KiwiSaver members want online research, not advice; New player says

KiwiSaver newcomer, kōura, says most people would prefer online research to an adviser when it comes to making investment decisions.

Tuesday, October 8th 2019, 5:51AM  2 Comments

2 Comments

The scheme set up by Rupert Carlyon and backed by Warren Couillault and Hobson Wealth, is pitching itself as a roboadvice platform using passive funds.

“Digital advice is a very popular proposition overseas and we are excited to be able to launch a truly consumer focused digital adviser in New Zealand,” Carlyon says.

The firm says the majority of KiwiSaver members are in the wrong funds and that the biggest issue is a lack of advice.

Instead of using advisers to solve this issue, kōura plans to solve it using technology.

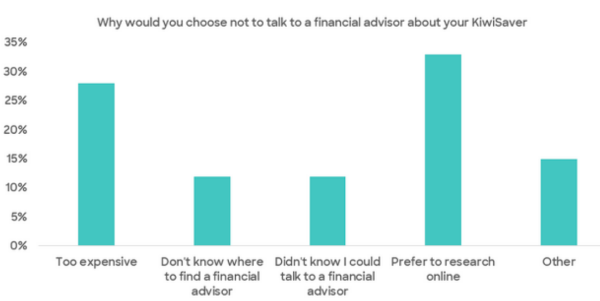

“In the 12 years since KiwiSaver has been operating, the focus has been on encouraging customers to sign up to KiwiSaver, rather than focusing on ensuring the right outcomes for customers. Advice and help is really hard to come by. Financial advisors are seen as out of reach for most people and our research shows most would prefer online research to an adviser in any event."

“We strongly believe that free digital advice will play a key role in improving the financial literacy of KiwiSaver members and help them make meaningful informed choices that are in their own interest.”

"kōura offers investors six separate passive investment funds providing investors an exposure to more than 45 global markets and more than 3,000 companies. Rather than offering the traditional Growth, Balanced and Conservative funds, kōura creates a personalised portfolio that’s tailored directly to the customer’s life stage and financial goals."

This is the third KiwiSaver Scheme that Warren Couillault has established, the previous two schemes being the Fisher Funds and Generate KiwiSaver Schemes.

“All of the KiwiSaver schemes I’ve been part of have been an evolution to what’s already in the marketplace, providing something more advanced,” says Couillault. “kōura is the same. We’re bringing technology into the KiwiSaver space – helping make sure that all kiwis maximise their KiwiSavers’ potential. Hobson Wealth Partners (which has a shareholding in koura and provides various support services) is excited to be a part of this journey as we believe in the value of advice."

"Helping people achieve better financial outcomes is what we stand for at Hobson Wealth so kōura is a perfect fit for us.”

update their goals and objectives

| « Code Committee: We've thought about what could have been better | Mann on a mission to diversify financial advice » |

Special Offers

Comments from our readers

The one's that move with me would not have addressed their default positions if they had not had someone take them through it directly. They would have never decided to seek advice on the basis they don't know what they don't know.

To be fair I've only transferred those that have made a reasonable choice on the structure needed and they have wanted to use the provider I work with. The right structure over the provider being the guiding reason for change and the person in front of them is going to help.

Which has been the FMA stance, a member in the right structure is better over a member in the best fund manager. They’ll do better than the default unconscious position they started in.

And for the purists yes, they could be improved from there. Though a client with a few thousand in the account is less likely to seek and pay for advice than one with a few tens of thousands in their accounts.

What has been interesting is once the funds get to a certain value I do get requests for planning, which I do refer on to AFAs. Which I would suggest is the more likely evolution as fund values increase.

The research also suggests the reasons for the finance company issues are still alive and well, as unadvised clients were the primary victims of that debacle.

So the better answer is advisers empowered with research to assist clients with their choice as a better approach. And under the new rules, this is where it is going with the full advice requirements on advisers going forward.

Being a RFA I'm also limited in what I can do outside of explaining how Kiwisaver works and this is the provider I use, I cannot provide comparison, I cannot provide research, as that triggers personal advice with their current provider.

The majority that have had existing advice on structure stayed where they are, which is what should happen in a class advice situation with undereducated client's.

So the new rules are going to make this space more interesting, potentially more difficult to access an adviser directly in the early stages until RFA’s sort out what they can, and can't do, with licensing.

@mike and his email, maybe you need to consider that the adviser concerned hasn't been paid as well as you think. Most Kiwisaver trails to the adviser barely cover a letter and a stamp, and the ongoing trail is somewhat covering the initial advice bill.

That's not to say your experience of no service is acceptable, it's not. There should be far more contact than you have experienced. Though too, the scope of service/terms of engagement you have in place may specifically state no ongoing service. I would be surprised if it did and I would be surprised if it was in place if this transaction was dated prior to 2011.

However, I'm going to resist sending you an email offering a review, as that would be a commercial offer under the spam act and illegal. You may want to change your handle to remove your email address here too...

But if you do want to discuss things, I’m happy to assist, you’ll find my details above under the insurance tab...

Sign In to add your comment

| Printable version | Email to a friend |