Understanding rebalancing: A portfolio well invested doesn’t do things in excess

Consilium Head of Adviser Services Ben Brinkerhoff says rebalancing enforces good investor behaviour in these turbulent times.

Monday, April 6th 2020, 3:46PM

by Ben Brinkerhoff

Ben Brinkerhoff

A wise person once said that balance means never letting success go to your head and never letting failure go to your heart. We can all see an application of this in our everyday lives, but could it also apply to our investment portfolio?

An investment portfolio also has a balance, and it has similarities to the quoted balance between success and failure.

At the heart of a portfolio are two competing desires. Firstly, there is the desire for returns. The bigger the better, most of us would say. Secondly, there is a desire to avoid losses, even temporary ones, often referred to as volatility. The smaller the better, most of us would say.

If this isn’t a balance, I’m not sure what is!

On one side of the equation, if we got great returns, we might want to just keep doubling down. We might even let this success go to our head. On the other side, if we experience poor returns, it could go to our heart and we might want to take all our investments off the table. Although this often means we would leave ourselves with little or no chance of achieving the goals we originally targeted when we first started investing.

A portfolio needs balance. And if it needs balance then, reasonably, from time to time it will need to be rebalanced.

What is rebalancing?

Rebalancing is the practice of restoring your investment mix to its original target allocation. It’s achieved by selling assets that have gone up in value and adding to those that gone down in value (relative to each other).

The purpose of rebalancing is simple. It’s to ensure your portfolio is positioned to achieve the investment outcomes you want, without taking more risk of temporary losses (volatility) than necessary.

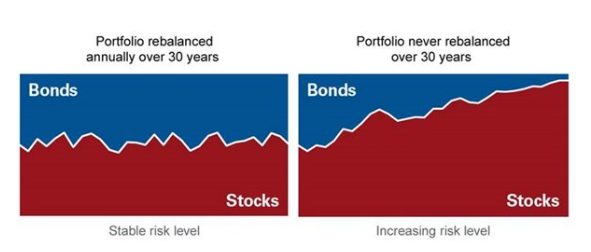

A portfolio that never rebalances will eventually look very different from your starting portfolio. The chart below was produced by Vanguard (1) and shows how a portfolio that originally contained 50% shares and 50% bonds might change over time if it was either annually rebalanced, or never rebalanced at all. The difference is stark.

If you have a portfolio that is never rebalanced, it is likely to mean your portfolio will get riskier and riskier over time. It’s an important point because, as investors age, they typically prefer portfolios that are less and less risky over time.

Over recent weeks, the opposite has occurred. Share market weakness has meant many portfolios currently have a lower weighting in shares than their original allocation. If this lower weighting in shares was maintained it would have the effect of reducing the long term expected return of the portfolio.

So, does rebalancing deliver investors better outcomes?

Charles Rotblut, CFA, published an excellent study in May 2014 in the “American Association of Individual Investors Journal,” (2) to help answer that very question. In simple terms, he found that yes, rebalancing works.

Rotblut evaluated three different investor behaviours regarding rebalancing, using a portfolio originally comprising 70% shares and 30% bonds, over a 26-year time period starting in 1988.

The three different behaviours were:

- Discipline: Rebalance a portfolio each time the allocation to shares was greater than 75% or less than 65% (remember the original target was 70% in his study).

- Drift: Never rebalance a portfolio. Just let the share and bond weights inside the portfolio change over time however the market moved them.

- Panic: Simulate a panicked investor by selling out of shares entirely every time the market fell by more than 20%.

Rotblut found that the Disciplined portfolio outperformed the other two portfolios AND had less measurable up and down price movements (volatility) than the Drift portfolio. It had about the same up and down price movement as the Panic portfolio. In other words, the Disciplined portfolio was the more “efficient” portfolio. It delivered the best ratio of returns for the amount of volatility the portfolio experienced.

Rotblut wrote in his study “Although the goal of pulling out of the market was to stop the pain of the bear markets, over the last 26 years, an investor would have experienced the same level of volatility by simply sticking with shares and rebalancing as necessitated.”

In other words, Rotblut was surprised to find that the Panic portfolio didn’t make the investing ride more comfortable with less overall up and down price movements, even though that’s what it was intended to do.

But why would the Disciplined investor that regularly rebalanced get higher returns? There are two main reasons:

- Rebalancing allows a portfolio to ride out a market sell off.

- Rebalancing enforces a rule where you are selling recent winners and buying recent losers (relative to each other).

Put simply, rebalancing enforces good investor behaviour. In a valuation sense, rebalancing means you are always selling assets that are relatively more expensive and buying assets that are relatively less expensive. It’s smart, as Rotblut proved, but it can also be psychologically challenging because you are often needing to buy the types of investments that aren’t popular at the moment and selling the ones that are. This is very hard for most investors to do.

In summary, rebalancing helps prevent an investor letting success go to his/her head or failure to his/her heart. Or, as another wise person said (3),

“A life well lived (or a portfolio well invested) doesn’t do things in excess.”

Ben Brinkerhoff, Head of Adviser Services, Consilium

Ben is the head of investor services at Consilium.

| « Iress: Covid-19 pushing advisers into digital working | [WATCH] Newpark update » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |