate of return and of course, subsequent capital growth, they can own a standalone, three-bedroom home, with a garage, on its own independent section for under $300,000 in Manukau City.

“With rents at around $300 a week, the return compares more than favourably with alternatives like inner city apartments.” And, he says, as landlord, you’re not dictated to by a body corporate and having to pay the associated costs.

James identifies two areas as worthy of investor interest. “Otara, which is bound by the new Highbrook development and will see a lot of new business coming, and Mangere, where you’ve got the new airport runway, and a progressive commercial infrastructure that will create a strong demand for housing.” He says new homes being built in Otara are better quality and more expensive which is ‘dragging through’ the cheaper properties in the area.

Viall pinpoints the Botany to Flat Bush area as having a great medium to long-term outlook for investors. “There’s an excellent range available with some being sold at below replacement cost or at bail-out prices and with a whole new city being built at Flat Bush it’s impossible to believe its neighbours won’t be taken along for the ride. I think the future for this area looks very bright indeed.”

Lumon, who has a significant property portfolio in Manukau City, identified Otara almost three years ago, he says. Located in the triangle between Highbrook, Dannemora and Manukau City centre, it’s also handy to Otahuhu and Papatoetoe, “strong growth areas in their own right”, and has easy motorway access. “A lot of properties are former state houses in brick and tile or weatherboard and tile, on good sized sections.”

Lumon is an investor who’s still buying. “There’s a lot out there and I’m purchasing at mortgagee sales. But I’m not buying to hold. My main game at the moment is to trade and keep the bank happy.”

Brill also invests in Manukau City, but admits that he’s taking a very conservative approach right now. Indeed, there are a lot of people sitting back, he says. “Those with equity in property are being careful. They’re not jumping in like they used to.”

And, he says there’s a shift from mum and dad investors to professionals. “They’re even coming in from overseas and investing in residential property.” de Bettancor calls it a ‘sea change’ that’s become apparent over the past couple of years. “Why would you invest in property at 5% return when leaving money in the bank will return 8%?”

But if mum and dad aren’t going to buy property, what’s the alternative, asks James? “Everyone will get their feet back on the ground and you can’t beat buying your own investment property. That’s where I think Manukau City, in particular, provides an opportunity for investors.”

Dean Letfus has a number of properties in Manukau City. He sees the area as having several distinctly separate identities; the troubled areas in what’s widely referred to as South Auckland, through the white, middle-class eastern suburbs to the million dollar-plus Manukau Heights area. “It’s four or five cities in one,” he says.

“Manukau has a strong rental demand which is good for buy and hold. But there are many parts I wouldn’t invest in. The eastern suburbs – Howick and Pakuranga – offer exceptional opportunities due to their proximity to the beaches and high-decile schooling which creates good capital growth prospects.”

The real money, says Letfus, is in the capital growth and equity on purchase. “The rent is just what it is.” If you invest for yield you’re in the wrong game, he says. “You’ll never get wealthy through $20 or $50 a week on property.”

Property investment in Manukau City has enabled one local couple to achieve their dream – a motor home in which they plan to travel around New Zealand.

A surprise inheritance about 18 years ago enabled them to invest in a home on a large section in Mangere East. “We retained and rented out the house, cross leased and sold the back half of the section, recouping our deposit after all expenses had been paid. With the money from the section we purchased another property and it went from there.”

They currently own four properties (having sold one and purchased the motor home) which they manage themselves, using their combined skills in finance, management and plumbing.

“We’ve purchased well in middle to low socio-economic areas of Papatoetoe, Mangere East and Manurewa, and our tenants to date have been extremely good. Only one did a runner owing four weeks’ rent.” (They actually have a professional rental company do the initial vetting of tenants).

Massey University’s residential Rental Market Report for September showed the median rental for a three-bedroom home in Manukau City at $350 a week – up $10 from the May median.

But Real Estate Institute figures (Sept 08) for various suburbs within Manukau City, highlight the difference a few kilometres can make. In the eastern suburbs of Howick, Bucklands Beach and Botany, the median for a three-bedroom home was $430 – up 8% over the previous year. Pakuranga was unchanged at $400, Papatoetoe showed a decrease of 1% to a median of $355, and in Manurewa, an increase of 4% lifted the median to $330.

Crockers Market Research for October suggested Manukau City has shown a turnaround in returns on rental properties over recent months, rebounding off the lows of the end of last year. The report highlighted Papatoetoe as delivering significant returns with both higher rentals and average median sales prices saying that clearly the lower prices are delivering opportunities for investors looking for good returns.

Opinion seems to be divided on whether or not there’s an over-supply of rental property in Manukau City.

James says they’ve yet to see it. “Rents actually rose at the start of the year and while they’ve since softened a little, they’ve held up quite well. With mortgage costs starting to go back down, landlord investors are getting some balance.” He says they’ve definitely noticed less movement in rental properties. “Occupancy is being maintained at a very high rate – our vacancy rate is very low. People are less inclined to move about.”

But Viall reports supply and demand has left some newer locations with a modest over-supply problem. “This is placing downward pressure on some prices but I’m sure this will disappear very quickly once the turn commences.”

And he says stay alert. “Studies have shown that recoveries in the real estate market are particularly rapid at the turn and bargain buys disappear overnight.”

Losses in value during previous property downturns have been recovered within 12 months of the recovery commencing, says Viall. “With the shortage of housing Auckland is expected to experience in the second half of next year, I personally believe those prudent enough to buy a good quality home or two now, are likely to be looking back in 12 months, very pleased with themselves.”

| « Tauranga: Bargains in the bay | Regional review: Prospecting Rodney » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |