Advisers inch closer to writing 50% of ANZ's loans

Mortgage advisers continue to account for a growing share of home loans originated by the country's biggest bank, ANZ.

Friday, May 1st 2020, 9:39AM  5 Comments

5 Comments

Antonia Watson

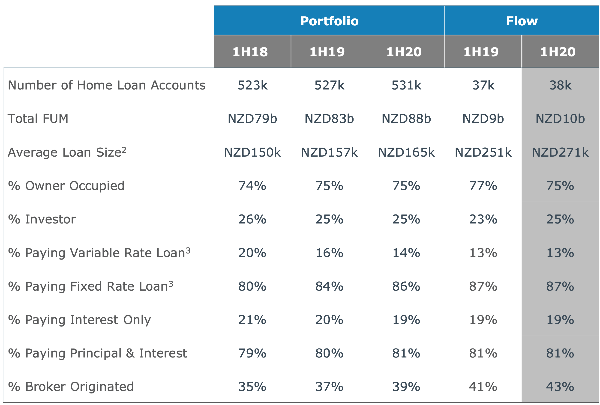

Advisers share of loans has increased from 35% two years ago to 43% in the first half of this financial year.

A similar trend is happening at BNZ too. Drawdowns through the broker channel increased from 25.3% in March last year to 29.2% this March.

ANZ chief executive Antonia Watson says advisers are an important part of its business and she attributes the growth to customers picking advisers over bank branches and mobile managers.

It's driven by "customer choice", she said.

Watson wasn't keen to predict when third party distribution would crack through the 50% mark. Rather she suggested things could change in the future.

"It won't be long before you can get your home loan online," she said.

How that will change the distribution model is unknown, and she acknowledged customers liked to talk to someone when making a big financial decision like a home loan.

ANZ reported its first-half net profit fell 15%, reflecting a $200 million increase in charges against profit for bad debts on the expected impact of the coronavirus crisis. Its net profit for the six months ended March fell from $896 million in the same period a year earlier to $789 million.

Watson said this provision was made at the start of the current Covid-19 crisis and may change as the impact on economic activity becomes clearer.

The bank's year-earlier results had been boosted by profits from asset sales included $98 million in profits from selling OnePath Life and its stake in Paymark.

While the bank hasn't been writing many loans during the current lockdown it has been busy helping customers with options to help them through the crisis,

There were three options; loan restructure, interest rate deferral or moving to interest-only.

So far it has:

- Provided financial help to around 30,000 personal, home and business loan customers through repayment deferrals or adjustments covering lending of around $12 billion.

- Deferred 19,600 home loan repayments

- Moved 20,900 home loans to interest only.

While the 19% of the bank's home loan book was interest only at March 31, that is likely to have grown into the early-20s, Watson said.

Compared to the GFC the bank and many of its business customers' balance sheets were in much better shape heading into the coronavirus crisis.

Watson said because of that ANZ is much better able to continue lending heading into the covid-19 crisis than it was heading into the GFC.

ANZ's average loan-to-valuation ratio when each housing loan was approved was 57% in the half-year, up from 58% a year earlier. The average dynamic LVR – the current position – was just 40 percent, reflecting repayments and rising house prices.

| « Reserve Bank ends LVR restrictions | Vincent Capital adds a South Island BDM » |

Special Offers

Comments from our readers

Instead of having a default attitude which still appears to 'fear' broker origination, which ultimately works for the customer by giving choice and advice, why not work with this? Technology firms will move continue to pose a much bigger threat, and mortgage advisers could be the best ally a bank (not just ANZ) could ever know.

Sign In to add your comment

| Printable version | Email to a friend |