Wellington looking for more listings

Some agents in Wellington are saying they can't get enough property listings for the level of enquiry they are receiving, although that is not having an impact on values.

Thursday, October 7th 2010, 3:02PM  1 Comment

1 Comment

by The Landlord

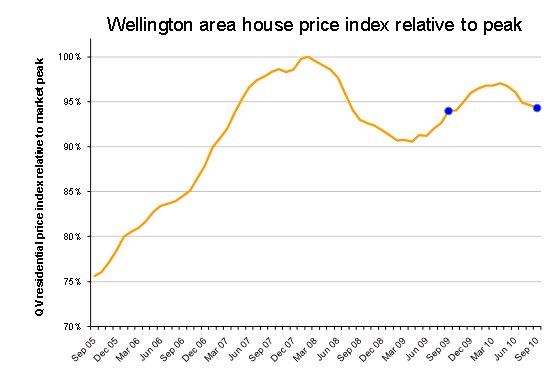

QV's Residential Price Index for September shows that property values in the Wellington region have continued to decrease, by 2.6% since March this year. In contrast, values increased by 3% in the seven months to March.

Consequently, values now sit 0.3% above the same time last year, but 5.7% below the market peak of early 2008 as the graph below illustrates:

Pieter Geill of QV Valuations said; "Residential property values in greater Wellington have been gradually falling over the last few months. The market is generally characterised by low volumes of sales and a lack of pressure on buyers to commit to the sale process. As such, some believe it is a good time to buy".

"September has continued in much the same way. However, a number our clients are saying that they can't find a suitable property to buy, and are consequently holding off from buying or selling. Similarly, some agents are saying that they can't get enough listings for the level of enquiry they are receiving and would love to have more listings. Interestingly, this shortage of stock is not having the affect of holding up values, as it did in winter 2009. Conversely, values have still been sliding, highlighting the recent lack of drive from buyers," Geill said.

"Our registered valuers have noticed less valuation work coming from home buyers, and more work coming from people who are upgrading their existing homes. This indicates that some home owners are more concerned with paying off debt rather than trading-up the property ladder. This is essentially limiting the available stock for sale and could exacerbate the current situation.

"We are however also working for some clients who are preparing their properties for sale, as is traditional for spring. It will take some time for these homes to come to market, which could lead to a later than normal spring resurgence. There are early signs that listing numbers are rising and we expect this to continue as the weather improves," Geill said.

The average sales price for the Wellington region in September was $453,023.

| « Momentum building in house market, according to ANZ | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

Comments from our readers

Commenting is closed

| Printable version | Email to a friend |