NZ equity returns for the next decade?

Jamie Young looks at the above normal returns achieved in 2019, how the market has been tracking since 2005 and what that could mean for 2020 and beyond.

Wednesday, January 22nd 2020, 5:59AM

by Castle Point Funds Management

By: Jamie Young

The New Zealand Equity Market had a stellar 2019, up over 30%, so we revisited our NZ equity return estimates to see how the outlook might have changed.

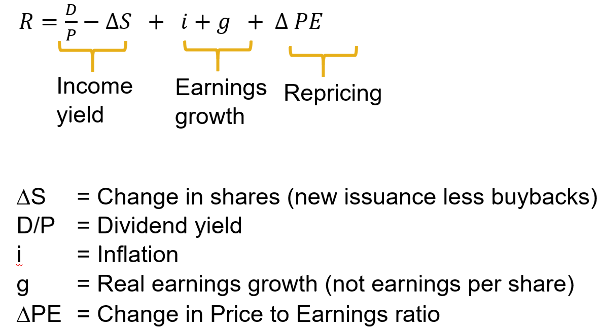

We use the Grinold and Kroner model to break down future returns based on the following equation:

Our return estimates below are “real” returns, the net return after inflation. If you would like a nominal return (including inflation) simply add on your desired inflation number.

Since last year, the dividend yield of the New Zealand equity market has fallen to 3.1%. Real earnings growth and share capital assumptions are pretty much unchanged.

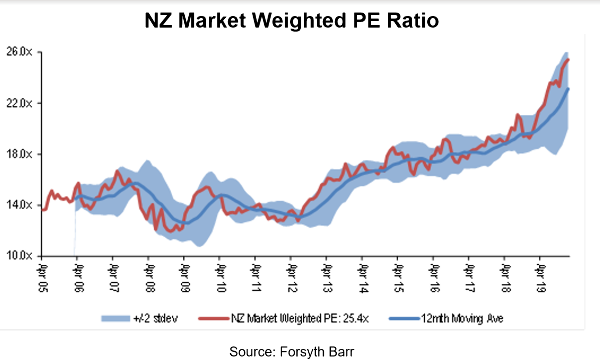

The biggest change is due to the strong performance of the equity market, which has stretched the forward PE ratio for NZX index to 25.4x. This may be a record for the local market. The average since 2005 is 16.2 and if you had data for a much longer period it would likely be a bit lower still.

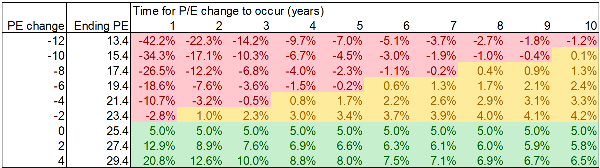

The following table allows the reader to pick an ending PE ratio and a timeframe for the change to occur to get the annual real return over that period. For example, if you think the PE ratio will drop by eight points to 17.4 (still above the long-term average) over seven years you get annual real return of -0.2%.

The shaded red real returns are less than 0%. Yellow is between 0% and 5%. Green is a real return above 5% per annum.

This is not to say we can’t have another strong year in 2020 for NZ equities, but each additional year of above normal returns makes any return to a more “normalised” PE more painful.

Jamie Young is a co-founder of Castle Point. The above commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

| « Downside risks reduced | No room for complacency in 2020 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |