Partners Life beats its own targets

Partners Life says its sales volumes have exceeded its own forecasts and it now holds the number one position for new business written.

Wednesday, December 12th 2018, 9:00AM

Partners Life CFO Sean Kam

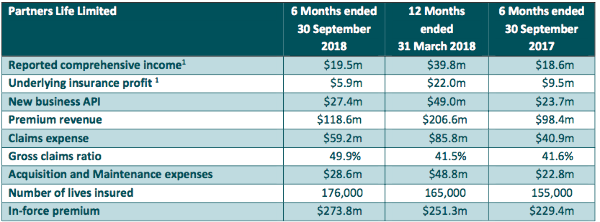

The company has reported underlying insurance profit of $5.9 million in the six months to September 30. This is 38% lower than in the comparable period last year when it reported a profit of $9.5 million

Chief financial officer Sean Kam says this was due to "some short‐term claims volatility".

During the period it paid out $59.2 million in claims compared to $40.9 million last year. The gross claims ratio was 49.9% in the six-months to September.

Overall, Partners Life has paid out $328 million in claims since inception.

Kam says growth was "surging ahead on its own sales and growth metrics against an external reduction in overall market sales."

This activity has converted to new business annual premium income issued for the six months of $27.4 million, up 16% on the $23.7 million for the previous interim period.

"This growth is exceptional against the backdrop of sales across the entire market being down from the previous interim period. The quarterly market share for September 2018 reflected this, with Partners Life achieving the number one new business market share for the individual risk market, its highest‐ever new business market share."

Comprehensive income for the six months was $19.5 million, compared to $18.6 million for the previous period. This included $1.3 million of one‐off expenses relating to merger and acquisition diligence activities.

Partners Life continues to maintain a strong solvency ratio; at 30 September 2018 this was 137% with a solvency margin of $106 million.

"The company has continued to deliver regular new initiatives and provide increased customer value while supporting advisers with their processes and managing upcoming regulatory changes," Kam says.

| « Old approach won't always stack up | Mixed reviews from advisers on FMA regulation » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |