Is your KiwiSaver manager diversified?

Michael Lang looks at KiwiSaver asset allocation and discusses the benefits of diversification.

Monday, March 9th 2020, 8:00AM

by Michael Lang

Michael Lang

Over the last decade New Zealand shares outperformed global shares by 120%. New Zealand shares now trade at a premium to their global counterparts.

Whether your KiwiSaver manager favours local shares over international ones has been an important determinant of historic relative performance, and if history is any guide, it is likely to continue to be so. Despite this there is a paucity of research on local managers’ asset allocation.

WHY DO MANAGERS FAVOUR LOCAL SHARES?

The basic problem is something called home bias. Investors and managers the world over prefer companies that are listed on their home exchange. These companies follow local laws and regulations, report and are reported on locally, and raise capital and hold AGMs locally. They are therefore easier to follow than their international counterparts.

In some countries a home bias is more than the warm fuzzies. In New Zealand for instance, the tax regime provides advantages for local investment. For example, Australasian shares are not taxed on capital gains and New Zealand shares enjoy the benefit of imputation credits, removing the potential for double taxation on company distributions. Outperformance during the most recent decade has not hurt allocations either.

WHY OWN INTERNATIONAL SHARES?

Despite this, there are compelling reasons to be globally diversified. It rarely makes sense to put all your retirement eggs in one basket. When the New Zealand economy faces a regional downturn, as occurred during the Asian crisis of 1997, it is useful to be able to draw down on a portfolio of strongly performing global shares.

Whether managers use risk-parity, minimum-variance, mean-variance, or the more sophisticated Bayes-Stein or BlackLitterman, the conclusion is broadly the same – the right allocation to international shares increases clients’ prospective returns, or for the same level of return reduces their risk.

WHAT IS THE OPTIMAL ALLOCATION TO AUSTRALASIAN SHARES?

One way to work out a portfolio’s optimal Australasian share exposure, is to look at volatility (or variance) instead of return. New Zealand shares will always have a tax-based return advantage but this does not always manifest itself in superior returns – for example, from 1994 to 1999 international shares returned around twice as much as New Zealand shares.

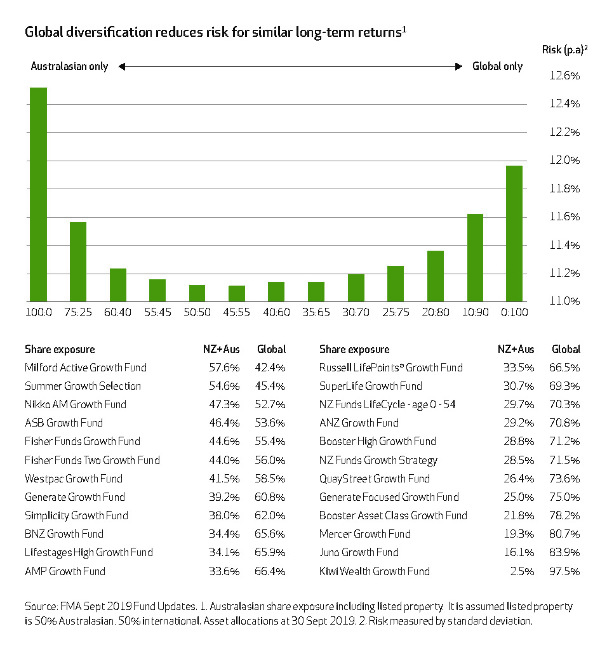

Using minimum-variance to optimise asset allocation gives a range of technically superior allocations – all of which are broadly equal – and shows what is not optimal. The optimal range extends from a minimum allocation to Australasian shares of around 30% where the SuperLife Growth Fund, NZ Funds LifeCycle – age 0-54 and ANZ Growth Fund sit, to a maximum of 55% where the Milford Active Growth Fund is positioned. Funds outside this range are, on this analysis, sub-optimally positioned, most notably the Kiwi Wealth Growth Fund – although the Juno Growth Fund, Mercer Growth Fund and Booster Asset Class Growth Fund also sit outside

the optimal range. Nevertheless, they may have performed well historically. How funds perform in the future will, to a large degree, be determined by their asset allocation.

Disclaimer: Michael Lang is Chief Executive of NZ Funds and his comments are of a general nature. New Zealand Funds Management Limited is the issuer of the NZ Funds KiwiSaver Scheme. A copy of the latest Product Disclosure Statement is available on request or by visiting the NZ Funds website at www.nzfunds.co.nz.

Michael Lang is Chief Executive at NZ Funds. New Zealand Funds Management is the issuer of the NZ Funds KiwiSaver Scheme.

| « FSC questions fossil fuels decision | Covid withdrawals possible 'but not always desirable' » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |