PE of 1

The holy grail of investing

Tuesday, May 21st 2019, 7:00AM

by Castle Point Funds Management

When investors buy shares in a company, they have purchased the right to a portion of that company’s future earnings. Past earnings are largely irrelevant in determining whether investors have a good or bad experience. The most important driver of returns is future earnings. Clearly the future is highly uncertain, which is the reason why the share market can be a highly volatile place.

The cocktail of uncertainty and human reaction to that uncertainty can cause severe share market fluctuations. There is no hiding place from that volatility, blue chips are just as prone to it as micro-caps. For example, Amazon fell thirty five percent during the recent and volatile December quarter.

In our opinion, the best and only reliable defence against equity price volatility is to obtain a considerable amount of earnings for the price paid. For example, buying a company that makes a profit of $10m for a price of $10m. This is effectively buying a company on a price to earnings ratio (PE) of 1.

In one year an investor gets 100% of the purchase price back in earnings. This is an extraordinarily quick pay back and gives the investor the opportunity to make very considerable profits if the company can generate more years of $10m. While it’s easy to understand why an investor would jump at such an opportunity, it’s a little harder to imagine why anyone would sell at such a low price. Even the share market at its most capricious struggles to offer up such opportunities. But hopefully this example gives a clear sense of the importance and attractiveness of getting a lot of earnings for the price paid.

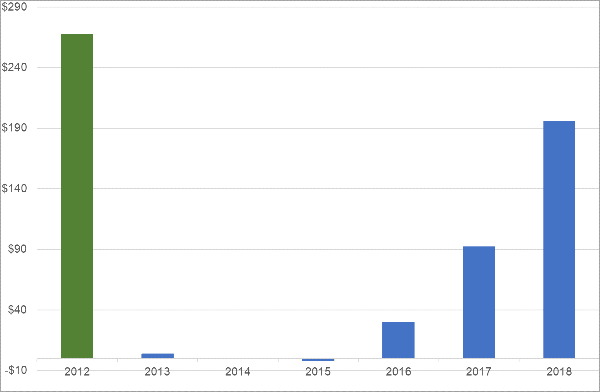

Let’s take the example a bit further and say that the investor is offered the chance to buy a company for $10m today that could grow earnings over the next 5 years to $10m. Essentially this would be buying on a future PE of 1. While not as good as a current PE of 1 this will almost certainly turn out to be a great investment, nonetheless. For exactly how good this could be let’s look at what happened with A2 Milk Company over the past five years. The chart below shows that an investor in June 2012 could have bought A2 for 45c which valued the business at around $260 million. The blue bars represent the earnings that the investor was entitled to a portion of in subsequent years.

The initial three years yielded little in the way of earnings for the 2012 investor into A2 Milk. The company was pursuing several growth opportunities that required investment. However, any level of success in the UK or the USA or China represented the potential for considerable earnings in the future. Ultimately the Chinese infant milk formula market proved to be a total bonanza for A2 Milk and earnings were significant, so much so that within six years the 2012 investor got the entire initial investment, and then some, back in earnings. Those investors made over thirty four times their money – the power of buying on a very low price to earnings.

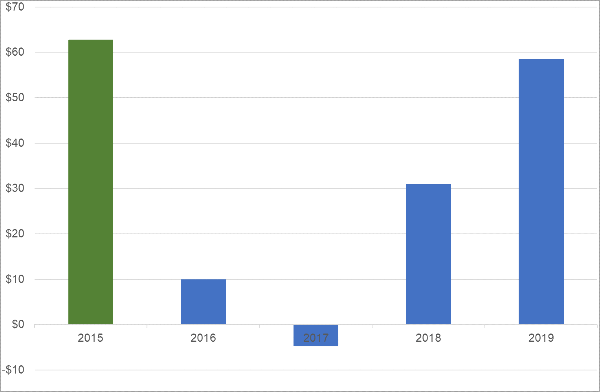

The A2 Milk story is not the only example of getting considerable earnings for the price paid. Back in 2015, MacMahon Holdings, a mining services business, was struggling badly to adjust to the resources downturn and was at that point a loss-making business and priced accordingly. The chart below shows that in early 2015 when the price was 5c, an investor was effectively buying the entire company at a price of $60 million. The blue bars represent the earnings they were entitled to in subsequent years.

Again, in a very similar profile to A2 Milk, 2015 investors into MacMahon had to have some patience as initial earnings were modest at best but looking longer term there were significant earnings to come. Unlike A2 Milk this company was an earnings recovery situation but like A2 Milk, investors in MacMahon were well rewarded for buying on a very low price to earnings, they made four times their money over the course of four years.

A2 Milk and MacMahon are recent real-world examples of the benefit of buying on a very low price to earnings but they are the exception, not the rule. The bulk of the market offers far less earnings for the price paid. Indeed, right now most of the New Zealand share market is offering less earnings than ever before. Take the example of Auckland Airport, currently it is trading above a price that takes over 30 years of earnings to recoup.

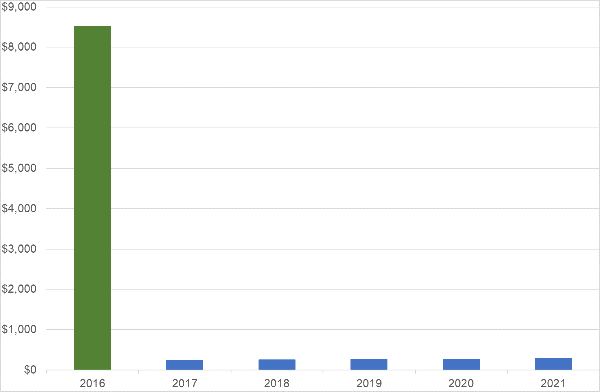

At Castle Point we consider ourselves long-term investors, but even we can’t get our heads around needing a 30-year investment horizon to justify a share price. There is long-term and there is just plain silly-term. The chart below shows the price to earnings equation for investors that purchased Auckland Airport in 2015 for $7 a share, or a value of around $8.5 billion for the entire company. The blue bars represent the earnings that they were then entitled to a portion of for the next five years.

The picture above clearly shows that the earnings that investors receive are nowhere near to paying back the initial investment. Interestingly paying over thirty years’ earnings has distorted the axis to the point that the 9% growth in earnings over the five years, that Auckland Airport is delivering and expected to deliver, can barely be discerned. In fact, the return profile is more akin to that which a bond investor would expect to receive. As an aside, this must be how the bulk of Auckland Airport shareholders see any value at current levels, as the dividend yield exceeds the interest currently paid by investment grade bonds.

The problem with holding equity as a “bond proxy” is that future earnings and dividends are uncertain relative to coupon payments. Any small short-term blip in earnings can have a dramatic impact on the share price as investors are reminded that future earnings are uncertain. Combine that with human emotions (upset and disappointment) and the result can be significant volatility.

Of course, this is only our opinion, not to be taken as a recommendation on what investors should do if they own Auckland Airport shares. The market’s willingness to support what seems for us to be unrealistic valuations can persist for years.

And while we understand that few companies can be purchased on future PE of 1, it is a Holy Grail that can be found by a patient and selective investor.

| « More bright spots emerge | Asset allocation: Modern Portfolio Theory v Behavioural Finance » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |